Why was Sam Altman fired from OpenAI?

What do the markets say about the OpenAI drama?

Did the scriptwriters over at Microsoft get GPT to generate the storyline for the events over the past few weeks? You could have fooled me, as I don’t think any human could have anticipated what unfolded.

Sam Altman was fired by the OpenAI board completely out of the blue. This had many implications, but for Manifold it meant users flooded to our site to gauge what everyone thought was going on. The next few days were met with uncertainty, fear, and of course, memes.

Sam has since returned as CEO, although for a time it was nearly certain he wouldn’t be and instead would join Microsoft. So what happened, and how did our markets reflect all this drama?

Retro on the return of Sam Altman market

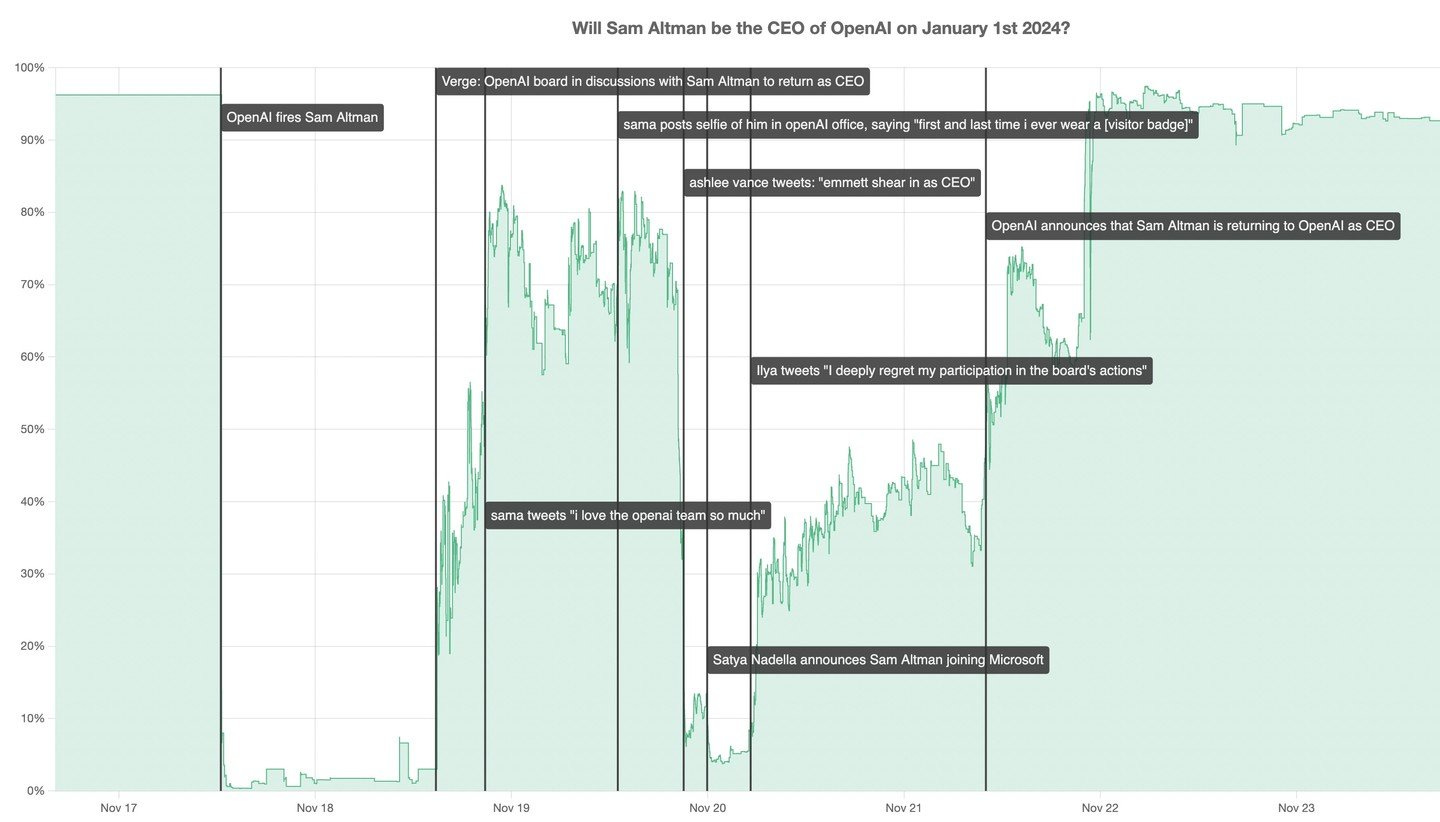

What a rollercoaster of a market. Below are two annotated breakdowns from our users.

https://twitter.com/cHHillee/status/1728849798265258208

Once again, our markets proved to be an engaging way to follow along with real-time updates of public sentiment. I love this direction for Manifold which is essentially: “The most real-time news recap in one picture”. You can see when it was announced Sam would be joining Microsoft people truly thought it was over and that was that.

Sidenote: We were inspired by these annotated graphs to implement a new feature on Manifold that allows creators to add notes to their market graphs!

Why was Sam fired?

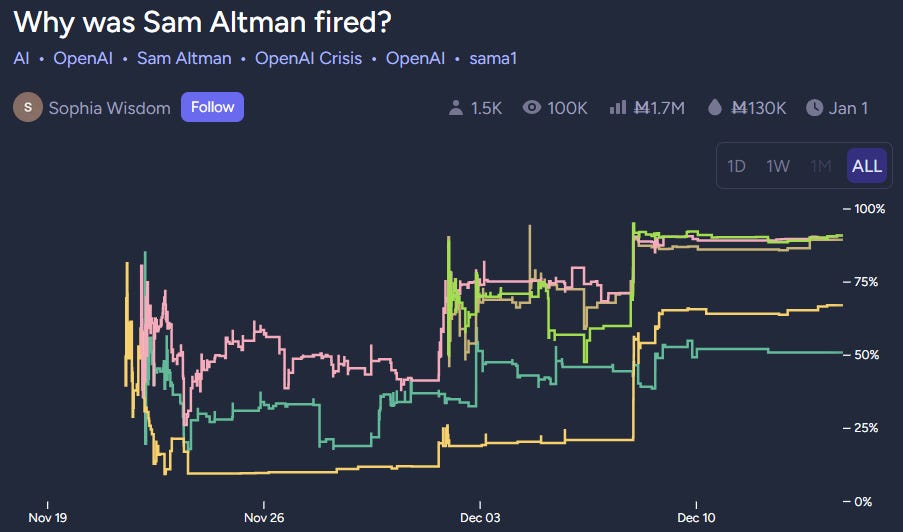

This is still an ongoing mystery and the market I want to focus on today.

With nearly 200 user-submitted answers, I’ve decided to include below a snapshot from the 23rd of November which includes the 3 top answers of the time, alongside the yellow and lime lines which were the initial leading answers. You may notice that these answers have some overlap and the probabilities don’t sum to 100%, I’ll explain that more in a moment.

This market was a relatively low information market, with most of the early popular answers predicting Sam was fired either because of his lack of regard for AI safety or moving away from the nonprofit mission.

There’s always been an underlying question about how useful these markets are. People like to bring this point up a lot with LK-99, aliens, and any other question that lacks significant public information. However, even if it is impossible to gauge over such a small sample size how accurately these big important markets reflect the objective truth, they are still the best source of information taking into consideration all public knowledge. Joe Weisenthal agrees that this is useful when thought about with the correct framing by saying the following in his article,

“…if you forget that these are referred to as “prediction markets” and just think of these prices as a gauge for where conventional wisdom of people engaged in the story are right now, they’re kind of useful to watch.“

Markets about OpenAI are an especially interesting use-case on Manifold as there are a significant number of OpenAI employees who use our site. I suspect in this instance most of them weren’t privy to information that exists outside of the public realm. However, if any are reading this, I would love answers to the following questions. Please email them to me at david@manifold.markets

Did you feel you had an edge in these markets in any way? If so why (eg. did you have insider info)?

Did you decide not to bet on certain markets because you worried it could jepordise your job or otherwise? Or if you did decide to bet anyways, were there any concerns?

Did you find the markets were helpful for you personally when trying to make sense of all the drama which could directly impact your career? In what way?

Now, let’s go back to reviewing what the market currently says about why Sam was fired. Since the snapshot from November, a lot has changed. Here are the current 5 top answers:

An interesting case study for our new independent multi-binary markets

You may have noticed that this market doesn’t quite look the same as markets you may have previously seen on Manifold.

It is a free-response market where any user can submit an answer, but unlike our previous free-response markets, in this market multiple answers can resolve to YES. That is, the probabilities of each answer are independent of one another, as is the liquidity and other things on the back end. Using this mechanism to ask why Sam was fired gave Manifold a huge edge over other news sources.

Whenever fresh information causes a new theory to emerge, traditional media outlets typically publish additional articles to discuss and analyse. This process involves explaining the significance of the new theory and its potential implications. In contrast, on platforms like Manifold, users are empowered to promptly respond by crafting new answers. This immediate interaction allows for a dynamic understanding of how these new theories impact previous answers and how much one should update based on the breaking information.

You can see that the pink answer “Sam tried to oust other board member(s)” has remained a top answer after several weeks. But a more specified answer about what that means was also created once the original answer’s probability grew. One problem with predictions is it can be hard to capture the question you truly want answers without making it very broad. It’s impossible to know how events will unfold to design your question in such a way that it encapsulates all possible scenarios. The most simple example is asking the question of when X will happen? Often you want to start off by predicting the month, but as you draw nearer it could become very important to predict it to a specific day. Independent user-submitted free response answers allow the criteria of answers to become more granular as events unfold.

The scariest market of all time?

“The scariest prediction market in human history is down to 22%.”

This was tweeted by Eliezer Yudkowsky along with a link to the market below on November 20th shortly following the news of Sam’s firing.

The market’s description, created by Manifold co-founder Stephen, states: “Was the reason Ilya ****Sutskever supported the ouster of Sam Altman in November 2023 due to an AI capabilities advance that he either witnessed or anticipated arriving soon?”

If this market were to resolve yes, it could have huge implications for people’s timelines on AGI.

Although initially high, the probability plummeted as more traders weighed in. However, there was a scary peak on the 23rd after Reuters published an article of a supposed letter from research staff warning the board of a breakthrough. But this has since been dismissed by traders as more evidence has surfaced from board members indicating this probably wasn’t a reason and such a letter may not even be real. I think this is a prime example of a market recognising there is new information, but only partially updating with consideration that it may not be wholly true. Feel free to read the comments of the market for the full context.

What’s next?

We’ll have to continue to keep an eye on why Sam Altman was fired. It’s going to be a challenging market to resolve as many user-submitted answers aren’t well-defined and overlap with other answers. The creator Sophia will need to be discerning when deciding when an appropriate time to resolve is. Factors such as locking up users’ mana, gauging whether we will ever know the whole truth, and deciding whether there is still ambiguity or if a consensus has been reached will need to be considered.

Making it as easy as possible for creators and avoiding user frustration that can occur from ill-defined answers is something we are going to have to monitor with this new market type going forward. But we are prepared to make any necessary product changes we see fit.

If you want to get involved in more OpenAI speculation, join the recently trending market about GPT 4.5’s release date following leaks of an imminent release.

Thanks for reading

I’ll see you in Manifold’s final newsletter of the year where we will review everything that has happened and our plans going into 2024.

David Chee

The new annotations are a nice possibility indeed. Here I used them recently: https://manifold.markets/marktwse/will-meta-publish-an-app-which-allo

When will journalists refer to prediction markets?

Could you reach out to someone to make “A Journalist’s Guide to Prediction Markets”?