I bet against a space launch as I cheered it on

It changed how I bet on events I care about, and I learned something about balancing profit and emotion

Astronauts Suni Williams and Butch Wilmore are now 280 days into their planned 8-day mission to the International Space Station. After several issues were found with the experimental Boeing Starliner spacecraft that brought them there, it returned to Earth without them.

They are now at the center of the planning for a rescue mission and the minor political controversy surrounding it. There are several open markets where you can follow the oft-changing plan to bring them home:

But right here, I want to rewind back to the days leading up to their launch in early June. Space news has many fans, myself included, and there was an abundance of news coverage and market activity following the anticipated launch of a new vehicle. As the Starliner astronauts prepared for their test flight, I was learning a valuable lesson about my Manifold betting patterns.

Differences in Development

The first orbital test flight of an uncrewed Starliner test vehicle was aborted mid-flight in 2019 after a software issue caused the capsule to expend too much of its fuel much too early in the flight. For those following closely, there have been many indications of issues in Starliner’s development program. The aborted mission to dock with the International Space Station in low-earth orbit followed a series of issues and delays for the project, which was first scheduled to fly in 2017. Analysis following the test flight revealed additional potentially catastrophic issues that had been missed in development.

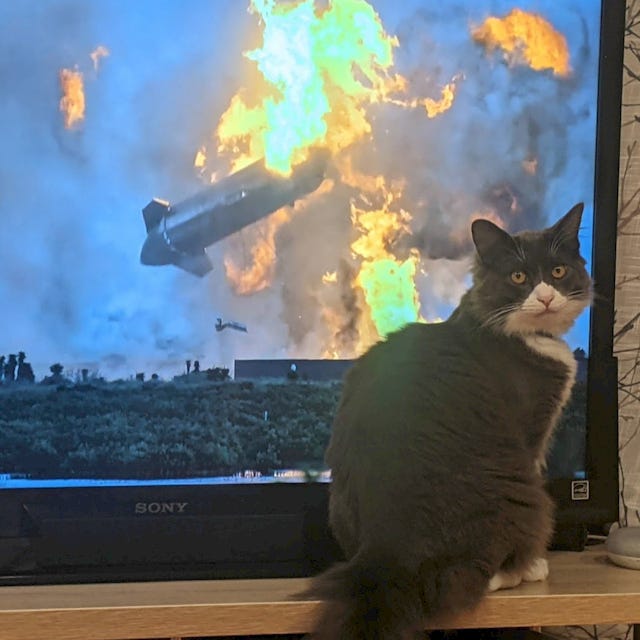

But SpaceX blows up test rockets all the time! Why is a relatively clean mission abort such a big deal for Boeing?

The two companies, who both have won contracts for NASA’s commercial crew program, have different development cycles. Boeing follows a traditional model for aerospace development: they design, simulate, and analyze every component and possible failure. It’s a huge engineering effort, but Boeing, NASA, and many other aerospace organizations have used this technique to great success. SpaceX favors a more iterative approach: building on actual hardware and testing to failure, often in a very dramatic fashion.

Despite the different design philosophies, they have something in common. When the design is done, they bring it to NASA and declare themselves ready for a demonstration mission. It doesn’t matter if the tools used to test the designs to their limits were fuel and fire, or math and physics simulations, all that matters is demonstrating that the design is ready at that point.

Spaceflight is so expensive that running enough demo missions for a good statistical sample isn’t realistic, so on a single demo any failure should be taken very seriously and be examined as a possible indicator of additional issues. Boeing made changes and performed a second demonstration flight in 2022 that NASA accepted as meeting the mission objectives, but to me and many others following the development the failure to complete the mission objectives of the first orbital test flight was a sign of deeper issues in the development process. That is, after all, only a 50% success rate.

Launch Days

The Starliner system was designed to carry crew to and from low-earth orbit and the International Space Station. The next step for certification in NASA’s commercial crew program was a crewed demo launch, with NASA astronauts onboard.

This is an exciting milestone, and there were several markets tracking the expected launch day.

But one market that seemed to get much of the attention, was this one that pitted Starliner against a Starship test launch. There’s nothing like a sense of competition to get traders’ attention.

And this is the market that I want to focus on. This is one where I made trades, and learned lessons about my own personal attachment to certain markets.

Feeling Something

In case it’s not clear, I like space exploration and I’ve followed the development of these new crew-carrying ships with interest. It’s something I value, and so I wanted to see the field progress with a successful launch.

In the days before Manifold, a launch day would have been filled with hope and excitement as I watched a launch livestream.

But I was aware of some of the issues that had caused so many delays and previous failures, and so I was betting against a successful launch. In many ways, this was a completely rational thing to do; I thought the market was mispriced based on information I had, so I was betting it down as low as the 50% range.

On June 1 there was a launch attempt, and I was making bets in real time as I watched the rocket prepare on the launch pad.

And the more I watched, the more I realized that I like watching launches and wholeheartedly cheering for their success. Now I was watching the launch prep, hoping for success in one part of my mind, but knowing that an abort would lead to Mana profits and the dopamine that comes with that. That mental conflict changed the experience.

I enjoyed the experience a lot less than I could have, because of that conflict. The launch that day was eventually scrubbed, and I closed out my positions at a loss.

When Starliner did launch a few days later, I watched it without any Mana staked, without any reservation or mental conflict, and I enjoyed the experience much more.

Other Examples

Following the recent plane/helicopter crash near Washington D.C. there was a market predicting the number of survivors as the search went on. There was some discussion in those comments and elsewhere online about the ethics of making such predictions.

I think the reflex to criticize these markets is rooted in some of the same sentiment and discomfort that comes with hoping for one outcome while betting on another. In some ways, it’s adjacent to antisocial behaviors of dishonesty and disloyalty, or saying one thing while doing another.

But the betting behavior on these markets has potential societal benefits, even if it pattern-matches with hypocrisy on a first glance.

There was another plane crash a few days later in Alaska. The terrain and weather conditions made a search and rescue effort difficult and dangerous. This is a similar but more tangible example where decisions had to be made between potential rescue of victims and risking the additional lives of those on the search and rescue team. These decisions are made in conditions of uncertainty and imperfect information. Prediction markets are information aggregators, and markets like this one estimating survivors can improve the timeliness and quality of information available to the teams involved, leading to better decisions with more lives saved overall.

Has this changed how I bet?

Yes. For now, I’m cautious about making bets on markets that are closest to the things I enjoy, especially when I’d be betting against the outcomes I want.

Perhaps one day I’ll be able to separate my values and beliefs to the point that I can bet on space launches and still watch them with full enjoyment. That would be an achievement in personal growth. Even before this instance, that separation is something I’ve been training and I think it’s improved my experience of the world on the whole. A large part of the reason I joined Manifold is to measure my beliefs and see how they compare to reality with a record of profit and accuracy. Now I see there’s a chance to understand and improve myself along with my understanding of the world.

> Boeing follows a traditional model for aerospace development: they design, simulate, and analyze every component and possible failure

The "mistakes are not allowed" model is not the traditional model of aerospace development. The iterative approach is also the traditional approach. The Apollo missions used "all-up testing" to find issues early. Before that Von Braun had used a prototype-rich approach to build working rockets.

SpaceX is a return to tradition, not a break with the past.