Manifold vs the World

The value of play money

News broke today that Polymarket is acquiring derivatives exchange “QCX,” a derivatives exchange that recently received a CFTC license to legally provide prediction markets to American consumers. The value of such a license would have made for an interesting market, if only someone had had the foresight to make one in advance of the deal. It appears that the true value is north of $100 million, as QCX sold for $112 million, a week after Polymarket had received word that the DOJ and CFTC were no longer pursuing investigations against the company.

These licenses to operate as a DCM (Designated Contract Market) are hard to come by, with only a handful granted over the last decade. Railbird received a license in June, and look like they intend to launch a prediction market platform. I wasn’t able to find any information about Quanta Exchange or their plans, but they received a license in May. Forecast Exchange, which lists Robinhood on its website as a broker offering its forecast contracts, received a license in 2024, along with IMX Health which appears to be targeting customers looking to “hedge the healthcare economy.” Before then, you have to go back to the end of the first Trump administration to find the last license that was granted.

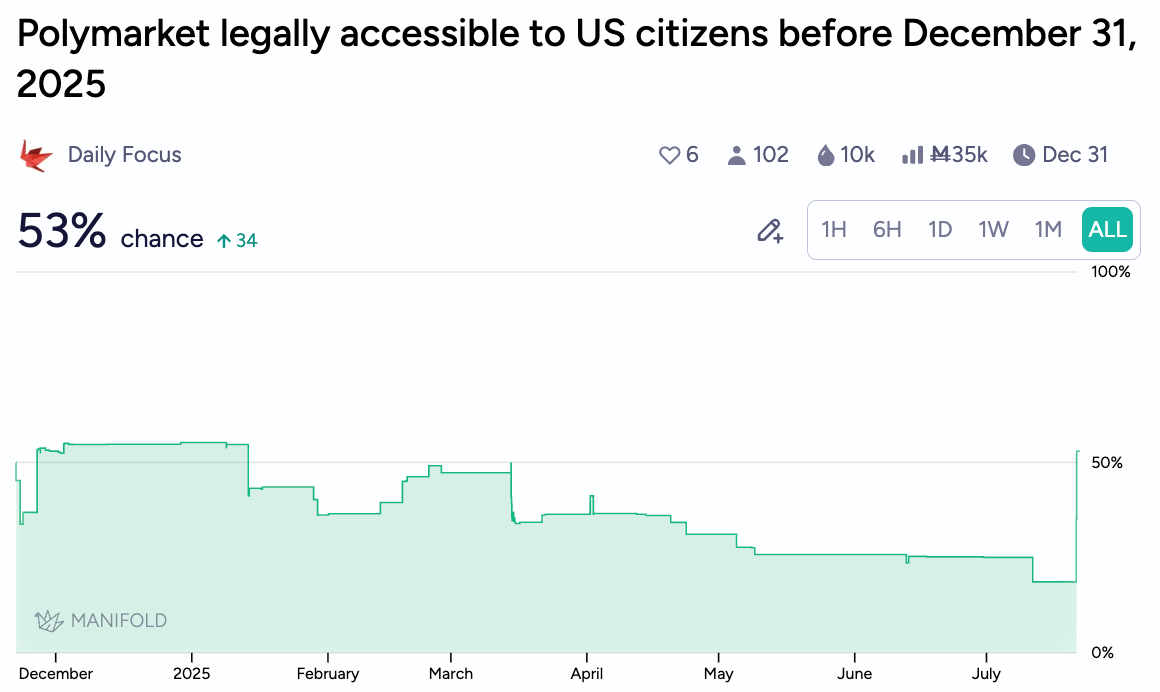

This has caused the odds that Polymarket will be accessible legally to US residents by the end of the year to double to above 50%. Manifold traders think it might be only a matter of time, as the odds of readiness by the 2026 midterms is even higher, at 80%.

Shayne Coplan, the CEO of Polymarket, has already announced his company’s excitement to return to American consumers to compete directly with Kalshi. It remains to be seen whether Polymarket will spin off a second platform offering fiat currency, rather than crypto, offerings, or if there’s a way to leverage their newly acquired DCM license with their current systems.

As Polymarket readies its return, it’s as good a time as any to assess the value that play money markets provide in the prediction market ecosystem. And that value proposition is manifold (pun absolutely intended).

1. Operating Markets Where Others Cannot Tread

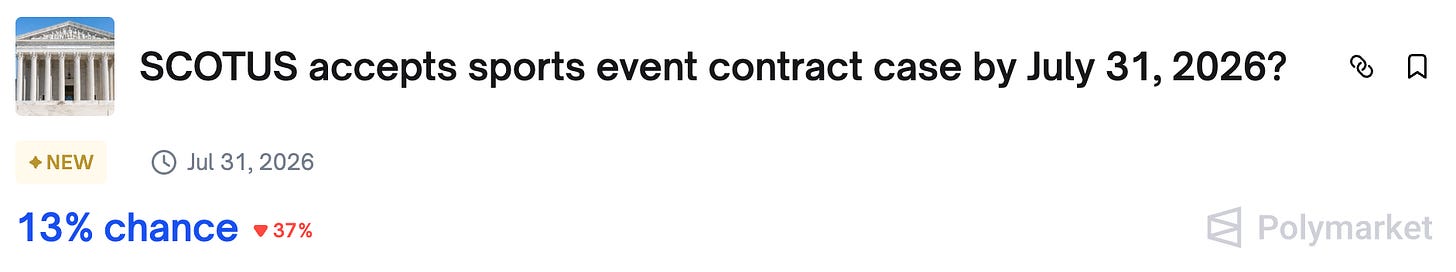

Of course, at a meta-level, Manifold operates markets about the prediction market ecosystem itself. Across Polymarket, there exists only one market even tenuously about their own operations, on whether SCOTUS will take up a sports event contract case about their rival Kalshi. Kalshi has no markets about either of the firms.

Of course, operating real money markets on your own operations not only has the potential to elicit regulatory suspicion, but also might incur some questionable hedging motivations from traders. And markets specifically about prediction market regulations is far from the only domain that real money markets are hesitant to create markets about. Markets on conflicts, death, and other heavy topics come with warnings…

…and in many cases are avoided altogether, despite a tacit policy that these markets do provide a clear value to society.

When markets become regulated and scrutinized, this comes with a certain level of self-censorship. This isn’t necessarily a bad thing — there are many good reasons to practice moderation around these topics. But the freedom to generate play money markets on topics that might alienate regulators or even the public, when those questions are attached to actual fiat currency, provides value.

2. Avoiding the Issues of Financialization

Manifold is subject to considerations like hedging, insurance, discount rate phenomena, and other behavior that affect the accuracy of markets. However, they avoid these in ways that might be insurmountable to real money markets.

A real money market called “This market resolves YES in 5 years,” sitting at 80%, is a poor investment. Earning a 4% rate of return is worse than many government bond or FDIC-insured certificates of deposit, and probably substantially riskier, given concerns around transferability, taxation, crypto wallet security, etc. On Manifold, mana is no longer directly exchangeable for money, meaning that there’s no alternative sources of low-risk growth. Long-term markets essentially can function as bonds. Of course, there are other issues with play currency (inflation, the potential for changes to the currency system). But these issues don’t have to additionally interface with all of the issues of existing within a global financial system: motivations, foibles, monopolies, insurance policies, options trading, and all sorts of other lovely financial instruments that could cause events contracts to be priced at values other than their true probabilities.

3. Quantity Becomes Quality

Kalshi and Polymarket each operate a single market on GPT-5 (on when it will be released). It’s quite plausible to me that the trading volume and real money incentives on these markets will make them marginally closer to the “true” probability than Manifold’s equivalent play money market. But if you’re a prognosticator, turning to prediction markets for insight on the release date of GPT-5, you’re better off looking at Manifold’s offerings.

Manifold can allow for more fine-grained forecasts, with markets sometimes forecasting down to the individual day that an AI model will be released, rather than the limited “Before August / Before September / Before December” that real money markets offer.

Moreover, you might be wondering, “What are the odds that a model literally called GPT-5 will be released?” Or perhaps instead, “What are the odds that a major successor to GPT-4 and 4.5 will be released by OpenAI, regardless of its name?” Or maybe you want to know, rather than being explicitly released, “What are the odds that it will be announced on a certain date?” If you want to paint a full picture, you’re often better off being able to ask a large quantity of peripheral questions with a variety of criteria, than you would be having one really precise value.

Even with their large valuations and enormous trader bases, Polymarket and Kalshi still find issues in liquidity provisioning for their more niche markets. The cost in time and oversight energy for creating a market is higher when there’s real money on the line. Moreover, there can be a chicken-and-egg problem where smaller markets can’t incentivize traders because there’s less liquidity, and there’s less liquidity because there aren’t enough traders.

4. Flexibility in Market Governance

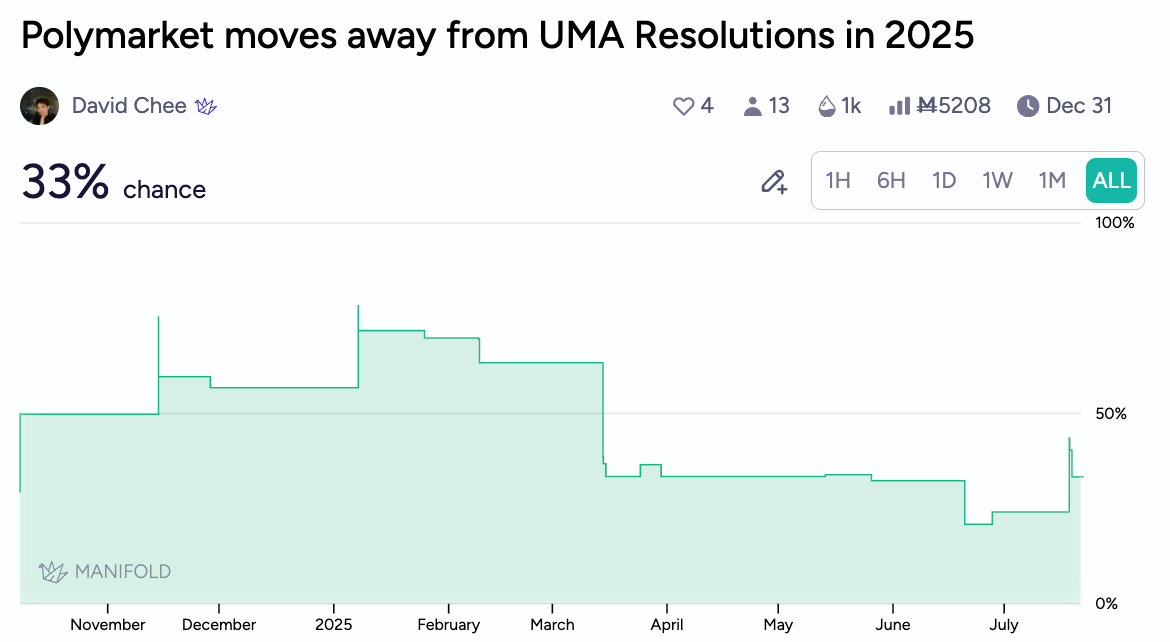

There’s a long-standing debate on whether markets should be resolved based on the spirit of the law or based on the letter of the law. You can even see this debate playing out in how different real money markets decide to govern their resolutions. PredictIt operates with a quasi-judicial system, and “resolves markets based solely on the language in the Rules.” Polymarket, on the other hand, resolves markets based on a voting body, the UMA “oracle,” and thus has slightly more flexibility in resolving based on common-sense interpretations. Both methodologies can suffer from reputational issues when they resolve against what insiders or outsiders understand to be the “correct” ruling. Polymarket’s issues with resolving a market with some serious gray area over what constitutes a “suit” recently received media attention. Indeed, Polymarket may be attempting to move away from their current resolution system:

While Manifold markets can have controversial resolutions, using play money substantially lowers the liability and damage of a mis-resolution. Additionally, market creators have the flexibility to offer markets with resolution criteria that can adapt as problems and gray areas arise. Bettors can ask for clarification on how creators will resolve in hypotheticals, and they can determine whether to bet in confusing markets based on whether they trust the creator, not based on whether they trust the overall governance of the system.

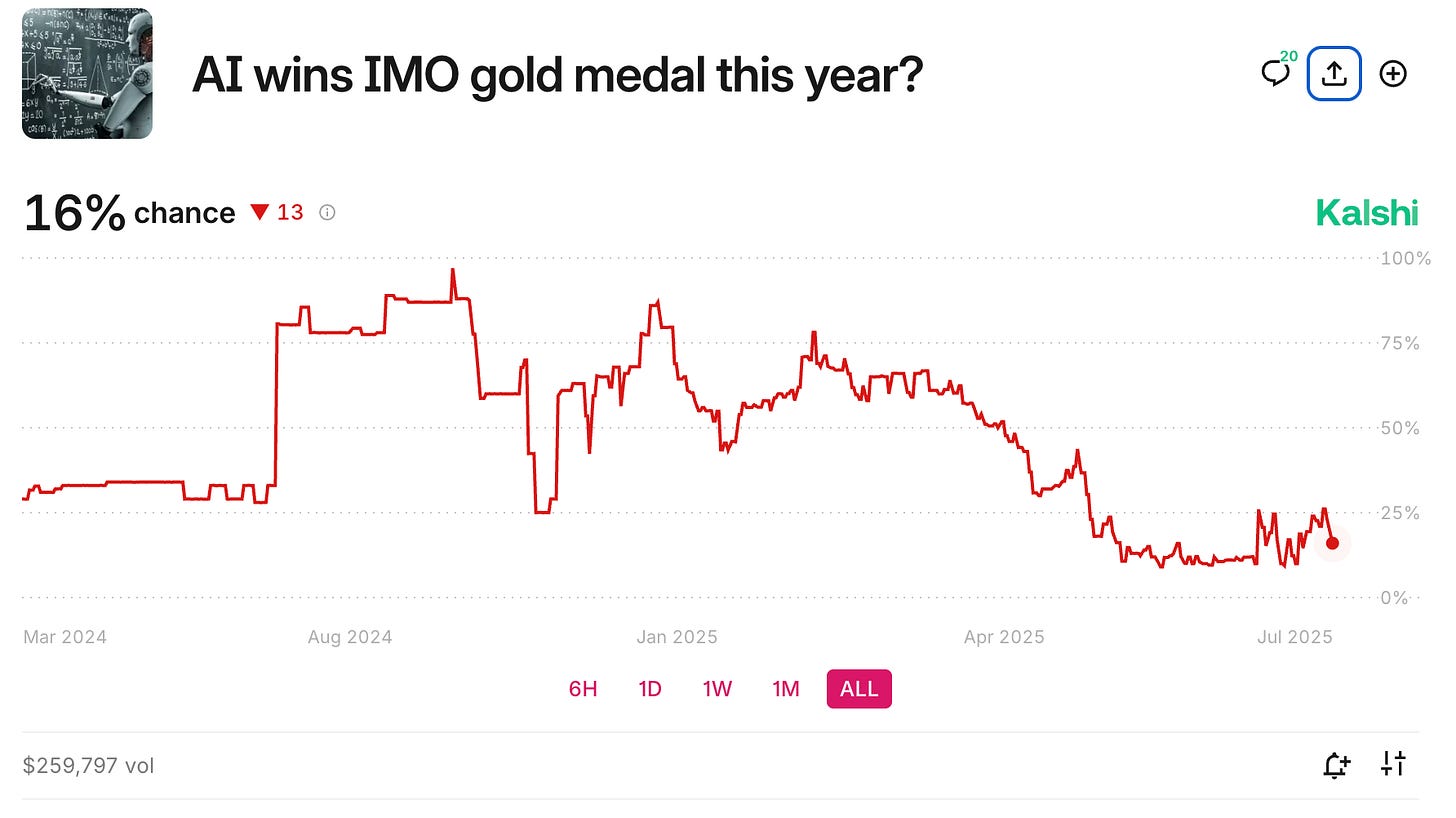

For example, take the latest International Mathematical Olympiad gold medal results from OpenAI and Deepmind. On Kalshi, the market has fallen to 16% due to gray area in the rules around internet use and third party verification. Given that the market was trading well above 50% earlier this year, this conflict likely came up because there was a lack of clarity in the rules over how this would be adjudicated.

“Reproducibility. The AI must be open-source, released publicly before the first day of the IMO, and be easily reproduceable [sic]. The AI cannot query the Internet.”

Manifold’s market, which wasn’t bound to a narrowly determined set of rules designed to minimize liability, was able to ask a question that better reflected what people were interested in: namely, benchmarking AI capabilities. And indeed, there were several markets on the topic with slightly varied criteria for traders to choose from.

5. Creativity in Utilizing Clever Market Mechanisms

Manifold has a few basic mechanisms that many real money markets currently lack: sum to 100% multiple-choice markets, numerical formats, the ability to resolve to a probability, to correct resolutions retroactively, and to N/A questions altogether (which also allows for conditional markets). Multiple choice markets in particular provide huge benefits for the accuracy of low-probability events, by bypassing the issue of no one wanting to bet NO on something with 1% odds. The mechanism to resolve to probabilities can protect markets from ricocheting dramatically between 0 and 100 by allowing for nuanced resolutions in ties, situations where there are multiple winners, and edge cases.

But on top of this, creators have wide discretion to get creative. Take a look at this market, which at first glance appears to have the same probability as the long-standing Manifold market of the same name.

Here are the criteria, which use a new methodology from Siddarth Srinivasan, Ezra Karger, and Yiling Chen to attempt to get around a perennial obstacle to long-term markets with indeterminate resolutions:

Immediately after a new trader bets on the market, there is a 1/100 chance that the market resolves to the AMM probability that the new trader left the market at. This continues indefinitely, until the 1/100 hits. Everyone else can trade in the meantime. Say Steve just joined the market and moved it from 42 to 70:

- If the 1/100 hits, the market resolves to 70%.

- If the 1/100 misses, it just continues.

You can find many other markets of this ilk: trying out fun approaches to get more accurate and more insightful markets. In other words, Manifold users are innovating.

Okay, so… What are the tradeoffs?

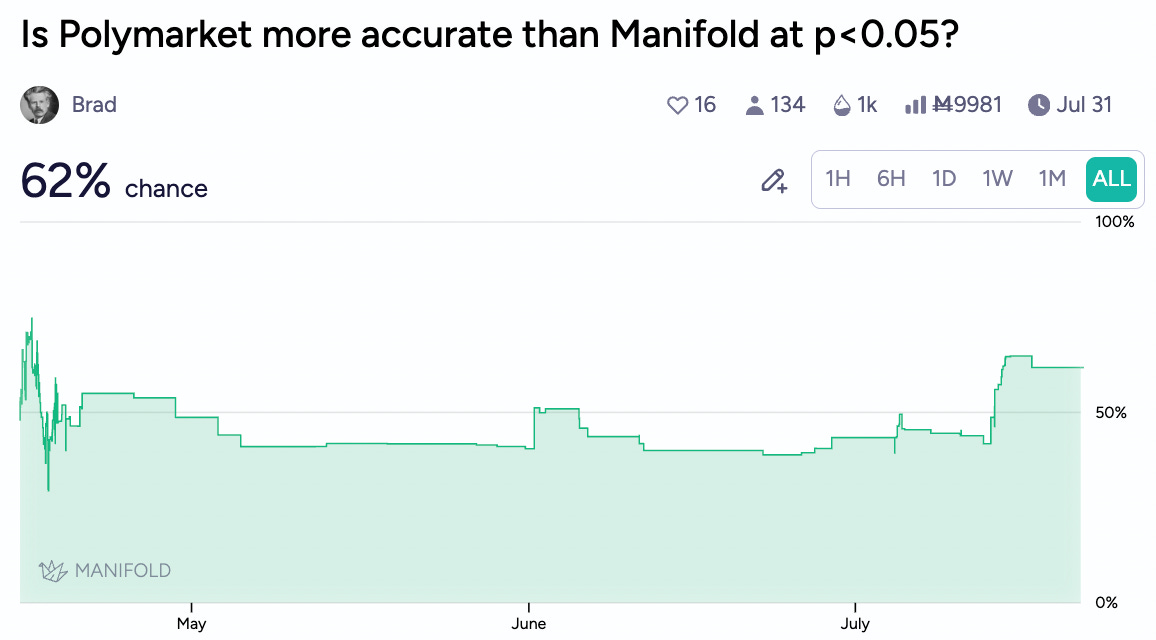

Serious financial motivations do make for larger, more robust, and more incentivized markets. Even with this, however, the benefit that real money markets provide isn’t that large. Manifold user Brad has a market on what his undergraduate thesis will give as the statistical significance of real money markets’ edge over Manifold. The market thinks it’s only slightly more likely than not to yield a p-value < 0.05:

Also, while there’s an ongoing debate on whether active manipulation improves or worsens the accuracy of prediction markets, it’s surely easier to manipulate the odds (for vanity or nefarious purposes) of a Manifold market on a large election with a few thousand dollars’ worth of mana, than for an equivalent real money market with millions of dollars of cascading limit orders.

But you also can’t host a knockout-style 2k mana buy-in tournament for a user-made 2D platformer game on a real money market like you can on Manifold:

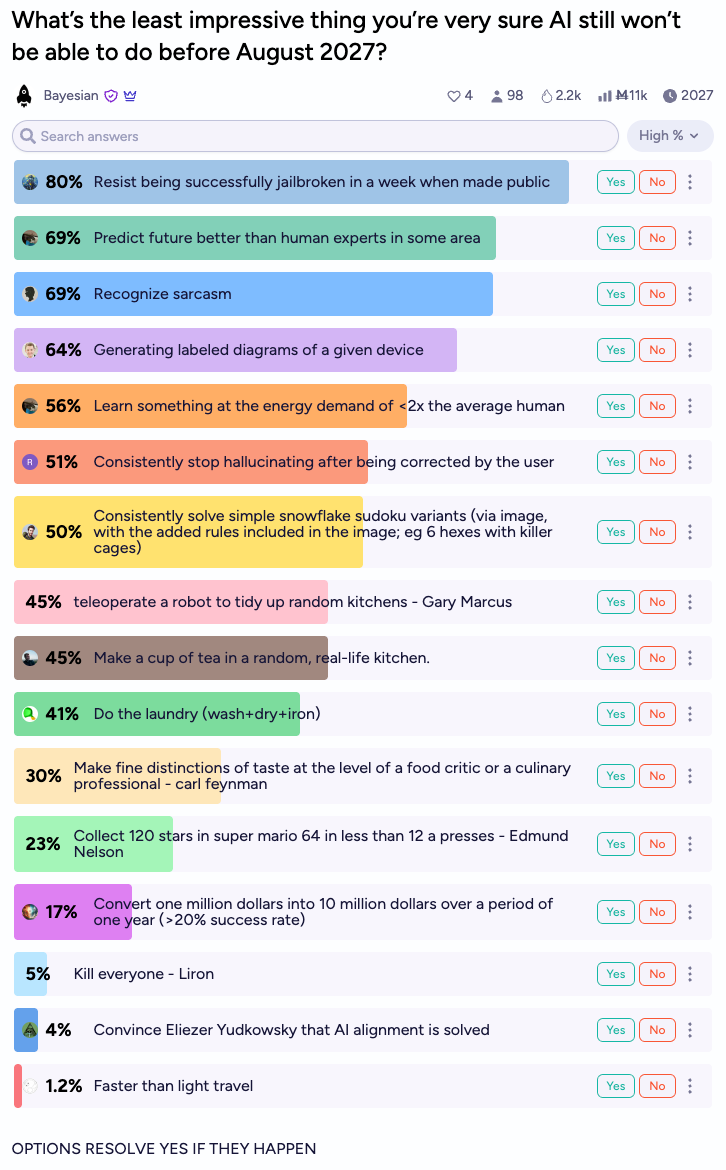

Nor could you crowd-source your own bettors’ confident 2-year predictions:

Happy Forecasting!

-Above the Fold

"Kill everyone" - Liron