OpenManifold

Forecasting AI's leading firm

Restructuring Complete

Yesterday, OpenAI announced the conclusion to its years-long attempt to restructure itself into a for-profit entity. The main winner in my mind was the negotiating team tasked with hashing out a near-impossible agreement. Reflect for a moment on the sheer number of stakeholders with conflicting goals that were a part of this deal. There are of course the business-oriented constituencies within OpenAI, trying to create a structure that allows it to stay competitive in the industry, and the non-profit constituencies, attempting to keep control over the direction of a pivotal technology. But you also have Microsoft, OpenAI’s largest investor, with a huge financial stake in the final arrangement. And *the public* is interested, represented by the attorneys general of California and Delaware, Rob Bonta and Kathy Jennings, who seemed mostly concerned over issues like how children use their products. The employees of OpenAI also have substantial equity stakes in the final arrangement, and any deal that would have angered them would have risked hemorrhaging researchers that AI companies value in the tens or hundreds of millions each. There was also pressure related to Softbank’s substantial capital investments into data center construction, which would have been cut substantially if OpenAI couldn’t find a way to adopt a more clear corporate structure. Oh, and I guess stakeholders in Jony Ive’s firm, io, which was acquired for $6.5 billion, were interested in this final arrangement as well.

The final arrangement chops up the shares of OpenAI’s new structure as a Public Benefit Corporation into four roughly-equal pieces. One will be held by Microsoft, the second by the new (and old) OpenAI nonprofit, the third by the employees of OpenAI, and the fourth by a mishmash of investors from various funding rounds.

At first glance, this doesn’t seem great to the nonprofit entity. After all, didn’t it have 100% control at some point? Well, if you read the terms of the agreement, it retains a great deal of control even after the deal! The Delaware attorney general secured the following terms during the restructuring (quoted from their press release):

The NFP [not-for-profit] will retain control and oversight over the newly formed PBC, including the sole power and authority to appoint members of the PBC [public benefit corporation] Board of Directors, as well as the power to remove those Directors.

The mission of the PBC will be identical to the NFP’s current mission, which will remain in place after the recapitalization. This will include the PBC using the principles in the “OpenAI Charter,” available at openai.com/charter, to execute the mission.

PBC directors will be required to consider only the mission (and may not consider the pecuniary interests of stockholders or any other interest) with respect to safety and security issues related to the OpenAI enterprise and its technology.

The NFP’s board-level Safety and Security Committee, which is a critical decision maker on safety and security issues for the OpenAI enterprise, will remain a committee of the NFP and not be moved to the PBC. The committee will have the authority to oversee and review the safety and security processes and practices of OpenAI and its controlled affiliates with respect to model development and deployment. It will have the power and authority to require mitigation measures—up to and including halting the release of models or AI systems—even where the applicable risk thresholds would otherwise permit release.

With the intent of advancing the mission, the NFP will have access to the PBC’s advanced research, intellectual property, products and platforms, including artificial intelligence models, Application Program Interfaces (APIs), and related tools and technologies, as well as ongoing operational and programmatic support, and access to employees of the PBC.

And in terms of the financial shares of the company given to Microsoft, et al… well, the NFP entity was always bound to honor these, regardless of OpenAI’s transformation into a PBC.

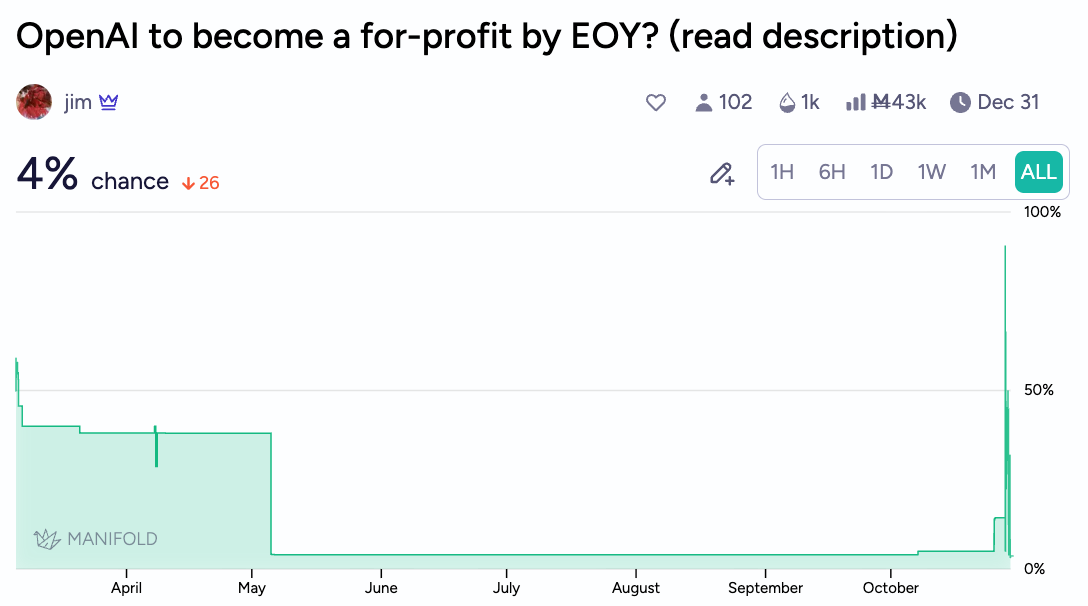

Despite the press framing, one Manifold market on whether OpenAI would become a for-profit corporation is unchanged. Why? Because OpenAI’s core business is still “controlled by the non-profit board” pretty clearly under the terms of this arrangement, which was part of the criteria of this particular market. I think this operationalization is best. OpenAI has already been operating as a conventional corporation for some time, given that it creates, launches, and supports products that comprise billions of dollars of annual revenue. By restructuring as a PBC, has the company really divested control out of the hands of its NFP components? Not really, if you read the fine print.

Many are still unhappy about the arrangement, some describing it as the greatest theft in human history after the dissolution of the USSR. I think this overstates the extent to which the changes reflect an actual de facto shift in control, versus a legal change that allows OpenAI to operate with greater flexibility, doing things like launching an IPO, as well as allowing the non-profit to begin to spend large amounts of capital itself!

Valuations

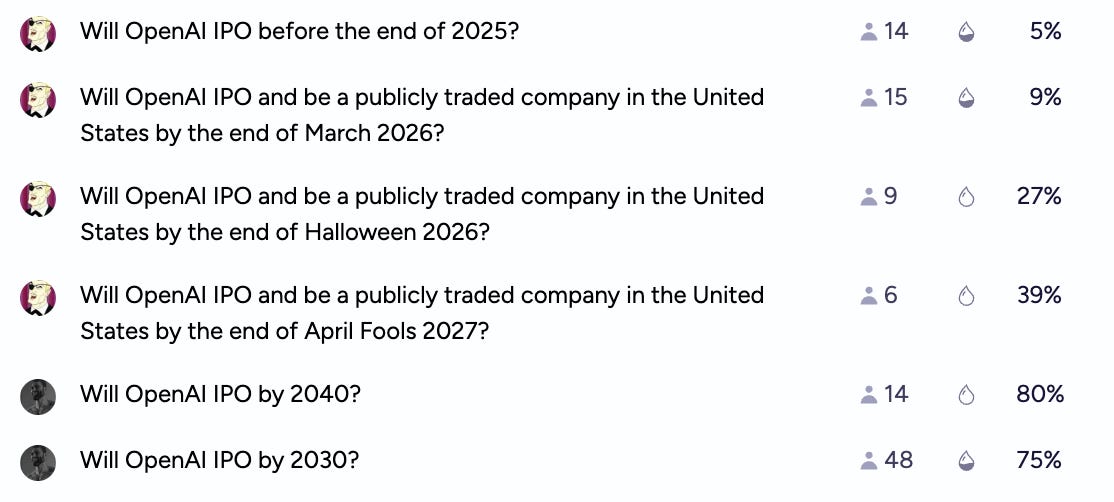

Forecasters also think the valuation of OpenAI will continue to increase before its IPO (which traders now think is 75% likely to happen in the next 4 years).

Conditional on an IPO occurring, forecasters expect a modal outcome of over $1 trillion, double its current valuation of $500 billion. Keep in mind that this forecast might involve some artifacts due to the fact that worlds in which OpenAI fails to IPO are likely worlds in which their valuation recedes.

Will these valuations be justified? If OpenAI revenue continues to follow its upward trajectory, probably. Manifold gives pretty decent odds to OpenAI reaching $100 billion in revenue in just three years, and a ratio of about 5-10 between revenue and total valuation is fairly typical for tech companies (although their revenue is currently far lower). Peter Wildeford has a deep dive and some forecasts on why the valuation for OpenAI is not super unprecedented in the scale of fast-growing tech companies.

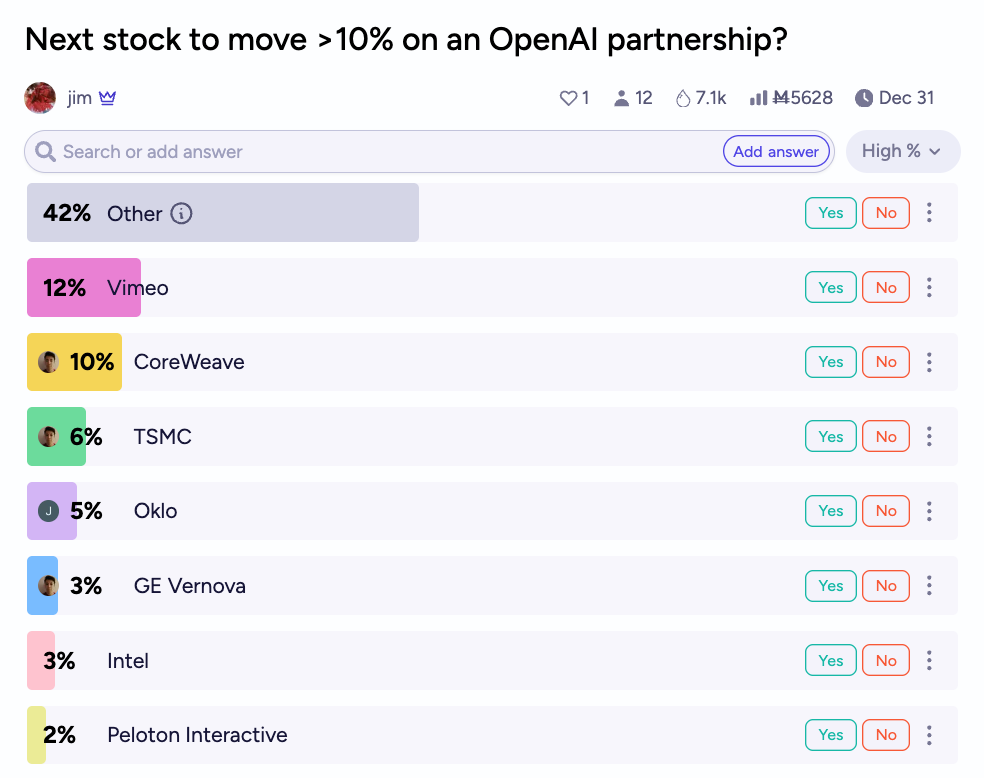

And these gaudy valuations are likely to involve further partnerships, mergers, and consolidations. You can speculate on what will be the next stock to soar upon news of a partnership with OpenAI (as Oracle and others have). The current leaders appear to be Vimeo, CoreWeave, and TSMC, but the market thinks there’s still a 2% chance that we get a live-generated Peloton instructor to cheer you on while biking.

Sam Altman

Notably absent from the restructuring was any kind of direct benefits to the CEO, although I think it’s an open question how much of the employee shares will go to Altman. Still, with the rumor mill implying that Altman would receive as much as 7% of the shares of the company (which now seems quite unlikely), there’s still some value in speculating on whether Altman will receive the kind of compensation that CEOs tend to command, and are often necessary to keep them from jumping ship.

Altman doesn’t need the money per se—his net worth is over $2 billion—but the market seems to think that one way or another, he’ll find a way to a skyrocketing valuation on a personal level:

In any case, if Altman ever gets short on cash, he can always make a couple thousand mana by making an account and betting up this market.

OpenRoundup

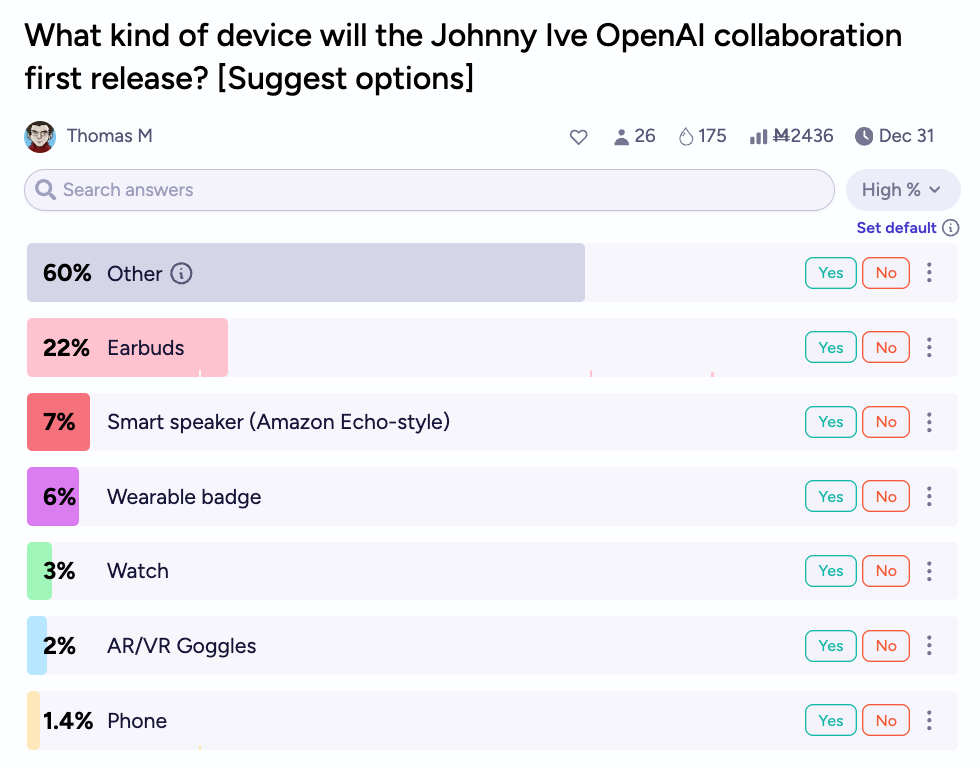

You can try to forecast what the first io/OpenAI device will be…

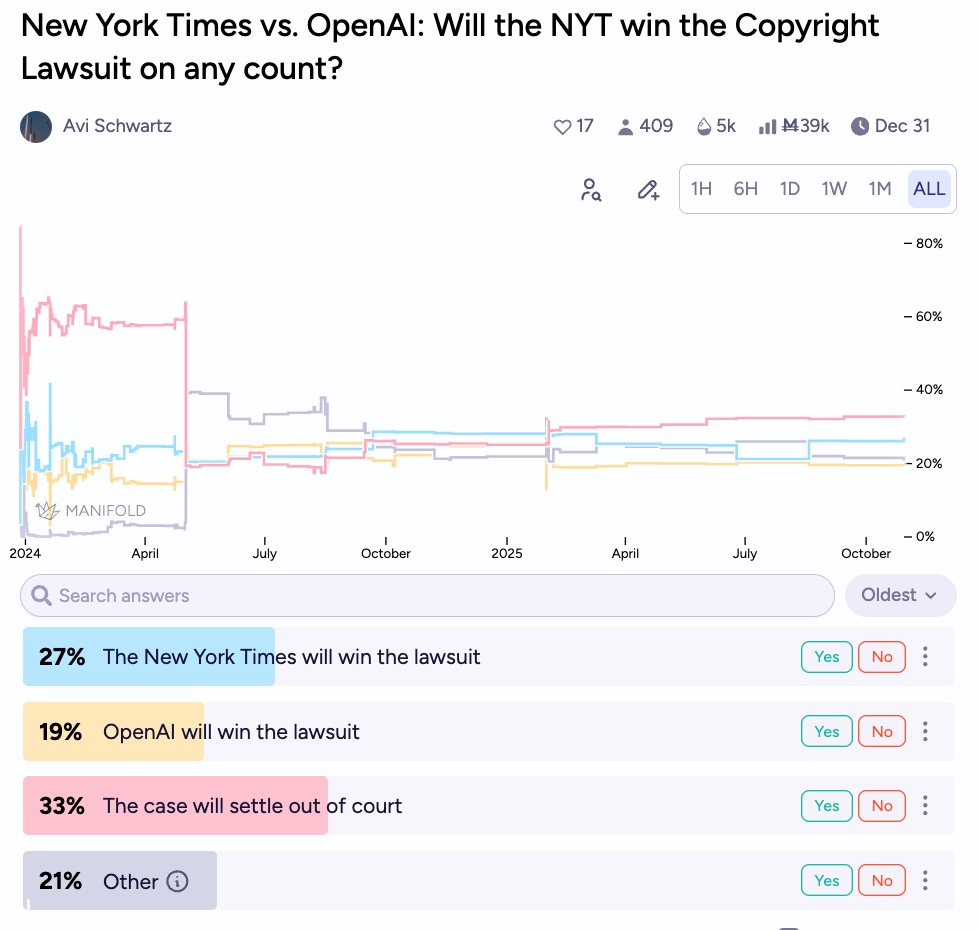

…or the outcome of the NYT vs OpenAI lawsuit…

…and there’s still a 4% chance that OpenAI claims to have AGI before the end of the year.

Happy Forecasting!

-Above the Fold

Correction 11/1/25: I had previously written, “Because Manifold’s core business is still “controlled by the non-profit board” pretty clearly under the terms of this arrangement.” I meant that OpenAI’s core business was still controlled by the non-profit board, and have corrected the text. Manifold’s core business is not controlled by the OpenAI board, but rather by an oracular artifact from the third century BCE, kept in a secure location in an unmarked field outside of Modesto, CA.

I opened this very hopeful that it was about easily running Manifold’s open source implementation on my own machine

> Manifold’s core business is still “controlled by the non-profit board”

"Manifold" > "Open AI"