Shutdowns and War Plans

Manifold forecasts a polycrisis

Shutdown Blues

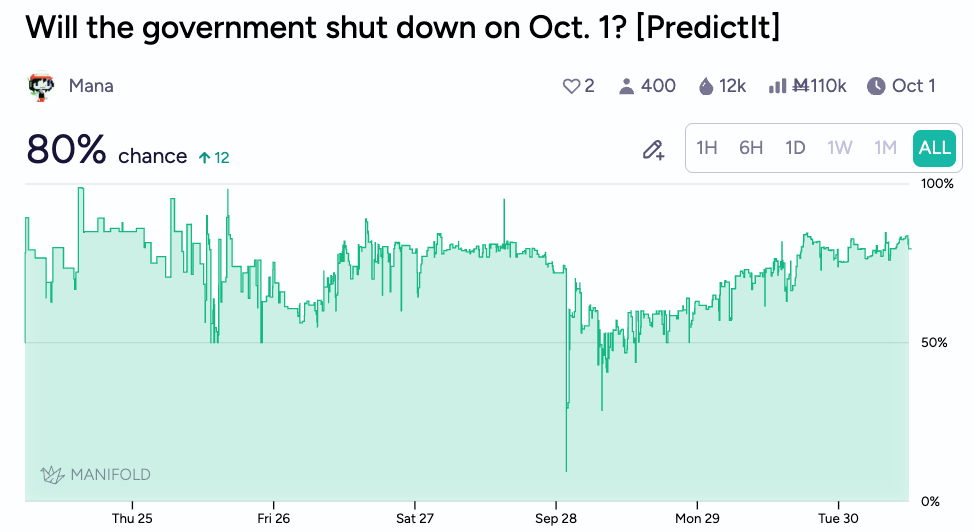

For the last week, a shutdown has looked “pretty likely”? Or is it “almost certain”? Or perhaps “probable”? Whatever you want to call it, avoiding a shutdown at this stage would be at least a mild surprise, and even in the 20% of worlds where the government doesn’t shut down, in a few of those we might see another shutdown pop back up in 10 days or 2 months, depending on the deals worked out.

Odds for a shutdown (at midnight tonight) fell to parity on Sunday and Monday, as congressional dems planned a meeting with Trump and a brief stopgap was considered to give time for negotiations to play out. But the odds have risen again to above 80% after the negotiations yielded nothing and Schumer disavowed the stopgap originally attributed to him.

There are a number of markets on a shutdown on Manifold—part of the flexibility of a play money platform—which are harder to arbitrage than you might think. If you’ve been paying attention during past shutdown scares, there’s always the possibility for a “technical shutdown” at midnight, if the President fails to sign the bill before midnight (or the Senate doesn’t hand it over until late). While this might seem silly, as the government doesn’t visibly shut down, there are in fact components of the government that do have to make adjustments for even a very brief technical shutdown. Imagine a backup generator coming online, and then think of all the cascading funding-dependent systems in the government, especially in more opaque sectors of defense and intelligence. However… for the most part these technical shutdowns are in-name-only, and bettors have been burned before by the media reporting “No Shutdown” only to have the market resolve in the opposite direction.

Most platforms have been getting better about this, and the PredictIt criteria above are my favorites, leaving flexibility for edge cases, with a common sense interpretation. Why can’t all markets be like this? [The actual answer is quite complex, but “inadequate governance leading to an over-reliance on literal interpretations” should suffice.]

“This market shall resolve to Yes if, subsequent to the launch of this market and by the End Date listed below, the Federal Government is in what is described by media sources, determined by PredictIt to be reliable, as a full or partial government shutdown.”

Polymarket, which had previously defined the shutdown as a funding lapse of any kind, has a mirror market on Manifold trading up near 90%, while the actual shutdown market trades a few percentage points lower. Given the tense negotiations, even if we get a deal signed, traders think it’s likely that it won’t be signed until after midnight.

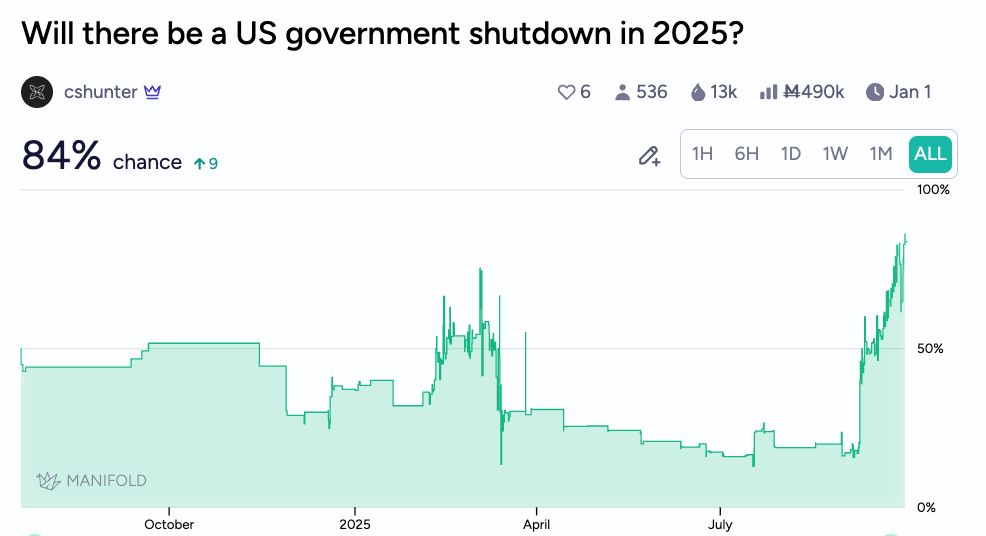

And of course, the market on a shutdown in 2025 is a little higher as well, given the possibility for (another) shutdown later this year in November.

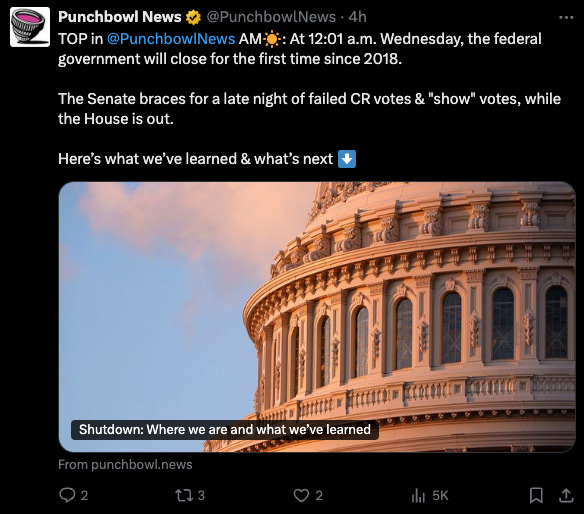

Some outlets, like the shutdown mavens at Punchbowl News, are already treating it like a foregone conclusion.

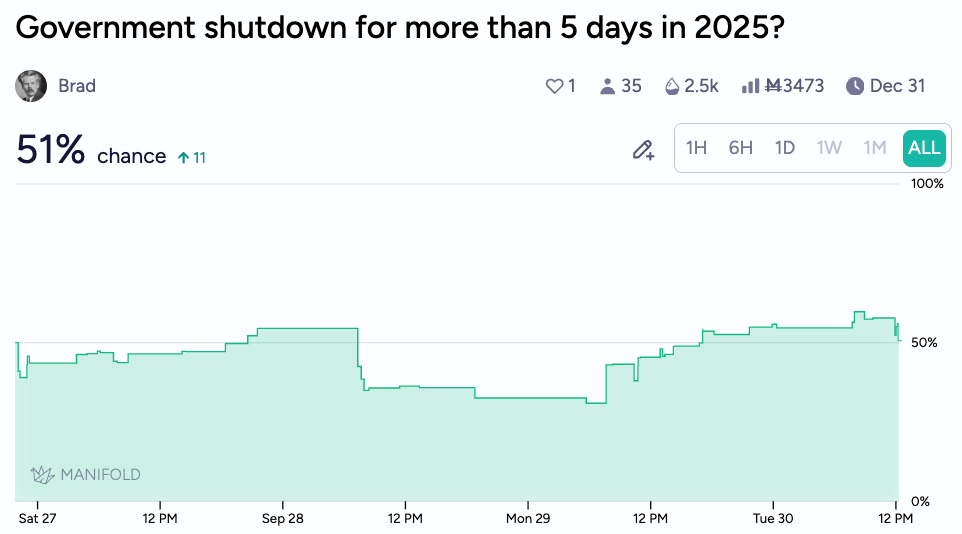

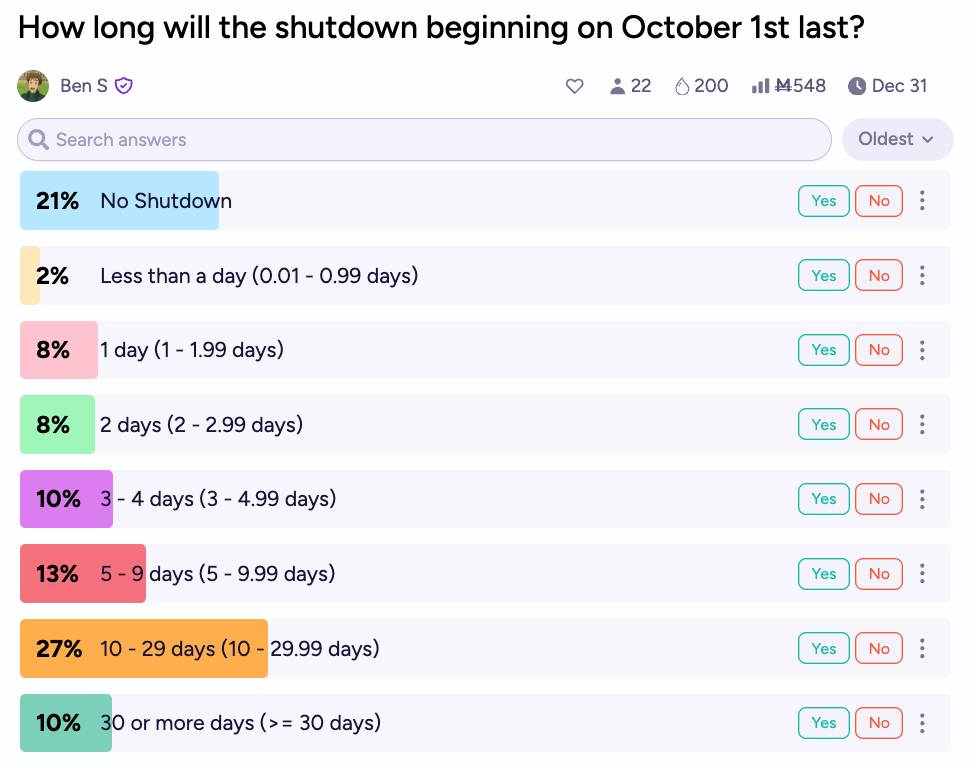

And so let’s start to consider the ramifications of a shutdown. First of all, how long will it last? Traders assign roughly even odds of a short shutdown, yielding to negotiations, and a prolonged painful shutdown.

There’s even about a 10% chance of a shutdown lasting over a month.

In this case, we’d likely see some pretty tense situations in DC. The Trump administration has already threatened to use the opportunity to fire large sectors of the civil service, a threat which some see coupled with the opportunity to build out hiring after funding resumes with loyalists. This could only take a day or two to execute, but it’s likely that a prolonged shutdown would lead to more rounds of threats, some carried out, some left in reserve.

The democrats are currently hoping to use the shutdown threat to negotiate an extension of Obamacare premium subsidies, but even if Senate republicans concede on this, there’s no guarantee that that bill would fly in the House, where Speaker Johnson is toeing a fine line between his caucus’s demands to not cut deals with democrats, and the Senate’s markups on the bill, which might require some democrat support in the reconciliation process.

Some think that Trump might eventually apply pressure on his own party to negotiate with the dems (at least, this is the hope in democratic appeals directly to the President), and most think that he’ll sign whatever funding bill lands on his desk.

Trump, for his part, seems much more concerned with other matters foreign and domestic, this week…

Pax Americana

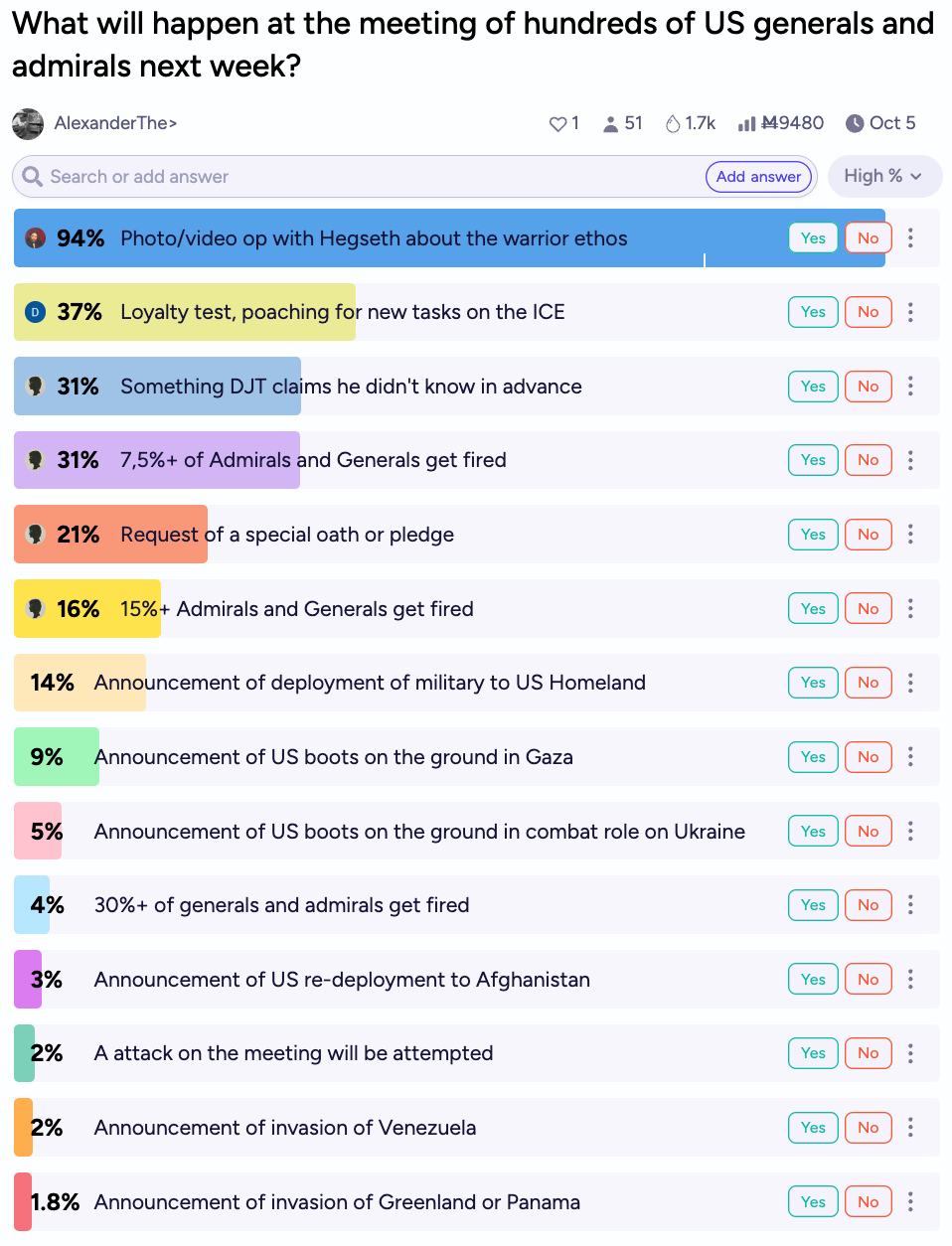

In advance of the top brass summit in Virginia, here were the odds on what might transpire:

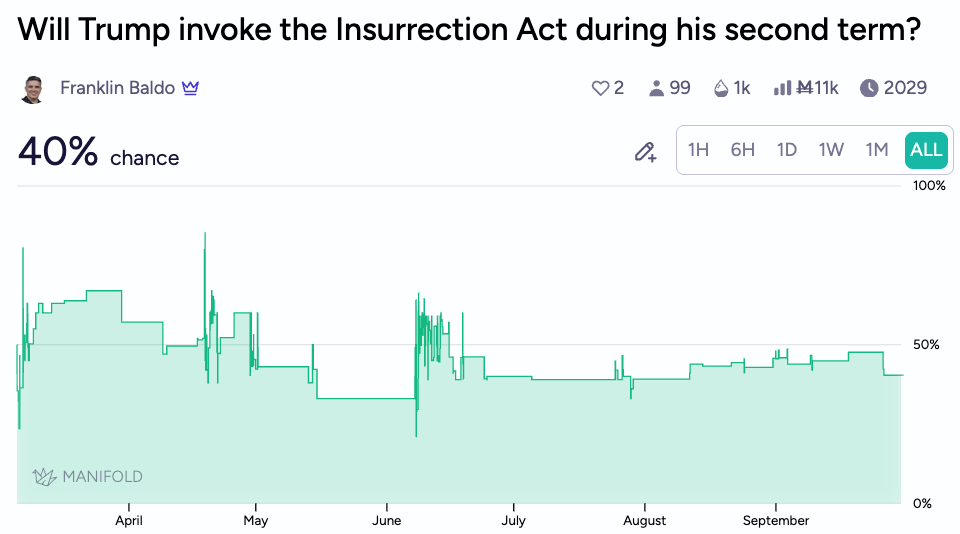

The summit appears to be ongoing, but Hegseth has indeed been hammering home about the warrior ethos, announcing the implementation of fitness checks, complaining about “fat generals” in the halls of the Pentagon, and also… beards? Trump, for his part, implied that the military should focus more on an “invasion from within” rather than far-flung places. This might hit harder, were it not for Trump himself attempting to negotiate a peace deal in the Middle East, while escalating attacks on Venezuelan boats in international waters. But traders still assign about 40% odds to Trump invoking the Insurrection Act during his second term to deploy the military against protestors.

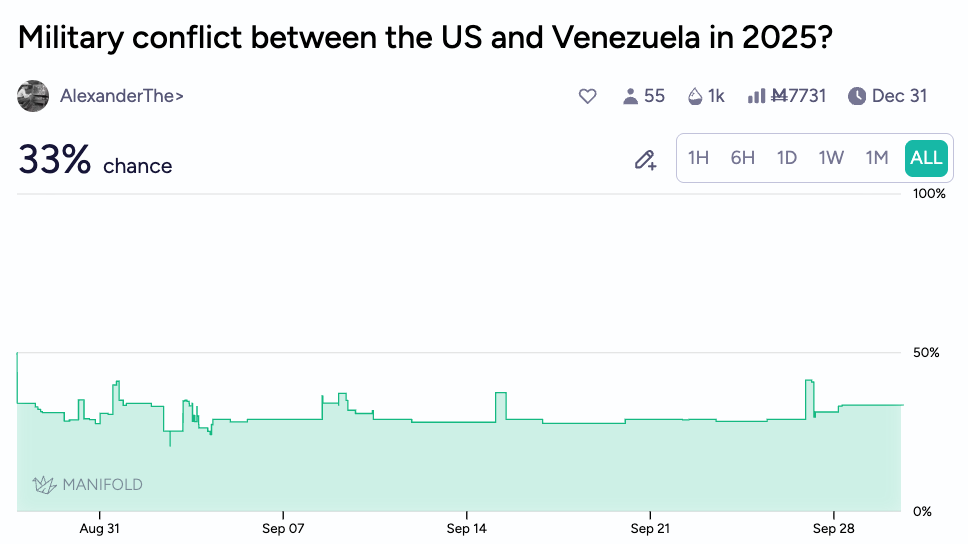

Manifold also still gives 1 in 3 odds to a conflict between the US and Venezuela by end of year, although those are partly high between any airstrike on Venezuelan soil or waters (presumably without the blessing of Maduro) would count, even in the guise of counter-drug operations.

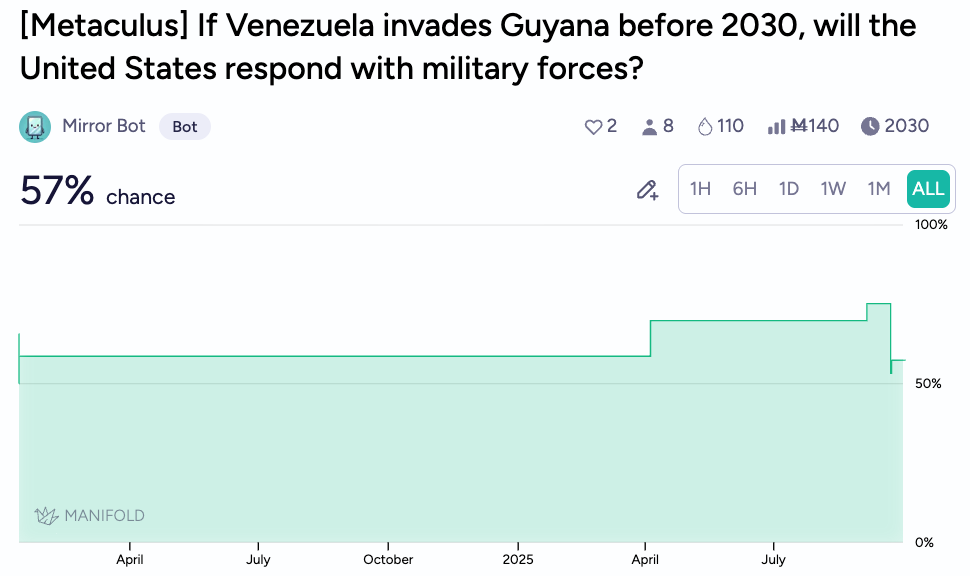

Traders also should not forget about Venezuelan desires on the Esequibo, a part of neighboring Guyana, to which forecasters believe the US would be likely to respond militarily.

Trump’s twitter-announced peace plan between Israel and Gaza, which Hamas has a few days to respond to, hasn’t yet given him a bump in Nobel Peace Prize odds, where he still remains a heavy underdog.

Roundup

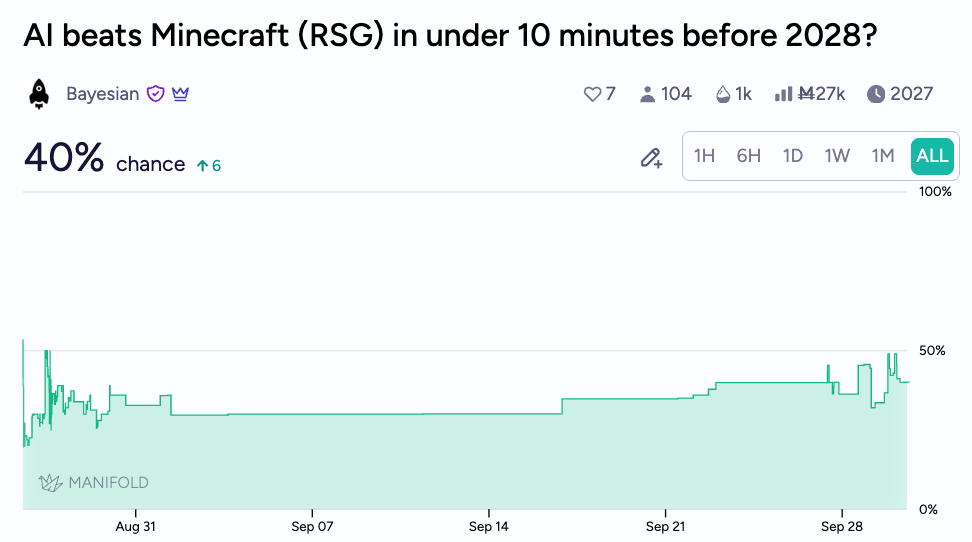

I think this market on an AI being able to speedrun Minecraft is pretty interesting, and might be the next phase of world-interfacing agent benchmarking somewhere between Pokemon and full-on robotic interfaces:

Eric Adams dropped out, but Mamdani remains an overwhelming favorite against Cuomo:

California’s YIMBY housing bill awaits the signature of Newsom nervously:

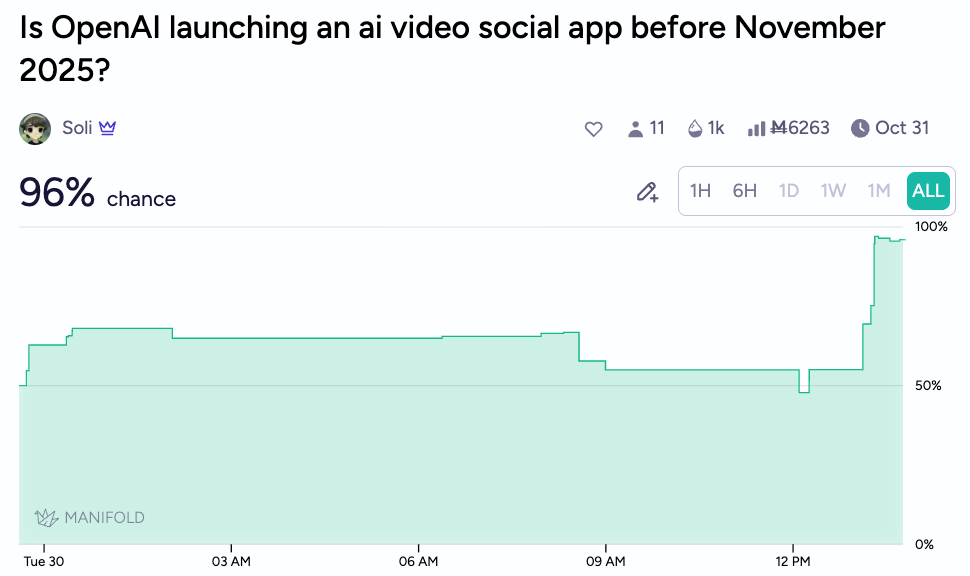

Sora 2 just launched and OpenAI does in fact appear to be launching an AI video app (or a slop trough, as the short-form video crusaders might say) before November!

While writing this newsletter, shutdown odds have risen by to ~85% tonight or ~90% on the year!

Happy Forecasting!

-Above the Fold