Above the Fold: Play-money efficacy

Play-money efficacy in forecasting

Many skeptics don’t think Manifold Markets can be taken seriously due to “monopoly money” not creating real incentives. However, our calibration analytics and recent performance forecasting the midterms suggest otherwise.

Check out this poll we did:

Jack, our top all-time trader, created an awesome writeup comparing different sites.

These are log scores, green (closer to 0) means more accurate, red (more negative) means less accurate. For comparison, predicting 50% for everything gets log score -0.69

As you can see, none of the 4 top performing sites involves real money. However, the Salem Manifold instance which works exactly the same as Manifold Markets suggests the disparity may stem from the political demographic of each site rather than a significant difference in forecasting ability.

I found this Reddit comment made some compelling arguments for play-money.

“I think we should consider the possibility that using play money might actually be better than using real money:

It's accessible to a larger audience of potential forecasters with more diversity in both disposable income and personality type (risk tolerance, attitude toward legal grey areas, etc.)

The perceived stakes of bets may be higher for the average user: instead of betting your lunch money, you might be betting a significant fraction of your available resources. We know from video games that people can really care a lot about virtual currency.

People with more real-life money can't buy more influence over the market. The only people with disproportionate power to push the market around are those who've already proven to be exceptional forecasters.”

Here is the article the prompted the above discussion on Reddit:

FTX Collapse

We have direct (received $1.5m in grants and investments) and indirect (Effective altruism) ties with FTX. Fortunately, our site will not directly be affected by recent events, although we are nevertheless deeply saddened.

With the uncertainty came a heightened interest in our markets. We saw an uptick in traffic to our site with users using our markets to elevate their understanding of the situation as it unfolded. This is becoming a common trigger for user re-engagement: breaking news → uncertainty → markets to provide some certainty.

Here are a couple of markets from the FTX Insolvency Crisis group.

Hopefully, Manifold Markets never gives out more mana than it can cover. 😬

Manifold in the Wild

The first thing you should read is Scott Alexander’s latest Mantic Monday which is increasingly becoming Manifold Mondays! He discusses FTX and Twitter drama, midterms calibration, and attempts to do some market manipulation of his own on Manifold!

In our previous newsletters, we often included some discussion around various links related to Manifold. For the next couple of weeks, I am instead going to experiment with creating more frequent summaries and upload them to this group on Manifold.

Fraud markets drama

Destiny users crash a market temporarily due to the high frequency of trades

Destiny users create a live stocks tracker

Analysis of Manifold Market’s performance in forecasting the midterms

You can still expect the newsletter to directly cover anything big happening on Manifold Markets itself. And, anything particularly spicy will be covered in more depth in the newsletter compared to the frequent posts.

Fifa 2022 Qatar $500 World Cup competition

Check out our World cup competition!

Site Updates

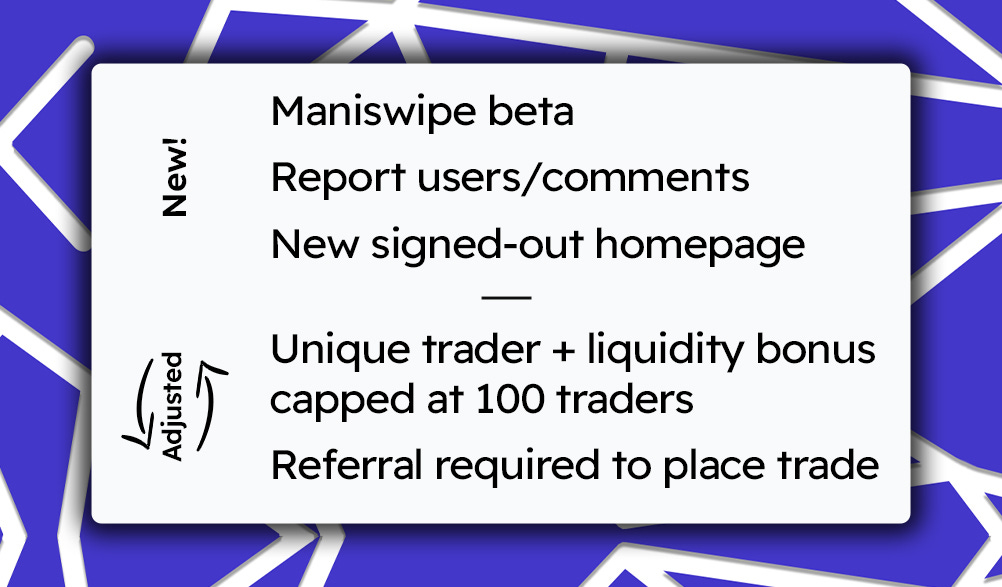

Not pictured: Major rework of Multiple choice markets.

They now use our fixed payout binary market system (similar to Yes/No markets). This means you can now short answers too!

I just want to state here that I'll boycott the FIFA World Cup in Qatar and encourage everyone else to do so as well.

In case that matters: I'm German.

Now that Manifold markets are being embedded in blog posts regularly, it would be nice to have a feature that lets the embedded post show the market status at the time the article was first posted, with a toggle to show the current status as of the time it is read. Not sure what the ideal UX/presentation and defaults should be on that, but both should easily be visible in some way, or else a lot of context will be lost when a blog post is making a point related to a market's current status that has now changed significantly. Also, showing the eventual resolution will add a lot of cool context to blog posts when you go back and read them!