Above the Fold - Petrov day drama... is Manifold untrustworthy!?

Report markets, comment bounties, twitch integration, Petrov day discussion

Lots to unpack in today’s newsletter! The usual site updates, a deep dive into the LessWrong Petrov day drama, a brief mention on EAG D.C., and some interesting links.

Site updates

Report a misresolved market

Thanks to Fede, you can now flag resolved markets. This will report it if you think it was misresolved and the author isn’t trustworthy.

If a resolved market receives enough reports relative to the number of traders, it will be considered a “bad” market. Creators with enough bad markets will have a warning next to their name on any of their markets. This is just a first step towards reputational features which is a highly requested feature.

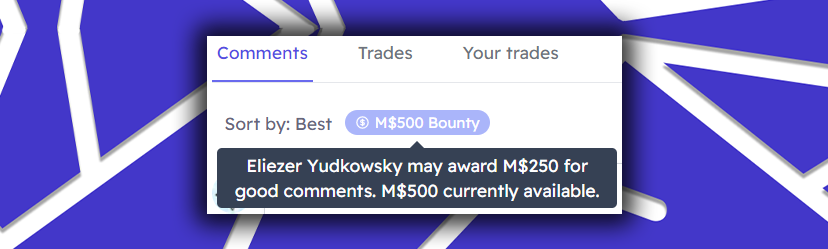

Comment bounties

You can now add bounties in increments of M$250 which a creator can reward to valuable comments. Ian created this awesome feature for his hackathon project whilst in D.C.

Anyone can contribute to the bounty pool, but the creator decides who to award them to. One of the most valuable parts of Manifold isn’t the markets nor the probabilities they produce, but rather the discussion. We wanted to provide the community with ways to reward this and encourage insider information to be shared.

Look out for the bounties badge which will let you know which markets have bounties available.

Twitch integration

We’ve just finished building a Twitch bot that you can add to your livestreams to bet on our markets straight from Twitch chat! Predicting on Twitch is already popular using what is called channel points, but, is very limited in what you can do with it. We wanted to experiment with integrating our markets and view it as a potential growth vector.

Get started at https://manifold.markets/twitch.

Other site updates

Spoilers are here! Similar to Discord, text in the description and comments can be blocked out.

Daily Trending markets - New collection of markets at the top of the home page.

Consists of markets with the highest product of unique bettors over the last 3 days and change in probability over the last 24h.

Changes to groups

Navigation reverted to tabs at the top of the page.

New overview page which allows pinned content, posts, and trending markets.

You can now add multiple posts to a group.

Sort comments by best (used to be just newest). Comments which have received bounties are placed highest followed by those with the most tips.

Manifold labs ft. US elections state map and Manifold dating docs.

Bug fix: Receiving emails after opting out. You can now also toggle out of all future email types that may be added at the bottom of the notification settings.

Thanks to Marshall you can now zoom in on graphs by clicking and dragging over the area you wish to view. You can also hover on PC to view the probability at a given date and who moved the probability to that %.

Profile page redesign

Separate graphs for profit and portfolio value

Visual design changes

Mobile betting panel redesign

The panel is now expandable under the graph instead of being an annoying popup.

Petrov Day LessWrong button controversy

Context: LessWrong is an online forum that annually runs an event for Petrov Day, celebrated to honor the deed of Stanislav Yevgrafovich Petrov avoiding nuclear conflict. During the event, a large red button is placed on the homepage. Anyone* can click this button which will take down the entire homepage for the rest of the day. *There is a karma threshold which decreases as the day progresses. See here for the full details of how this year’s event worked.

Several markets where created on whether the button would be pressed. Notably, user Multicore created a market allowing users to predict the specific time it would be pressed. The intent was for the market to be resolved to PROB with the % correlating to how much of the event had passed. Users were thus predicting at which karma threshold they believed someone would cave in and press the button.

Now, this is where things get controversial. Two hours into the event the button was pressed taking the front page down. However, it was due to a bug which allowed users with exactly zero karma to be able to press the button when they shouldn’t have been able to. Users weren’t aware of this and just saw the front page had been taken down so began betting the market down. Upon the revelation that it had been due to a bug, Multicore commented that he would not be resolving the market to count this button press.

This was not a popular decision and before long an extremely detailed writeup found its way to LessWrong on how markets on Manifold are too ambiguous and shouldn’t be trusted. It was thought-provoking and presented criticisms in a way that is constructive so definitely worth a read, even if I personally don’t agree that a lot of the criticisms are actually problems.

Multicore, at the suggestion of the comments on the market, decided to resolve to N/A thus refunding everyone’s money. This seems like the best thing to do as there were two very reasonable options the market could be resolved to, and it wasn’t entirely clear which. The first button press did fulfil the resolution criteria outlined in the description but wasn’t at all aligned with the intent of the question. The second button press which did eventually happen within the last 2 hours of the event would have aligned with the intent of the question but have perhaps been dishonourable to the criteria and traders. It does raise an interesting question of what is the correct balance between strict, immovable resolution criteria vs keeping things ambiguous so the market is more likely to be helpful and resolve to the original intent. If you want to discuss this further we suggest taking a look at Jack’s comments.

Finally, there has been discussion on these markets being “assassination markets”, meaning they incentivise people to do “bad” things. There is a whole discussion on whether prediction markets can be unethical if they incentivise someone to do something bad. An extreme example could be a market on if “Putin will be the leader of Russia in 2023” could theoretically incentivise someone to bet on NO and then assassinate him. See this comment by Martin Randall for more thoughts on the matter, particularly with regard to the LessWrong markets.

EAG D.C.

The Manifold team spent last week in Washington D.C. attending EA Global. We wanted to briefly share some of what we got up to there, and how our involvement with EA could influence prediction markets.

Forecasting Workshop

We ran an introductory workshop on prediction markets and Manifold (slides here, follow the market for an update when the YouTube recording is uploaded). It was received very well with some fun short-form Manifold activities to introduce people to the site followed by practical advice on how you can use Manifold to become a better forecaster. One of our goals with the site is to lower the entry barrier and make forecasting fun, so it was great to see this happen live with 60+ people.

We will be running another one in a couple of weeks at EAGxVirtual which you are welcome to join!

Pastcasting

We had great discussions with a variety of people. One we found awesome was a small startup dedicated to creating forecasting tools. One problem with forecasting is that there is a long feedback loop between your predictions and the results so it can be hard to know how good you are and if you are improving. To help with that they made a site that allows you to “forecast” on old market questions to practice.

Big shoutout to all our users we got to meet there for the first time! David Glidden, Cedar, and Nathan Young are some I personally had the pleasure of meeting but I know there were lots more of you!

Links

FTX Future Fund is hosting a competition to reward work that changes the minds of judges about beliefs held about AGI. Check out the group we’ve created that has all the info you need as well as markets about it.

Whilst in D.C. we met with Nonrival, a new project that's half newsletter and half forecasting tournament. Each week readers get a newsletter covering an economic news topic and then make a forecast. Then later in the week they see how their forecast compares. It was great to meet you Walter Frick, really cool to see others passionate about incorporating forecasting into newsletters!

In-depth interview with Michael Story about forecasting and prediction markets.

Our markets on nuclear war have been going somewhat viral. They were featured in Marginal Revolution and the second largest news site in Croatia. We momentarily thought we had been botted!

Hope you enjoyed this newsletter! I am also super excited to share that our average DAU has almost doubled over the month of September hitting over 300 on several days!

-David Chee, Community Manager