Is Trump really 62% to win?

Understanding Trump's odds, Hurricanes, and Manifold's revenue

For the last few years, Manifold, Kalshi and Polymarket each had ~500 to ~2,000 people trading on an average day. That has all changed now as the election looms. Prediction markets are hitting record trading volumes, winning lawsuits against the CTFC to legalise election markets, and Manifold has pivoted to allow withdrawals for the first time.

At Manifold we’ve had our heads down, focused on improving our site for the elections. Today’s newsletter is going to reflect this by leaning towards our old style, a hodgepodge of what’s going on in the markets sprinkled with insights into the development of Manifold.

Trump’s odds are up, but should you trust them?

Other than a small blip on day one, Trump finally reached parity and then surpassed Harris for the first time on Manifold’s sweepstakes market.

Trump’s gain to 54% on Manifold is conservative when compared to his 62% on Polymarket. After months of flat graphs, these gains in prediction markets have caused quite a reaction on social media and major news. But, it’s important to take a step back and realise it’s still close to a tossup. While Trump now leads on prediction markets, polling and models are still favourable to Harris even if it’s neck and neck.

It’s plausible that some of Trump’s recent gains in the markets can be attributed to a single trader. Fredi9999, as reported on by Polymarket’s top trader Domer, has around $30 million on Trump and pushed Polymarket’s market much higher than anyone is willing to bet it back down. Rather than explaining it here, you should spend a couple of minutes reading Domer’s tweet, here is a snippet:

We had a market on the identity of who Fredi is but decided to take it down to not encourage doxxing in case they are just a “normal” trader looking to place some bets on Trump. The market does think it’s unlikely that there is substantial evidence of it being Elon Musk.

Speaking of Elon, the spike in Trump’s odds really began shortly after Elon shared Polymarket on X with his increasingly right-leaning fans. While it’s still possible that these market movements are a well-calibrated reflection of the poorly perceived hurricane response by Harris and her lackluster interviews, enough time has passed since those events that it should be reflected in the polls.

It was certainly easier to say trust the markets and not the polls when they both forecasted within tiny margins of one another. The next few weeks will be prediction markets’ biggest test yet to see that they don’t overcorrect in the face of hype from traders who are personally rooting for one side much more than the other. I’m still bullish on market accuracy overall, but it is important to know when to take the % on a given market with a grain of salt.

Prediction markets are kinda confusing

The other product of this newfound attention on prediction markets is the widespread misunderstanding of how they work. New York Times incorrectly framed prediction market probability by directly comparing them to polling data and then made an even more inaccurate correction.

This shared misunderstanding has been reflected by many on Twitter who seem to believe a 20-point lead in a prediction market is equivalent to a 20-point lead in a poll. If a trustworthy poll suggested a 20-point lead then you’d be looking at something closer to a 90% chance of winning (I admittedly haven’t taken the time nor have yet built the intuition to know if 90% is a reasonable number, but the point stands that the odds of winning would be much higher than just 60% with such a large polling lead). I’ve lost at least a couple of my brain cells seeing people proudly share Harris’s weakening odds while saying, “At this point if she wins you know it was stolen”. The screenshot you just triumphantly shared says she is expected to win 40% of the time!

This can make following prediction markets feel much more exciting than polls as any movement to favour a candidate results in bigger numbers. But it is important we educate people that these movements in the markets aren’t as significant as if a poll moved by the same number of points.

Hurricanes in Florida

Florida currently has some of the highest home insurance rates in the country with many major insurers pulling out of the state. Throw two large hurricanes into the mix and many worry how their insurance premiums may be affected. While prediction markets won’t be replacing insurance required by mortgage lenders, they could still play a role in allowing people to hedge against natural disasters.

Carson Gale created a market on if his parents’ home would experience significant damage.

This was a mana market so no real-money hedging could be done, but Carson still wanted to use the aggregate knowledge to help his parents decide whether they needed to evacuate or not.

However, the potential for operationalising markets about hurricanes and using them as a form of insurance is there.

Most markets on the hurricanes are resolved, although there is still uncertainty on which hurricane caused more damage in costs.

One month of sweepstakes, looking at the stats

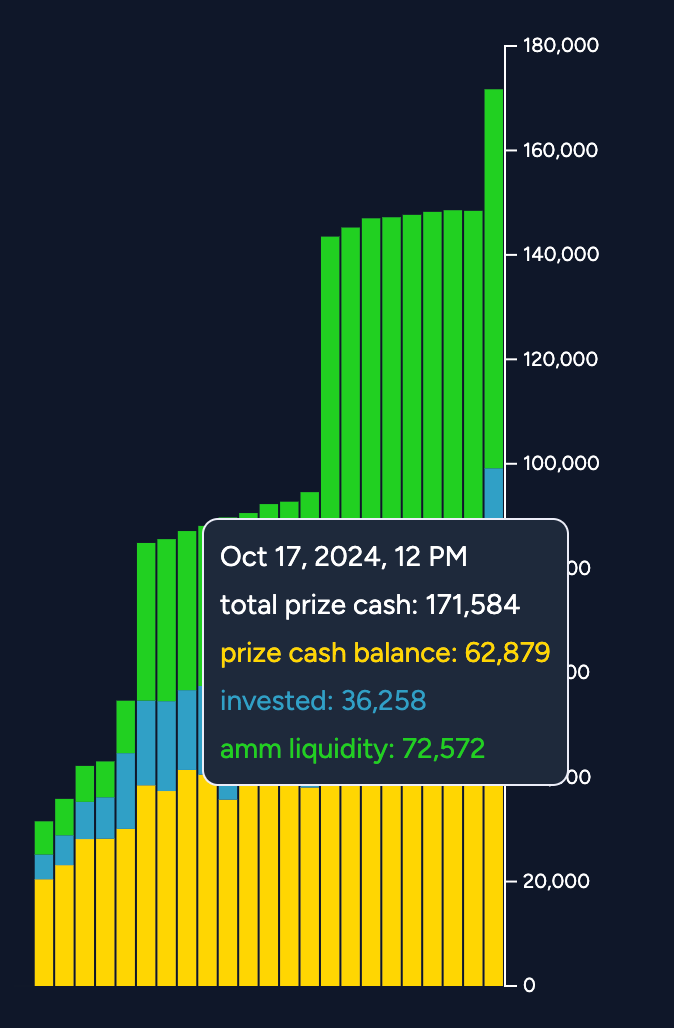

Today marks one month since the first sweepstakes market was created on Manifold. With Manifold’s usual radical transparency, let’s take a look at how it’s going.

First, the revenue. From 163 people we’ve had ~$41.5k in purchases. $34k of this is from our top 5 spenders.

As of today, there is 171,584 sweepcash in circulation. Of this, 50,000 is liquidity in the presidential market which Manifold will likely take out of the market on the night of the election.

Trading volume. This isn’t a stat we cared too much about with mana as it would see spikes when an appealing whale bait market caught the eye of traders and wasn’t as correlated with our key metrics. It becomes much more important with sweepstakes and thus far 55,600 sweepcash has been traded on our markets. With a couple of big purchases being completed recently, we expect to see a boost in this number as larger limit orders are created providing more opportunities for other traders. Due to the value of liquid markets, for a limited time, we are offering significant discounts for anyone looking to spend over $5,000. Please contact us to find out more.

Daily active users. Unfortunately, this figure has continued to decline following its downtrend since our July spike where a flurry of trading took place with Biden dropping out. Monthly visitors remain relatively stable with over 150k unique visitors and 3 to 4 million page views. We hope to improve these numbers by ramping up our marketing for the elections such as sponsoring the David Pakman show. If you would be interested in collaborating or know someone now is a great time to reach out!

The number of sweepstakes markets created. We’ve created ~80 sweepstakes markets in the past month. That’s still nearly half the average number of mana markets made in a single day. So far we’ve stuck to relatively safe, arguably boring markets. Over the next couple of months, we would love to 10x the number of sweepstakes markets on our site and you can expect to see us selecting some of the more spicy questions. The biggest challenge has been finding markets with unambiguous resolution criteria. For the average person creating a market on Manifold it isn’t worth it to spend 20 minutes accounting for all the curveball scenarios that most likely will never affect the market. If we want our sweepstakes markets to be more robust, this adds a lot of effort for us making the whole concept of user-driven market creation less scalable for sweepstakes.

As always you can view our full stats on our stats page (note the sales are incorrect due to direct ach payments).

Other minor updates

Unique trader bonuses are back! Only in mana for now.

There is a new referral code where you get 10 sweepcash for referring a friend! (There are some caveats to this and it is probably going to change again soon).

Creators can withdraw liquidity from their markets (useful if an event is about to happen and you want to leave the market open but don’t want to lose all the liquidity you put into the market).

Thanks for reading!

David Chee

That NYT "correction" is godawful. xD

Every time I think "hey, maybe they're actually kinda-sorta reliable now" I'm reminded that no, legacy media is pretty dumb.

Do you think increased competition is slowing your growth?