Above the Fold: Seeded!

News from Manifold Markets: Seed round, job board, calibration graphs, and more

Welcome to the ninth edition of Above the Fold! This week we’re discussing product simplifications, our seed round, new job openings, Manifold’s calibration, and more.

Simplifying our core experience

In our quest to make prediction markets as easy to use as possible, we’ve removed a number of complexities from our platform in the last couple weeks:

Variable market creation subsidies: There’s now one flat fee for creating a market that’s used to subsidize the liquidity pool (M$ 100). We will be adding the ability for users to subsidize anyone’s market in the future, but we think this change will help make it easier for casual users to create markets.

Dynamic parimutuel markets: All of our binary markets have finally been ported to our new fixed-payout mechanism.

Loans: Ok, this one has been very polarizing for users. The idea for fixed $20 loans was suggested to us by Scott Alexander as a way to improve long-term markets. We think that idea still makes sense, but our previous implementation was too complex for new users and psychologically unhelpful in terms of anchoring users to too low a bet amount. We may reintroduce loans in the future as a feature for advanced users or as a part of a subscription plan.

Communities: Another well-intentioned, but complicated feature that will probably return in a better form in the future.

And then, some major additions over the last couple weeks:

Improved site navigation with the side bar + bottom bar on mobile

Baby’s first algorithmic feed: We’re now using a very basic bag-of-words model to construct the feed based on previous markets you bet on. It should be showing more relevant markets than before, and we hope to improve it over time.

More useful portfolio page: By default, you’ll see a more compact view of your most recent traded markets.

How calibrated are we?

Manifold user VL has crunched the numbers and produced a calibration graph showing how the probability at the close time of our markets compares with the true probability.

VL explains:

Market probabilities are bucketed into 10% buckets (5% for the first and last). For each bucket b we want to estimate theta[b], the probability the market resolves YES (conditional on the market being in bucket.

This is a standard beta-binomial model, so at the end we end up with one beta distribution for each bucket

The line is 95% of the mass of that distribution (centered at the median of the distribution)... the 95% [confidence] interval

All of the code is available open source in VL’s Github repo.

The big take-away: If the market is approaching 60% at the close, SELL, SELL, SELL!

More seriously, given that Manifold is only a few months old, that we’ve now changed betting systems multiple times, and that we don’t currently allow user-subsidization of markets or liquidity injection, the fact that our markets are still reasonably well-calibrated is very bullish.

A few months from now—when the platform is more polished and when we have an order of magnitude more users—I expect our results to be even better.

Seed round success!

I’m happy to announce that Manifold Markets has raised $2 million in seed funding from FTX Future Fund via a regrantor and Soma Capital, as well as 25 different angels, many of whom are users of our platform themselves, including Max Bodoia, Paul Gu, Thomas Smyth, Tarek Mansour, Akhil Wable, Greg Colbourn, Daniel Reeves, Eric Jang, the Chen family, and many, many more.

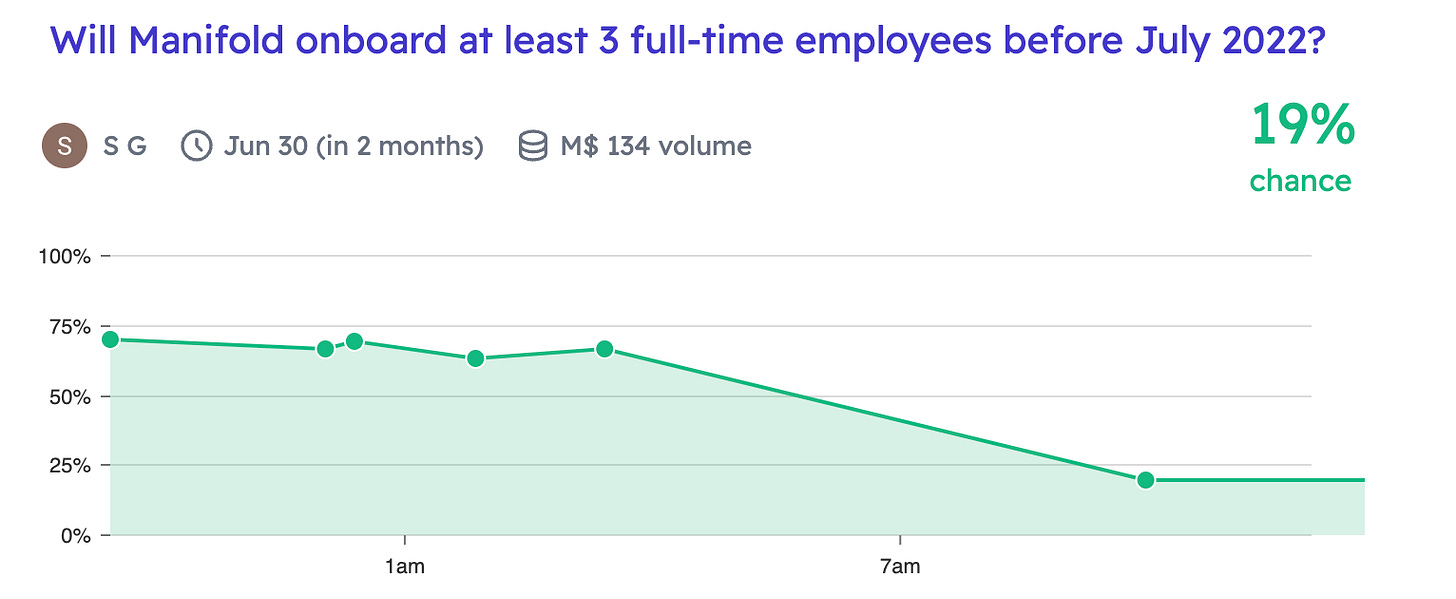

We kicked off this process when Linchuan Zhang reached out in mid-March, on behalf of the FTX Future Fund regranting program. He expressed interest in following up an earlier grant, made through the Long-Term Future Fund. We reflected on where Manifold has been, and where we’d like to take it — and decided we were ready to bring on more full-time help! After writing up a seed memo, we started looking for investors who shared our vision of making forecasting ubiquitous and accessible.

Thanks to everyone who participated — whether by funding us directly, introducing us to potential funders, or rejecting us while providing gracious feedback (though we hope to prove you wrong!) And to y’all in the Manifold community, for pumping up our numbers creating markets, placing bets, and generally making this an inviting and truthseeking place. We’re looking forward to making Manifold better than ever, together!

Jobs, jobs, jobs

In related news, Manifold is now looking to grow our core team!

If you are a full-stack developer interested in working on our site, a UI/UX designer who wants to make Manifold more delightful, a community manager who loves fostering discussion on our Discord (or, ahem, writing this newsletter), or an experienced head of growth with startup or gaming expertise, please check out our job openings!

We unironically expect to change the world, through better forecasting; here’s your chance to help!

Interesting markets

Will Ethereum merge to Proof-of-Stake by July? (8% — not looking good)

Manifold user Tetraspace has found a clever way to use randomization to amplify the odds of low-probability events (in this case, that London will be hit by a nuclear weapon in 2022).

Basically every question from new user Alex K. Chen

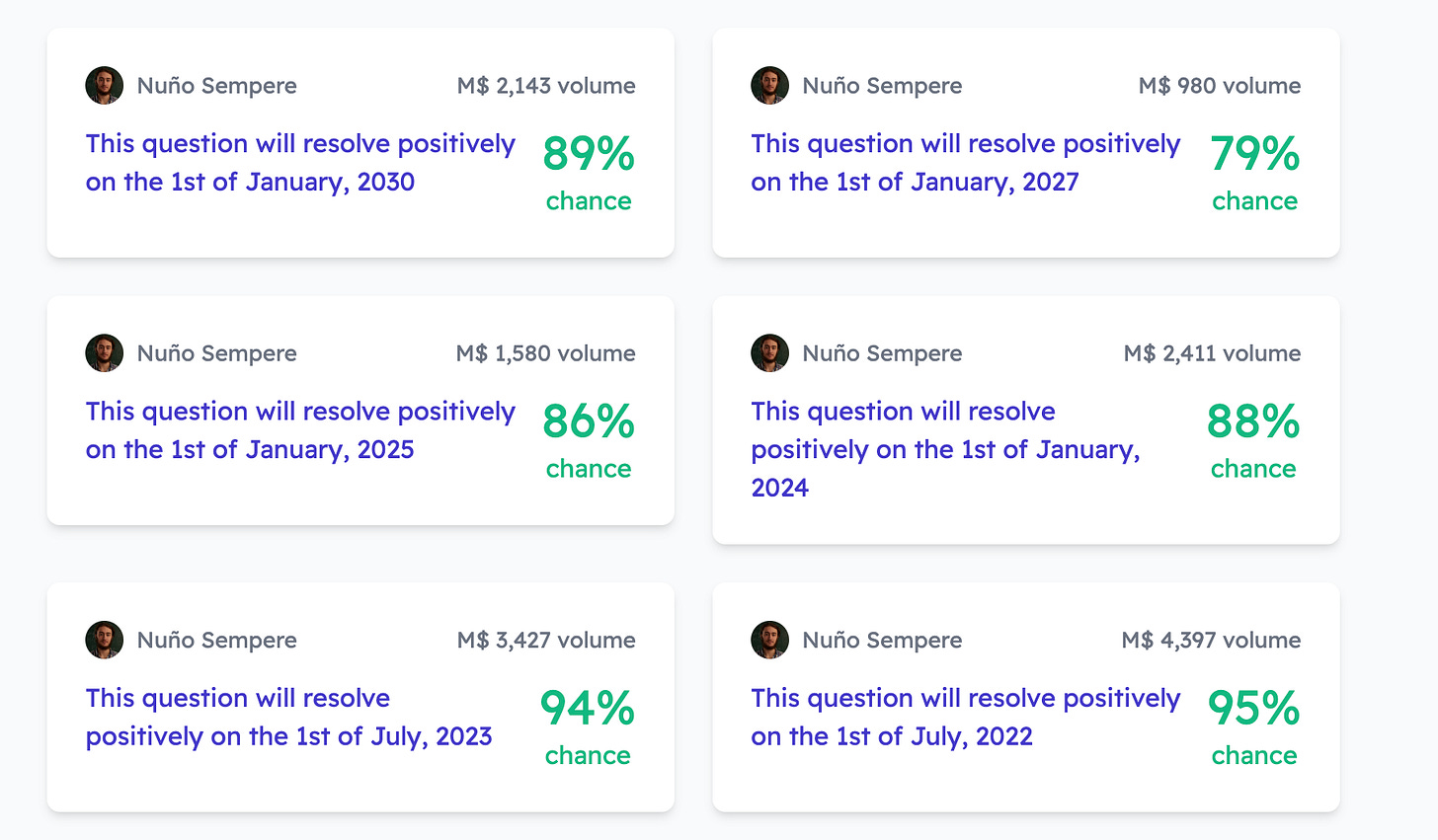

Calculating the Manifold yield curve:

It’s a giraffe. Or something.

Links & shoutouts

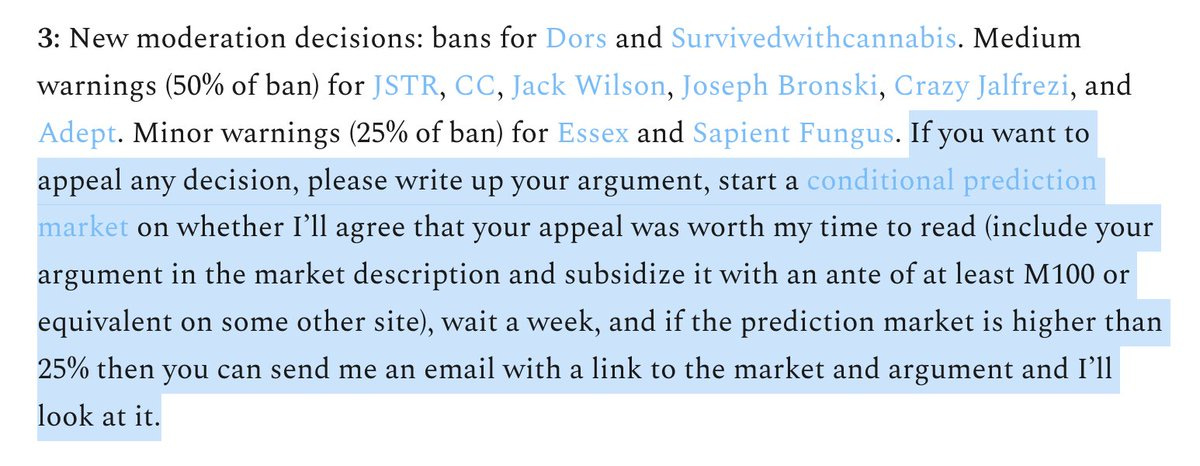

Scott Alexander is using our markets for moderation:

Replacing Magic: the Gathering judges with prediction markets

Nuño Sempere has released three papers on scoring rules. Here is a summary in tweet form.

As seen on our Discord:

Let us know if you’d use this!

Congratulations, Manifolders! I'm excited to be part of this!