Above the Fold - Visualising market data

Is this our juiciest newsletter yet?

Lots of juicy prediction market and Manifold content today! You can find the usual summary of site updates at the bottom, but let’s cannonball straight into the fun stuff!

Market stats visualised! 😍

We wanted to show some of the awesome graphs our user Wasabipesto made!

In this first one, we see how prediction markets can sometimes be a little over-optimistic as the blue line of death moves across the screen squandering traders’ dreams of big profits. Each blue dot represents a different market forecasting if Artemis I will launch by the corresponding date. You can see these markets and join the forecasting here!

In this next one we see Manifold risk-free interest rates. Note that this is not related to our loans feature, but rather markets set up by various users which are guaranteed to resolve to YES. This is an experiment to see what market % users will trade up to before it not being worth locking up their capital for small, distant returns.

Data sourced from this group of markets.

Current snapshot:

Storybook Brawl Tournament

Any gamers in the chat? We have a treat for you if you enjoy strategy games! We are hosting a Storybook Brawl tournament, with all the biggest streamers, to celebrate the official launch of our Twitch bot! You can follow the action here or watch from your favourite streamer's pov.

Mark your calendars for Saturday 29th of October 20:00 BST / 12:00 PST.

You can check out the bot now, although, there are still a few bugs we are currently fixing.

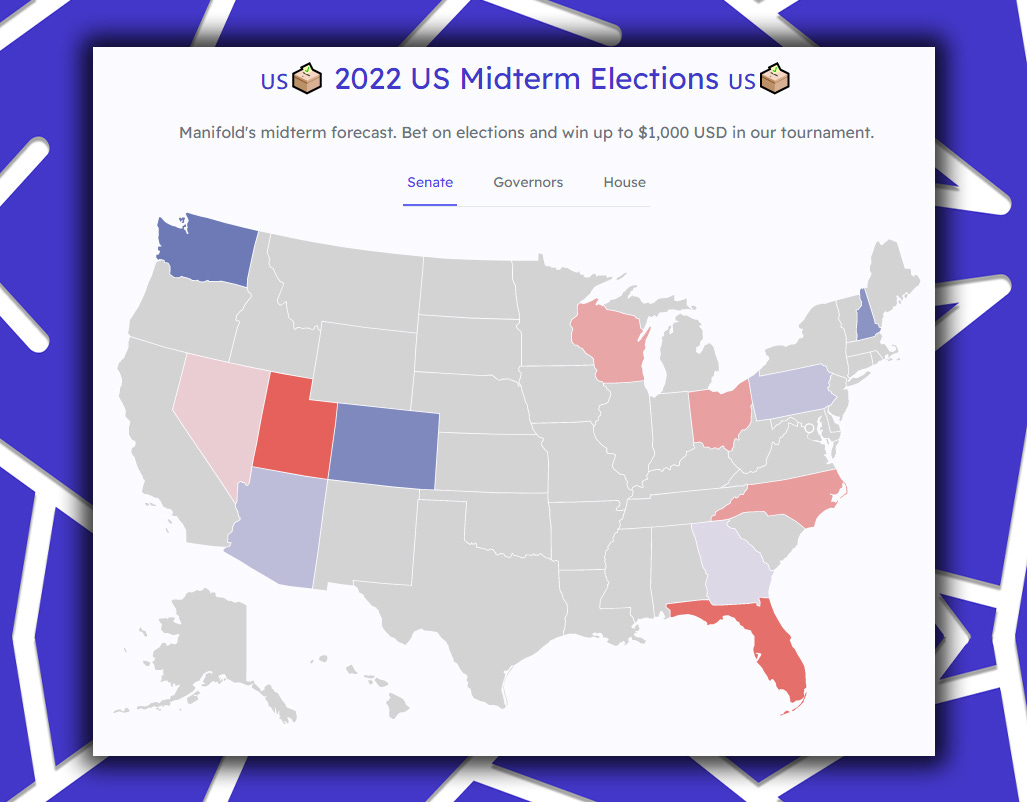

Midterms tournament

Our midterms page is now live! Check out our interactable map that shows you the relevant markets for each state!

Alongside this awesome new page, we are running a $1,000 tournament! All you need to do is be a top leaderboard bettor. It’s pretty high EV to participate so what are you waiting for? Here are the rules.

Markets 🔥

UK General Elections

Well, it seems like the trend in this market turned out to be correct. Although, bit of a poorly-aged moment for top-user Andy Martin who, 16 hours before the announcement, bet yes with this comment:

“Nonetheless — and as I write this I am aware this may turn out to be one of the stupidest things I have ever written — I am dubious that she will be removed any time soon.”

If you are interested in betting on the next general election you can do so here.

Nuclear weapons testing

The chance of a nuclear weapon being detonated has risen significantly over the past week due to concerns about North Korean testing.

At the time of writing both of these markets have a 34% chance, which would mean traders believe that 100% of scenarios a nuclear weapon is detonated in 2022 would be due to North Korean testing. However, this market puts Russia detonating a nuclear weapon at 8% so certainly some room for arbitraging.

Trading with or against the grain?

This is John Roxton’s portfolio. How satisfying is that curve?

Three months ago we shared an article from John who was doing an experiment to trade against the market (ie. moving the probability closer to 50%). He has written an update with how it has gone:

To summarise, he found contrarian trading to not be an effective strategy and in August decide to reverse the strategy and begin trading with the market. He traded as dumbly as he could on 429 markets, betting towards market sentiment. Around 80 resolved against him, but he ~doubled his balance in a couple of months.

The Spindler

Legend has it, that if you put a market under your pillow at night the Spindle fairy will come and traunch it.

We don’t know who or what their intentions are, we just know that they frequently bless the users of Manifold with their traunching.

However, the spindle sent us a passionate voice recording with some of their demands after accidentally losing a ton of mana when selling shares due to slippage.

Two fantastic articles:

Infoovores, one of the competitors in the Salem Center/CSPI tournament, wrote a superb article discussing the flaws of the tournament markets as well as his own strategies. If you are looking to compete in any tournament on Manifold it is definitely worth your time.

We know a lot of you found our site through Scott Alexander, so you should definitely read his most recent Mantic Monday if you haven’t yet. It is overflowing with embedded Manifold Markets!

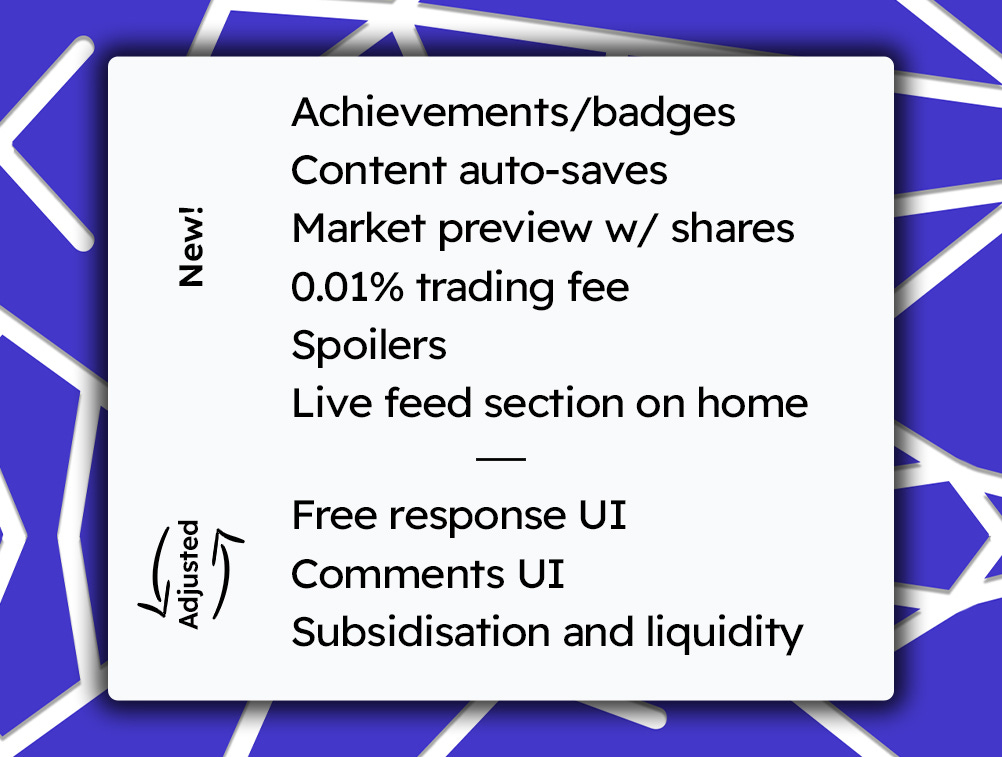

Updates to the site

From now on in the newsletter to keep it brief I will just post this summary image of all the updates with the exception of discussing one or two of the most interesting new features.

If you want more background information and to discuss the changes we recommend you join our #updates channel in Discord.

Changes to subsidisation and liquidity

The ability for anyone to subsidise any market existed for a long time on Manifold until one day, seemingly out of nowhere, was suddenly removed.

This happened because we discovered that users were subsidising a market before making a trade to juice their profits. Overall, a user doesn’t make any mana from doing this, however, the profit number is boosted compared to how much profit they would have made if they didn’t subsidise the market. This is clearly an issue for leaderboards and tournaments which chose winners based on profit numbers.

We are reintroducing subsidisation of markets with countermeasures! Whenever a market is subsidised, mana isn’t immediately added to the liquidity pool. It is instead trickled in slowly with some randomness. Manifold Markets is also subsidising markets with M$20 after each new unique trader so that market liquidity scales as it becomes more popular.

That’s all for this week! Thanks for reading and…

David Chee, Community Manager

Thanks for featuring my article! It’s been cool to see the contest markets evolve from the Wild Wild West of the early days when it was easy to make money as an informed trader to the present where it’s much harder to tell whether opportunities are truly free lunches or not. Even when they are, it’s less like picking up dollars from the sidewalk and more like deep sea diving to retrieve them from an abandoned shipwreck. The amount of research and attention you need to put in for modest gains has exploded.