Above the Persian Gulf

Prediction markets react to Operation Rising Lion and tumult at home in California

63 CE

History often repeats itself, if you know where to look.

In 63 CE, emissaries of the hegemonic Roman Empire, at the urging of Nero, tried to establish a lasting peace with the Parthian Empire. To achieve this peace, the authority to appoint the Armenian ruler was ceded to the Parthians. At the time, this concession was politically unpopular and damaging for Nero, but this peace lasted for half a century, ensuring peace along the Eastern frontier through a period of internal political tumult in the West.

In 2015 CE, emissaries of the hegemonic UN Security Council, at the urging of the Obama administration, tried to establish a lasting peace with the successor state to the Parthians, the Islamic Republic of Iran. To achieve this peace, sanctions were lifted on Iran and its nuclear energy program was allowed to continue under monitoring. At the time, these concessions were politically unpopular and damaging for Obama, but the peace lasted for… three years, when during a period of internal political tumult in the West, the United States withdrew from this treaty.

Despite this, and despite rising tensions between Israel and Iran amongst a series of proxy conflicts and air exchanges, full-out war had been averted. This period of restraint may be over.

As Trump’s memory-holed 60-day deadline in his letter to the Ayatollah on reaching a nuclear deal came to a close yesterday, Israel initiated “Operation Rising Lion,” opening a direct front in their conflict with Iran.

Prediction markets weren’t quite taken off guard by this. An Israeli strike on the Iranian nuclear program was priced at just under 50% a few days ago, and this surged to about 2/3 odds after the United States withdrew non-essential embassy staff across the Middle East. As savvy political bettor Domer has pointed out, there might have even been some sort of intelligence leak, with one account on Polymarket exhibiting a confident pattern of betting behavior in the hours leading up to Israeli strikes on Iran.

But why were traders skeptical to begin with, especially in the 24 hours preceding the attack? Israel’s posturing had been clear, to say the least.

Well, over the last couple months, the media had repeatedly reported Trump’s growing frustration with Netanyahu and Israel’s position on rapprochement with Iran, as the United States attempted to broker a nuclear deal. There were rumors that Trump was contemplating partial recognition of a Palestinian state, and a steady drip of articles, sources, and leaks on distance between the US and Israeli leaders.

Was this all geopolitical kayfabe, however? Two completely orthogonal media narratives have emerged.

Now that Israel has struck Iran, foiling US peace talks, the Trump administration is reluctantly attempting to deflect blame for the attacks onto Israel while acting like Iran perhaps had it coming by not reaching a deal in time. The Trump administration remains frustrated by this and failed to rein in Netanyahu’s worst impulses.

See The Guardian, The WSJ, and CNN’s coverage of the last 24 hours for examples of this angle.Alternatively, the US was in on the plan the whole time, acting like they were holding Israel back from striking, giving Israel the intelligence and time they needed while lulling Iran into a false sense of security by prolonging diplomatic talks. The Trump administration, which never liked the idea of a peace deal with Iran, was hoping for an Israeli attack to cripple Iran’s nuclear program once and for all.

See Reuters, Slate, and OSINT twitter for examples of this angle.

As usual, the truth probably lies somewhere in the middle. The US appears to be, on one hand, gesturing at the possibility for Iran to now continue talks (at a significantly degraded bargaining position), while on the other hand, signaling an intent to cooperate with Israel’s operation by assisting in intercepting missiles over the Persian Gulf.

If you think you have a good read on the current administration’s sentiment with regard to the conflict, you can even trade on whether Trump will continue to praise the actions of Israel, or whether he will attempt to assign blame to the previous Biden administration for the escalation.

The Iranian Regime

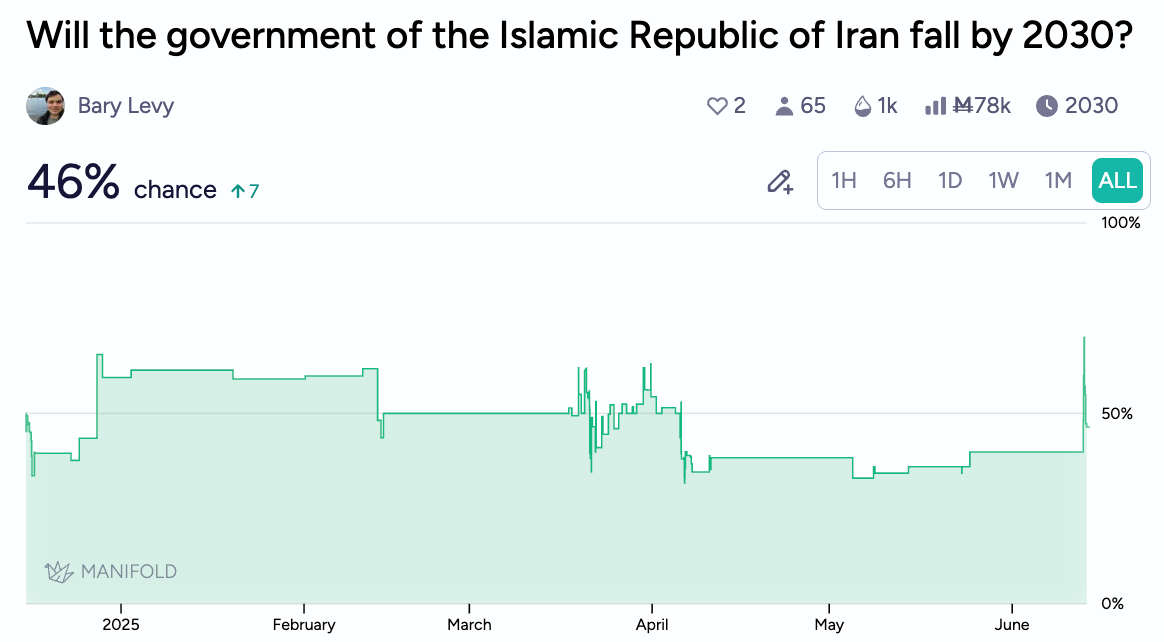

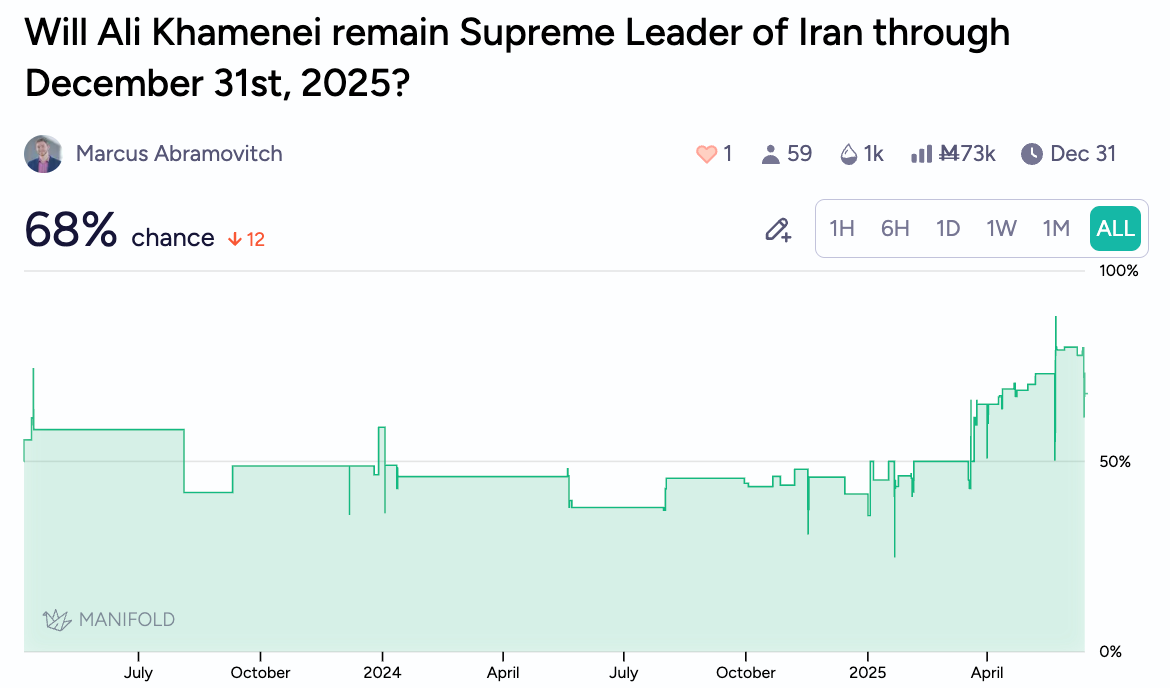

The odds for regime change in Iran this year have jumped up to over 20%, and almost 50% by the end of the decade:

Khamenei’s odds of staying in power through year’s end have also fallen to the high 60’s. Without immediate health issues, Khamenei’s chances were rising over the first few months of the year, with most of the uncertainty lying in the timing of the transition to his successor. Conflict with Israel increases the risk of regime change and targeted political assassinations, but perhaps pushes back the timeline for a direct successor to be appointed, due to the need for a steady hand during conflict.

While Israel has routinely taken out senior leadership in its recent conflicts with Hamas, Hezbollah, and the Houthis, markets do not seem to assign as much risk to this happening to Khamenei. Israel has already conducted targeted attacks against senior nuclear scientists and generals in the Iranian Revolution Guard Corps.

The odds of all-out war over the next few years, rather than a series of targeted operations (though this is difficult to define precisely), have risen to about 75%, and the odds of a conflict with a high amount of casualties have also risen.

However, traders remain skeptical that the US will participate directly in strikes on Iran, giving only about 1 in 4 odds to this scenario:

Both Israel and Iran are likely holding back on their maximally escalatory options. Israel is only priced at about 70% to strike Iran’s oil fields this month, for example:

And Iran might not be yet willing to turn to mortgage itself to China politically for military assistance, and may be holding back components of its arsenal as a last resort to respond to, for example, Israeli assassinations of political figures such as Khamenei. Currently the “modal” outcome from prediction markets and OSINT analysts, as best as I can summarize it, appears to imply several weeks of tit for tat strikes, with the US mostly attempting to stay out of the conflict. These strikes could escalate (as they did with Hamas and Hezbollah) or de-escalate (as they did last October with Iran). The senior political leadership of Iran is likely to remain out of the fray for now, but the serious risk to their lives may factor into Iran’s risk calculus. The specific tactics of Israel mimic those that it used to systematically destroy the military capabilities of Hezbollah: targeting senior leadership to erode the chain of command, utilizing shockingly deep intelligence breaches to create panic, and taking advantage of missile defense systems and air supremacy to conduct asymmetrical airstrikes.

The Home Front

Rising tensions between the federal government and state officials in California around ICE actions perhaps bury the lede in a larger conflict emerging between the state and country. As the tech industry starts to distance itself from an unpopular president (best exemplified by Musk stepping back from DOGE work and turning to his private ventures), and as the cosmopolitan, diverse populace of California clashes with federal anti-immigrant and anti-elite policies, there appears to be less and less shared cause and common ground.

Traders think it’s more likely than not that Trump will invoke the Insurrection Act, and these odds rose sharply on the recent military deployments to the Los Angeles area. If legal proceedings curtail Trump’s ability to deploy military forces at home, he may turn to the slightly firmer legal footing of the Insurrection Act. Indeed, the last time the Insurrection Act was invoked was during the 1992 LA Riots under the administration of Bush Senior.

While this particular instance of the LA protests appears to be slowing down…

…the tensions are only just getting started, with markets giving Trump even odds of threatening to relocate the 2028 Olympics, although a much lower chance of arresting CA Governor, Gavin Newsom.

In the spirit of California-Washington tensions, it has of late remained likely that Trump’s election rival, Kamala Harris, may decide to attempt a run for the governorship next year, which she would be a heavy favorite to win.

A secession vote appears to be plausible as well (although I can’t imagine the odds of it succeeding are nearly as high):

We’ll see how the recent protest movement might come to a head on June 14th, when Trump’s birthday military parade will be protested by (as markets predict) over a million people.

Roundup

Tesla’s robo-taxi service appears to be ahead of schedule (or at least, outpacing forecasters’ expectations at the moment):

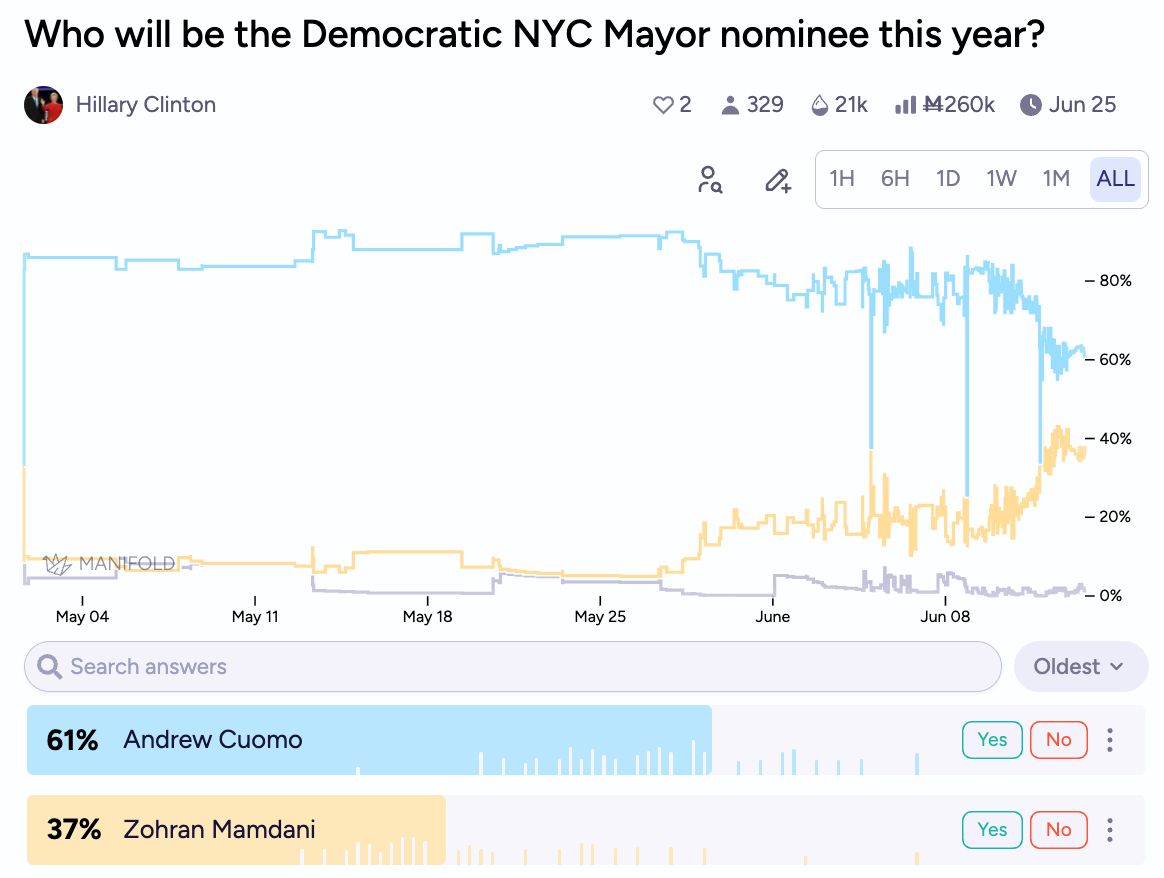

Zohran Mamdani appears to be pulling close to Andrew Cuomo in polling for the NYC mayor democratic primary.

The people also want to know of course… Will Jeremy get a text back?

Happy Forecasting!

-Above the Fold