Recession Odds Skyrocket, Sky Rocket Odds Recede

Prediction markets weather a rough week on a number of fronts

Recessions, Reserves, and Tariffs, Oh My!

The odds of a recession this year have risen dramatically over the last week.

This jump, from about 30% to over 50% before a slight drop, coincided with the Atlanta Fed’s updated forecast of real GDP growth for Q1 2025. The Fed’s forecast fell precipitously from above +2% to negative territory over the course of a few days, with revisions on Feb 28th (-1.5%) and Mar 3rd (-2.8%) causing Manifold’s 2025 recession market to jump twice on precisely the same dates. Despite this, Manifold users are still quite skeptical about the GDPNow forecast, giving only 13% odds to their GDP estimate being accurate (or an over-estimate, for that matter). Perhaps the GDPNow forecast and similar economic markers have led to broader negative economic sentiment.

Moreover, there are fears that economic data may not be reliably reported in the coming months. Commerce Secretary Lutnick’s suggestion that the GDP calculations should be changed to exclude government spending triggered a wave of criticism from economists, many of whom pointed out that the government does indeed already report a similar metric. Manifold users, albeit at low trading volume, seem concerned about this as well, giving a 19% chance to manipulation in the April economic numbers, and nearly twice that by the end of 2025.

“Promises Made, Promises Kept”

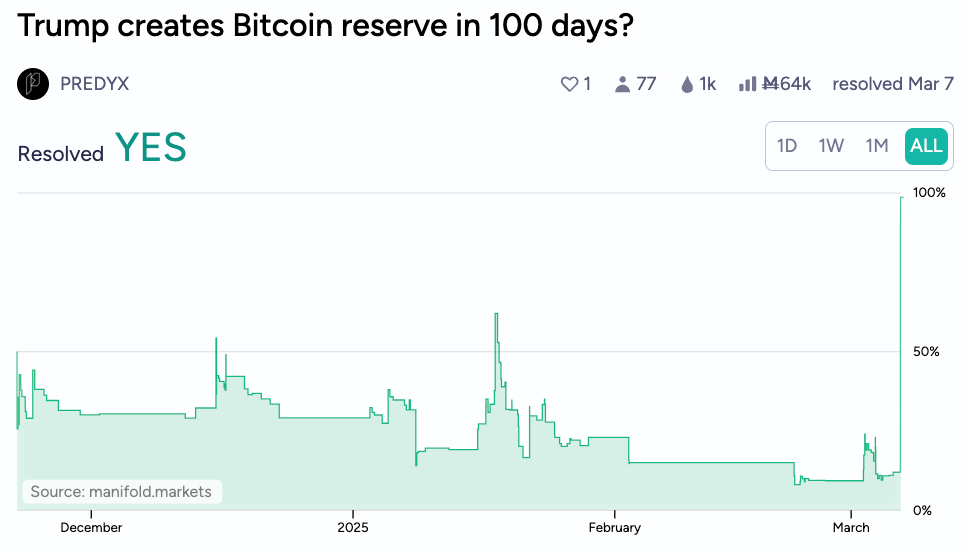

Despite repeated promises to do so—and rumors that he was going to do so—Manifold was still skeptical that Trump would actually go through with the creation of a National Bitcoin Reserve. However, he signed an executive order yesterday night for its creation (primarily through the aggregation and formalization of the various, dispersed holdings of Bitcoin the federal government already seems to have). The market for Trump fulfilling this campaign promise through executive order within the first 100 days was only at 12% when the news broke!

There’s still some uncertainty around how the Bitcoin reserve will be operationalized, and a different market on creation within Trump’s first year is hovering in the low 90’s for this reason, as the resolution criteria specify that cryptocurrencies must be “acquired” to some extent.

Manifold users were also surprised that the executive order specifically contained the word “Bitcoin”, as most expected that Trump might sign an order vaguely specifying the addition of cryptocurrencies without picking winners and losers. This market was trading about 20-30% lower than the establishment of a Bitcoin Reserve, right up until the announcement.

Unfortunately for crypto bag-holders, Bitcoin prices have not reacted favorably. Perhaps they had already priced in the likelihood of the strategic reserve, but Manifold is increasingly skeptical that Bitcoin will resume its upward trend.

O Canada

The largest piece of economic uncertainty comes from the chaotic rollout of tariffs, with multiple policy changes happening within a week. A couple days before they were due to take effect, the de minimis exception was reinstated. Then, after deciding not to further delay the tariffs on Canada and Mexico like the previous month, they went into effect on March 4th, triggering reciprocal tariffs from those nations. This seemed to partially catch the administration by surprise, and by March 6th, most of the tariffs—though not all—had been exempted through executive order. However, duties on many goods still remain and there’s active uncertainty as to the extent of these due to ambiguity in the policies. Moreover, there is the potential for the un-exemption of certain goods, and perhaps further tariffs on Canada. You can gauge the level of uncertainty around the Canadian tariffs from the last couple weeks of volatility in the market on whether they would get reversed before March 15th (not even two weeks after they went into effect).

Manifold still expects more large tariffs from Trump in his first year, although the odds have fallen about 10% as it became more clear that tariffs might last only a matter of days, making it more difficult to reach the 6% average rate over a whole quarter that the market requires.

Non Satis Ad Astra

In addition to signs that Musk’s influence at the White House might be slightly cooling, it was a bad week for his companies Tesla and SpaceX. Manifold gave about 3 in 4 odds of a successful Starship Flight 8, but alas, that did not happen.

Manifold bettors now think SpaceX is unlikely to successfully land Starship before summer, which might deal a severe blow to Musk’s plans of launching for Mars in the next launch window in 2026.

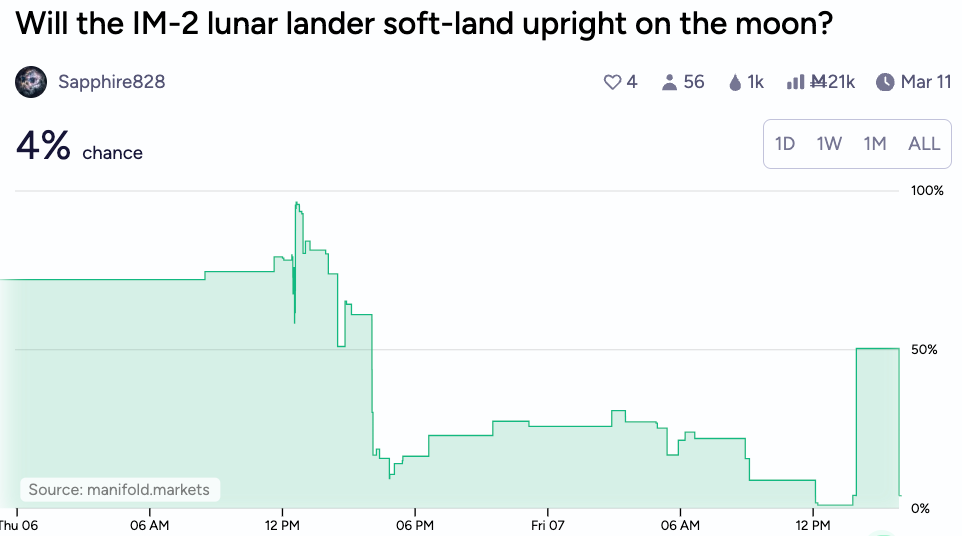

Another prominent space mission, a lunar lander from Intuitive Machines carrying several probes, appears to have landed on its side, and the mission has been declared “dead”. There were some interesting swings, as at first the mission appeared to have landed successfully, until some bad news dropped vis a vis communications with the lander. The market once again surged briefly on news that the probes might be able to be salvaged after the lander could recharge, only for those hopes to once again be dashed. Confirmation has now been given that the lander is indeed on its side.

FiveThirtyEight No More

In further sad news for lovers of data-based journalism and forecasting, elections modeling heavyweight FiveThirtyEight (no longer affiliated with Nate Silver) has been shut down by ABC/Disney and its staff let go.

Manifold users think it’s plausible that the brand is acquired and revived by the end of the year, but are doubtful that it will regain its place as the “Polling Aggregator of Record”. Efforts have already begun to salvage and replace the polling aggregation database that 538 provided as a free service for the rest of the internet.

Unfortunately, prediction market fans everywhere may become apoplectic upon realizing what this means for the hundreds of markets that are reliant in their resolution criteria on the trends, values, and forecasts of 538 models (across a number of forecasting platforms).

Roundup

In other, slightly more cheerful news, Claude restarted its Pokémon run, ACX has replaced its annual book review contest with an anything review contest (which you can bet on here), and it appears quite unlikely that the US will become a province of Pakistan.

Happy forecasting!

-Above the Fold

Ah, the profound ignorance of the Republican voter in America just shines through. Last 3 Republican administrations have ended in disasters yet give us some more of that Republican leadership. The last Trump one was such a sh*tshow and half of America wanted more of that? Give me unemployment, give me tanking stock markets, give me inflation, rising interest rates. Haven't we seen these kinds of economic disasters before? 2008? The first Bush term? Anyway, I'm loading up on puts. By the way, tariffs, as everyone but the Dear Leader seems to know aren't good for fragile economies. Recession here we come... It's like being strapped inside an aircraft with a demented patient piloting. Since the first Bush, I think the figure is 99M job created under Democratic presidents, 1M under Republicans. If you can't figure it out when you're dealing those kinds of figures, you're lost.