AI and Political Realignments, Foreign and Domestic

Markets react to foreign policy shifts and new chatbot launches

Vance Across the Pond

The transatlantic forecast is looking cloudy. European leaders might be well-served in turning to forecasting platforms, as they’ve been left reeling by rapid changes in US foreign policy toward the continent. These are perhaps best demonstrated by the stark shift in tone in Vice President J.D. Vance’s speeches delivered to the Paris AI Summit and the Munich Security Conference.

Vance’s speech in Paris envisioned American leadership in AI but also warned European regulators to scale back regulations in the digital space if they’d like to cooperate with the US. Vance had an audience in mind that has long been global tone-setters in caution-minded internet policy. Manifold users believe that the EU is likely to establish an agency for the explicit regulation of AI, and Europe is trying to straddle a fine line between encouraging innovation and business while mitigating potential harm.

Vance’s speech reflects the anti-regulation policies of his administration, and in general reflects a slowly growing political divide on AI regulation, a topic which splits the pro/anti-regulation and the (rapidly shifting) pro/anti-Bay-Area-tech-companies sentiments in the left/right divide of American politics. Manifold users think it likely that AI safety regulation will take on a left-wing valence in the coming years.

Vance’s speeches hold even more weight considering that he currently has the highest odds for the 2028 Republican nomination and the 2028 presidential election.

You’ll notice that Manifold bettors give Vance a 46% chance of being the Republican nominee and 33% odds of winning the election, despite considering the democratic party a slight favorite in 2028. That would indicate about a 70-75% chance of a Vance victory conditional on securing the nomination! This implies one of two things:

That Vance would be a strong candidate and is more likely to win the general election than other nominees.

That Vance is more likely to secure the nomination if things go well for the Republican party over the next 4 years, reflecting a desire to stick with what’s working by going with the sitting VP as their nominee.

And Manifold bettors believe all this, in spite of Vance being unlikely to shave his beard by the next election.

Ceasefire Soon?

Vance’s other speech, to the Munich Security Conference, stressed that American priorities with Europe might be shifting.

“I see many great military leaders gathered here today, but while the Trump administration is very concerned with European security and believes that we can come to a reasonable settlement between Russia and Ukraine, and we also believe that it’s important in the coming years for Europe to step up in a big way to provide for its own defense, the threat that I worry the most about vis-a-vis Europe is not Russia, it’s not China, it’s not any other external actor. And what I worry about is the threat from within, the retreat of Europe from some of its most fundamental values, values shared with the United States of America.”

This comes at a critical juncture in the Russian invasion of Ukraine, when negotiations for a ceasefire and the start of the end of the war appear imminent.

Manifold bettors continue to think a near-term end to the conflict is possible, although far from guaranteed, giving 25% odds of a ceasefire in Trump’s first 90 days…

…and 56% by year’s end, although Polymarket is trading 10% higher on that proposition.

Stakeholders to the negotiations are starting to jostle for position: while the US and Russia held high-level talks in Riyadh, Zelenskyy met with Erdoğan in the Turkish capital. Turkey is at decent odds to be the brokering party during ceasefire negotiations:

Expect the specific outcomes of the negotiations to enter the spotlight on prediction markets after the negotiations begin in earnest. The Trump administration has deviated from the prior administration’s position on land concessions, although this has not yet shifted Manifold’s (volatile) market on whether Ukraine will lose the Donbas in a peace deal.

However, the prospect of a peace deal soon—or perhaps US withdrawal from the conflict—has caused the odds of NATO troops in Ukraine over the next two years to rise (albeit on a very small number of traders).

Adams and Congestion Pricing

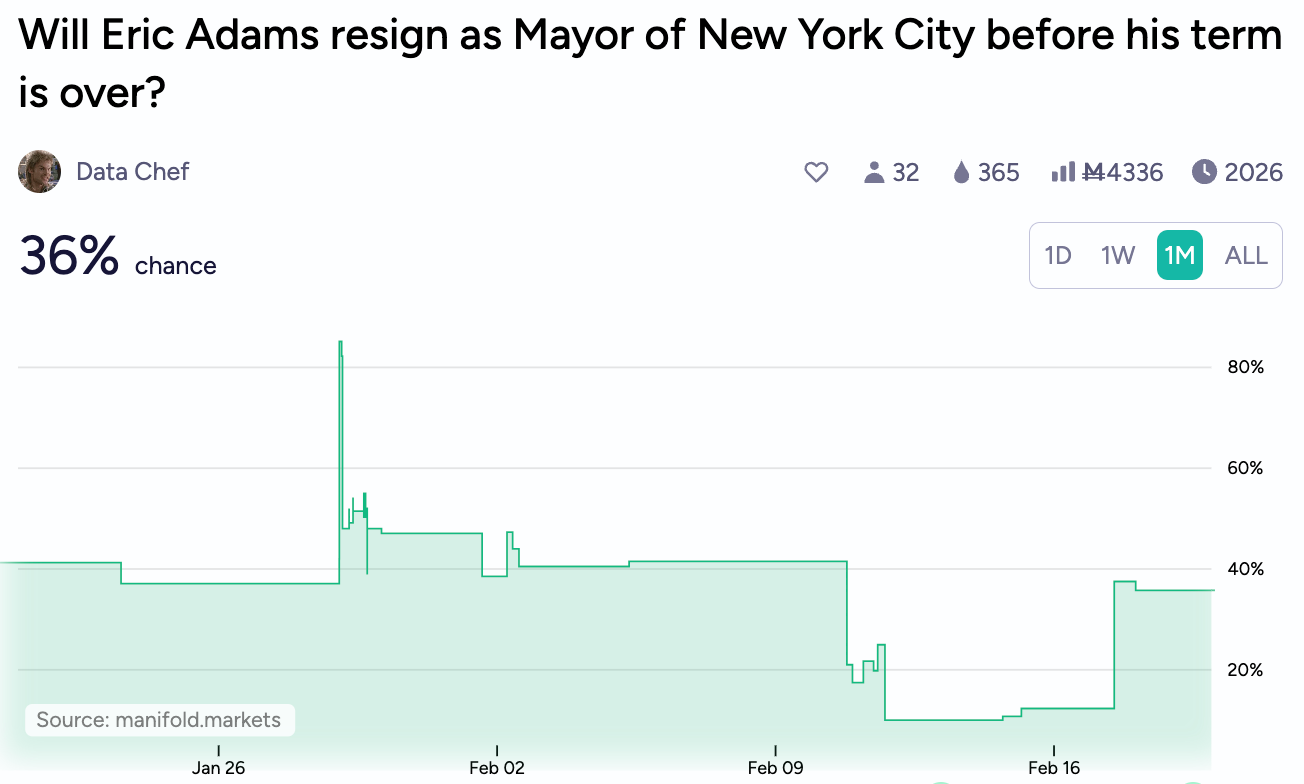

Meanwhile, in Little Ukraine, NYC, residents have been adjusting to their own realignments. The mayor appeared briefly to have his political career back, after Trump made moves to lift the corruption investigation into Adams, but this further antagonized his own allies in New York, creating chaos in the mayor's office. The market on whether Adams would finish out his term rose from 20% at the end of last year to 90% after Trump ordered the investigation to be lifted. Then it came crashing back down to parity in light of speculation on whether Governor Kathy Hochul may take steps to remove Adams as mayor, or whether Adams himself might resign to spare himself the indignity.

(Note the drop from 40% to ~10% for the few days when it appeared that Adams was back in the saddle).

Just when NYC residents were finally getting adjusted to congestion pricing and starting to realize the reduced traffic benefits, the Trump administration moved to revoke federal approval for the program. Manifold bettors did not see this coming…

… but still think that the revoked approval may or may not indeed take effect, given the lawsuit already filed.

If you’ll recall, congestion pricing had already been a rollercoaster for Manifold users, with wild swings associated with the multiple reversed decisions and delays associated with the program.

We have AI at Home, Too

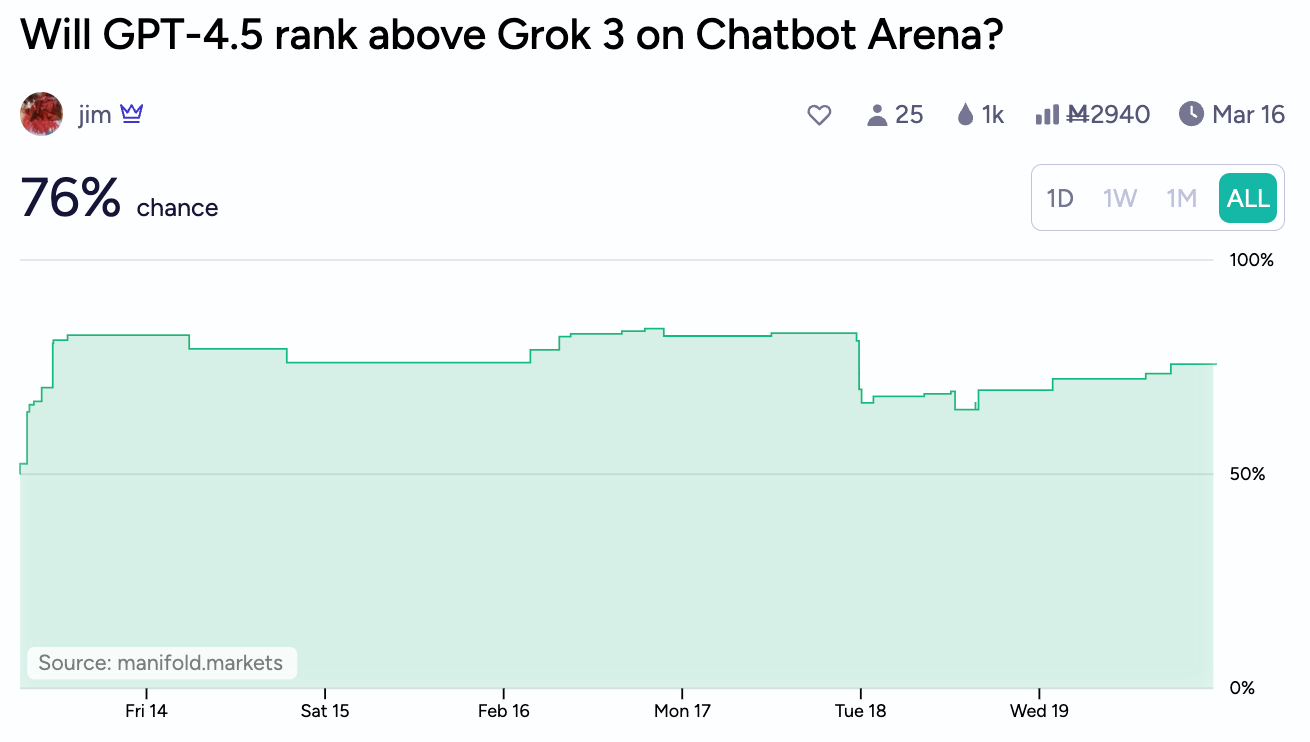

Speaking of wild swings, xAI’s new Grok 3 has provoked some dramatic trading, with Zvi Mowshowitz’s market on whether Grok 3 would live up to Musk’s hype as the “the most powerful AI in the world” leaping from 20% to 80% on surprisingly high benchmark scores and a #1 spot on lmarena. Even internal prognosticators at xAI did not see this coming. Bettors were perhaps overly focused on controversial criteria clarifications and internal bargaining within the market on whether reasoning models would or would not count towards the resolution (ultimately it might not matter since Grok 3 itself has reasoning capabilities).

It may not hold its top spot for long, with GPT-4.5 (somewhat of a surprise to begin with) due to be released in the next couple months, after an announcement from OpenAI CEO Sam Altman.

The Grok 3 news has updated forecasters towards a view that Musk’s AI venture might be a serious competitor among frontier AI labs, and now view them as having even odds at exceeding the valuation of OpenAI (although part of that may be due to uncertainty in OpenAI’s corporate structure).

Perhaps Musk can boost their valuation with any excess gold he salvages from the Fort Knox vault.

Happy forecasting!

-Above the Fold

"That would indicate about a 20-25% chance of a Vance victory conditional on securing the nomination!"

I think you meant to write 70-75%