Did the markets expect Trump to blame Harris for cat-eating in Ohio?

How did the Harris-Trump debate affect prediction market odds and fact checks

Last night's debate between former President Donald Trump and Vice President Kamala Harris unfolded as one might have expected. Trump gave fact-checkers plenty of material as he dodged ABC’s questions by stating inaccurate facts about Harris and Biden’s government. Harris appeared more composed and stuck to rehearsed talking points, but was also guilty of presenting inaccurate information.

Both candidates avoided in-depth policy discussions. Rather than engaging with the details of their policies and why their approaches might be better for the country, they spent much of their time attacking each other’s positions, often exaggerating. Trump painted Harris as a "Marxist," while Harris incorrectly claimed that Trump aimed to ban all abortions. Neither offered clear explanations of their policy strengths nor directly addressed the weaknesses of the other side’s proposals.

How did it affect the markets?

Overall, things went very well for Harris with the markets updating in her favor much more than anticipated. Even though the markets were very confident (70%) that Harris would be voted the winner of the debate, they remained less confident (53%) that Harris’s prediction market odds of winning the election would increase following the debate. This is logical as any anticipation of her victory should have already been priced into her presidency odds.

Before the debate Harris’s prediction markets odds sat at 47.4% and have now risen to 51.3%! This rise of 4% shows that the markets think Harris won much more handily than expected. I remain cautiously skeptical that a 4% increase is merited and wonder if the market pricing is being affected by momentum and vibes that a quick profit can be made because others will bet her up. I’ll be keeping an eye on whether Harris’s gains in the market are sustained or if they will drop back down a couple of points over the next few days.

Fact checks

Nathan Young ran a fact-checking market on Manifold to help viewers approximate in real-time how truthful each statement from either side was.

While using GPT as the deciding source of information is probably sub-optimal, it was a cool experiment that incentivized people with more context to generate information for those unfamiliar with the claims made. I could foresee a mechanism, possibly using prediction markets or perhaps an algorithm more similar to X’s community notes, that incentivizes viewers in real-time to weigh in on claims made which generates %’s that are automatically displayed on the broadcast within seconds. You would need to be careful it isn’t a poll and that people who weigh in are held accountable and their opinions weighted appropriately by a mechanism.

Trump blames border czar Harris for allowing Haitians to eat Ohio’s pet cats and dogs

While the markets were confident Trump would make outlandish attacks on Harris, each specific phrase people predicted he might say was often at 20-30%, offering good returns for traders betting on any particular phrase.

The statement that caused the most noise was Trump’s mention of Haitian immigrants. He blamed Harris, calling her the border czar, for letting them into the country and accused the immigrants of stealing and eating people’s pets. JD Vance had sparked similar outrage with his recent posts (1, 2) on X, although his response when confronted by a CNN journalist frames the situation more reasonably than Trump during the debate. Nevertheless, the markets on Manifold suggest that both are overstating things to aid their agenda as our markets put the pet-eating rumours at 31%.

But, the odds on Manifold have been consistently rising, and lend more credit to the rumours than many of the fact-checkers. BBC Verify pointed at the Springfield city official’s statement which claimed the city had no evidence to support the rumours. BBC then went on to say, “Trump’s comment followed a baseless claim”. While it is important to let people know that what Trump is claiming as fact isn’t supported by the evidence, presenting things in black and white and labelling things as baseless seems unhelpful when there is still a lot of uncertainty surrounding an event. This shows how the nuance markets provide is more important than ever.

Concluding remarks

The market on whether there will be a second debate has been very volatile since yesterday but seems to have settled at around 63%.

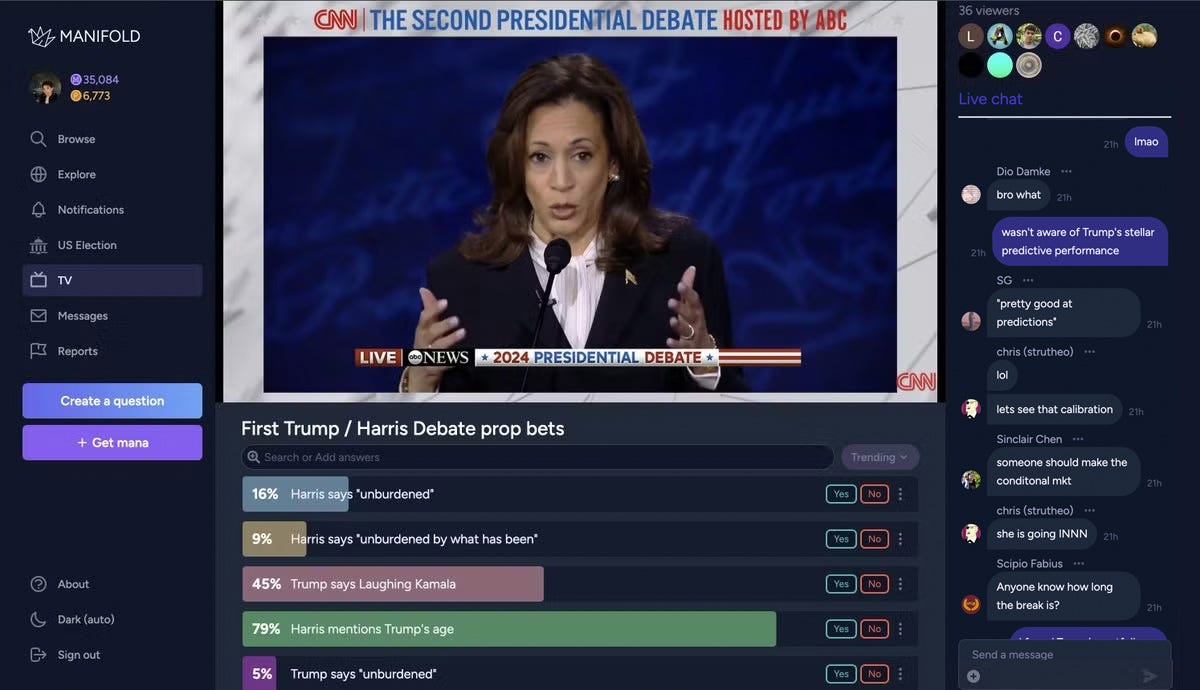

If there is another debate you should join our Manifold TV coverage where people live bet in our prop market while chatting with each other.

And finally, if you want to follow Manifold’s election coverage be sure to keep an eye on our election page. Who knows, soon you might even spot a market that allows you to withdraw your winnings…

Thanks for reading

David Chee

Can you please read the market titles you are putting into your Substack? The Trump claim and BBC follow up were about pets, so it's sloppy to use a market where wild animals are included as evidence against the fact check. This is especially true given the market appears to be updating about wild geese killings.

Harris was only wrong IFF you take what Trump said on truth.social (that he'd veto a federal abortion ban) as an accurate prediction of how he'd behave in office.

He's changed what he's said on this issue so many times you'd be foolish to believe he's the authority on what he'd actually do. In the last debate he refused to say what he'd do when faced with an abortion ban. I wouldn't be in the least surprised if Harris ends up being right, were a federal abortion ban to make it through the Senate. I would even say it's the likelier of the two options.

I've already voted, but as an abortion-rights voter I can only look at his past behaviour, and accordingly it's pretty clear who the correct choice is if it's an issue you care about.