AI 2027 and Liberation Day

Lines Going Up, Lines Going Down

AI 2027

Yesterday, a new pdf dropped. The report was authored by five Manifold users (some of whom are better known for other things): Daniel Kokotajlo, Scott Alexander, Thomas Larsen, Eli Lifland, and Romeo Dean.

This report, called “AI 2027,” was released primarily as an interactive website by the AI Futures Project, and contains a hybrid forecast and fictionalized scenario for the next few years of AI developments.

This report got press coverage from the NYT and resulted in Scott Alexander’s (perhaps) first podcast appearance. While the report is best interpreted as a single potential scenario (that represents the authors’ “best guess about what [the near-term impact of AI] might look like”), Manifold users are skeptical that these forecasts will be borne out as described.

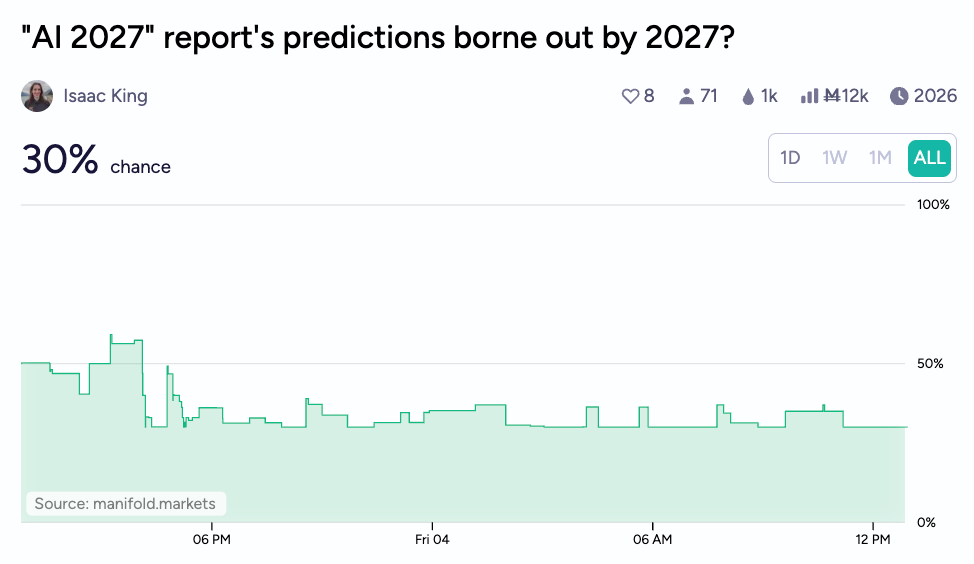

The above market resolves based on consensus from Manifold moderators at the end of 2026 as to whether the AI-2027 report’s forecast has been more or less correct to that point:

Resolution will be via a poll of Manifold moderators. If they're split on the issue, with anywhere from 30% to 70% YES votes, it'll resolve to the proportion of YES votes. Otherwise it resolves YES/NO.

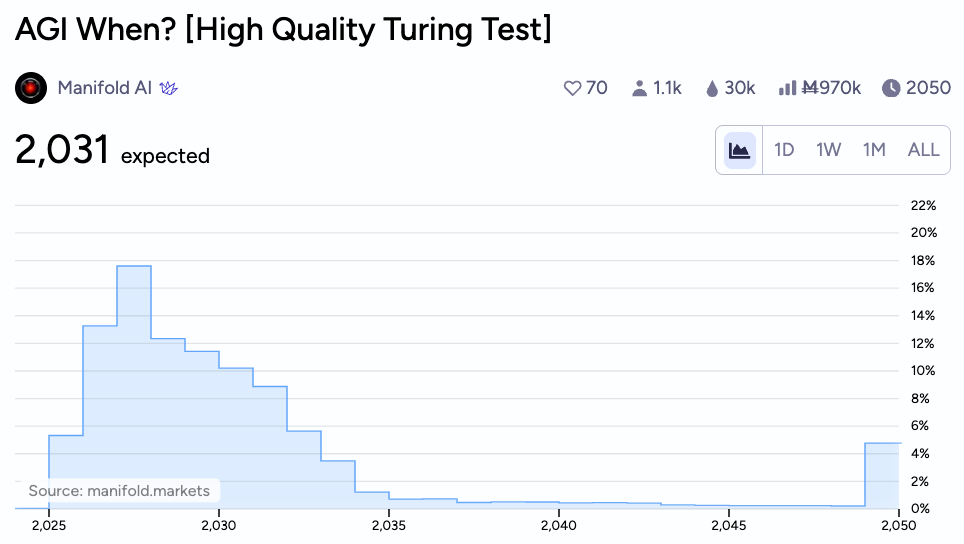

Part of this skepticism is natural, given that AI-2027 has given a timeline for something resembling AGI that is much faster than Manifold’s own market estimate. The report forecasts AGI (or at least several intersecting technological developments that equivalent Manifold markets would almost certainly characterize as such) by the end of 2027. Manifold does agree that 2027 is the modal year by which we could expect AGI, but (1) most of the probability space lies beyond that, with a median date of around 2029, and (2) the criteria for this market is a high quality Turing test, a lower bar than the ones AI-2027 thinks AI will clear.

Hopefully Manifold users will, as usual, do a great job of operationalizing the falsifiable predictions from the AI-2027 report into well-defined individual markets.

Superhuman Forecasting

For example, the AI-2027 scenario estimates that the forecasting ability of AI will be better than the best human by July of 2027:

This feels vaguely existentially threatening as a forecaster. I’m personally skeptical this threshold will be exceeded by mid 2027, but the forecast should’t be a complete curveball for those who have been following progress in AI forecasting.

For example, a Metaculus-built forecasting bot is currently ranked in the mid 20s on the website’s quarterly tournament, out of about 500 competitors, many of whom are serious competitive forecasters. This does sound impressive, but just by hedging to the community aggregate, following the news closely, and forecasting diligently on every question, it’s quite reasonable for a moderately capable forecaster to replicate this. However, this still represents a marked improvement over previous iterations of these bots.

As an aside, in a forecasting tournament I ran in my graduate school department a year ago, GPT-3.5 placed 6th out of ~35 competitors, none of whom had been in a forecasting competition of any kind before.

Manifold traders think it’s likely that even by the end of this year, an AI system will out-perform the community prediction on Metaculus, although this is still a level below out-performing the best human forecasters. On Metaculus, I would estimate that roughly the top 1-5% of the site’s active users are consistently “super-forecasters” in the sense that they out-perform the aggregate prediction. On Manifold, traders who can “beat the market” and earn a profit above Manifold’s discount rate are, in a sense, out-performing this aggregate as well.

Liberation Day

While the AI-2027 report projects an exponential increase in compute and investment in AI, I wonder whether they priced in an American recession, the effect of a double-digit tariff rate, or economic policy perhaps already designed by chatbots!

Trump’s tariff announcements on April 2nd, branded as “Liberation Day” for America, exceeded market expectations dramatically. In response… markets have cratered to the tune of about 8% over two days. Recession odds have leaped by over 20% in a week:

Markets are no longer uncertain whether the tariff threats will be lasting, Manifold now can safely project a tariff rate of over 6% in at least one quarter this year:

In particular, the market did not expect Trump to actually follow through on his campaign promise to enact a 10% tariff rate on all countries.

Trump has claimed he will impose a 10% tariff on all countries except China, which will have a 60% tariff.

This market will resolve to YES if Trump wins the presidency, and then he imposes a 10% tariff (or greater) on at least most imports (as measured in dollar terms) to the US from all countries except China.

Manifold is also unconvinced that these tariffs will even make progress towards the primary goal, as stated by the administration: reducing the US trade deficit. In fact, it seems the tariffs might increase the trade deficit rather than decreasing it, due in part to responses from other nations.

Economists view these tariffs as potentially apocalyptic for the economy. Congress, for what it’s worth, seems to have the power to end these tariffs, contingent on the Trump administration respecting these powers of course. Manifold bettors think there’s at least a chance that Congress acts by June to remove some of these tariffs, but aren’t counting on it:

Roundup

After a hectic few days, Manifold users are still trying to fix their sleep schedules. The successor to o3 seems to be called “o4” rather than o5 or o9, and GPT-5 has likely been pushed back (based on information straight from the tweets of Sam Altman) to the latter half of 2025:

By the way, Manifold bettors are still not sure who the Dwarkesh Podcast’s “biggest guest yet” will be, although shares of Scott Alexander soared briefly after the podcast was released.

Happy forecasting!

-Above the Fold

What’s the manifold discount rate?

Guys your AI 2027 website is down

Pls 🥺 fix it