Above the Fold: Midterms Special

Deep-dive analysis on how well calibrated Manifold markets is and more!

Hello! Today we grace your inbox with Manifold’s final Midterms forecast, some exciting market calibration results, a review of self-resolving mechanisms, and a hearty welcome to the Destiny community!

Final Midterms forecast

It’s the day before Election Day! Last chance to get your trades in on our midterms tournament.

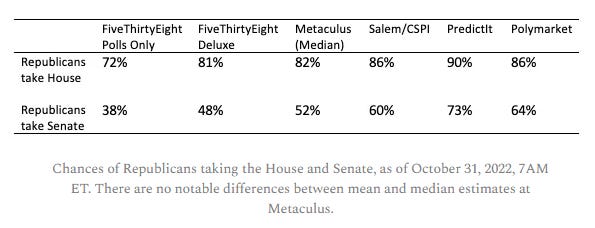

Manifold is currently predicting a 65% chance of the Republicans taking the Senate and an 88% chance they take the House.

Our Salem Center/CSPI tournament gives a 73% and 88% chance of Republicans taking the Senate and House, respectively.

There have been significant differences between forecasting sites which Nonrival and Richard Hanania discuss. We also have a market going on Manifold so you can predict which site will prove the be the most accurate!

Is Manifold Markets well-calibrated?

Vincent has written an awesome piece of code that helps users perform their own analysis of Manifold Markets data.

He then used his tool to answer the question: How well are markets calibrated when comparing the probability halfway through the life of the market to the resolution? As seen in the graph above, markets are indeed well-calibrated on average.

Below is the full data. Those with at least 5 trades are significantly more well-calibrated than those with fewer trades.

Interestingly, having more unique traders doesn’t necessarily mean a market is more well-calibrated than just having 5 trades with fewer traders according to these stats.

Users subsequently ran a study to determine how many traders it takes before a market becomes reasonably well-calibrated. It seems that after 2 traders markets become well-calibrated for the most part with markets within the upper and lower probability ranges appearing to be less trustworthy.

They seem to become even more accurate after 10 traders! The sample size is then too small when analysing markets with more than 20 traders, but it will be interesting to see how the data develops.

The search for a self-resolving market mechanism

A snippet of market description from Daniel Reeves (Dreev):

In case you missed it, there have been some fascinating experiments with self-resolving markets on Manifold lately. The idea of a self-resolving market is that sometimes it's hard or impossible to pin down unambiguous resolution criteria for a prediction. In that case, resolving to the consensus of the market participants may make sense. And from a prediction market perspective, the obvious way to define "the consensus of the participants" is the market price. See also Keynesian beauty contests. It's weirdly self-referential but maybe there are conditions in which we expect it to work?

We've seen one spectacular failure in which an exciting tug-o-war was waged that had little connection to what the market was purportedly predicting (see below).

Here’s another example of a market that is mostly self-resolving which also failed.

After these market failures, Dreev share some thoughts with us in Discord and created his own experiment. The key difference is that for his market to resolve it has to quiescence - settle at a probability - with no movement for a period of time.

I wanted to support zzq's experiment and am not sure what to infer from the demonstration that market manipulation with a hard deadline is possible. We knew that already, which is why we went to such lengths in other experiments to factor that out. It was an interesting idea to see if a small nudge in favor of team truth could make that a sufficiently stronger selling point and maybe it normally would. Why, in normal circumstances, would a team of market manipulators get together to ruin a market? Profit, of course, but, I don't know, it still seems so trollish. I guess eventually I'll have my optimism beaten out of me.

Anyway, mainly I just instinctively bet on what's true and didn't think ahead to the hard deadline until it was bearing down and I tried to salvage my position by doubling down and then lost everything. pretty frustrating.

I guess I expect my experiment to not fail like that, though it may go all month without quiescing and thus resolve N/A. That's not necessarily a failure since the price will presumably be oscillating near the truth that whole time.

A concern of this particular experiment is that if applied to real markets, people who own the losing shares can just keep moving around the probability so it never settles and thus never resolves.

Welcome to the Destinygg community!

You may have seen these random ”stock” markets popping up (and I’m sure a lot of you have already used our new block feature on them 😅). These are fans of the live streamer Destiny who found our site thanks to Yaboi69 sharing it on Reddit. It’s been wild seeing how quickly the markets have become popular within their community starting from one individual and has looked great on our stats page!

Many of their markets are similar to what existing users are making, but the majority of markets are these “stock” markets designed to gauge public sentiment of Destiny’s orbiters — or people who are guests on Destiny’s stream. To avoid dodgy resolution criteria, many Destiny fans have opted to make these stock markets “permanent”, with the idea being that they would never resolve them and instead people can profit by selling their shares.

In effect, it’s a Keynesian beauty contest with the added challenge of having even less incentive than usual to bet towards the extremities since the market never resolves.

Yev, who is currently at the top of the Destiny.gg leaderboard doesn’t even watch Destiny and yet sits with a profit of M$11,000 from placing limit orders that abuse the fact the stocks just bounce between 50% to 80% for most liked orbiters!

We look forward to seeing how their usage of our markets adapts as they learn how they work and become more educated in forecasting!

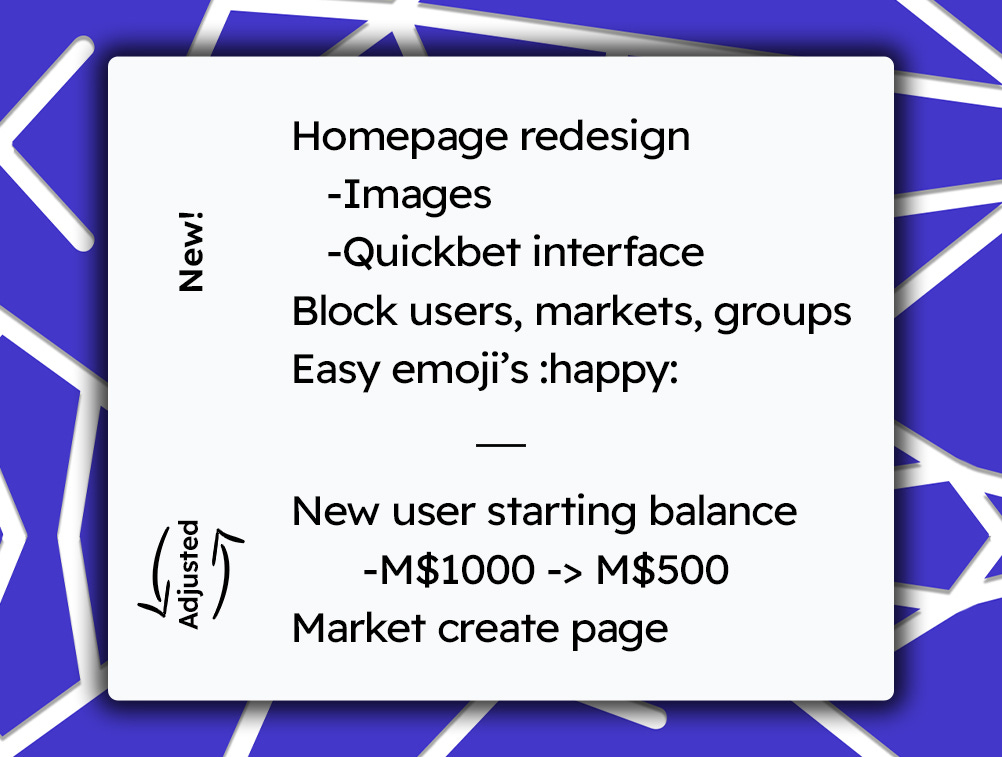

Site updates

Market creation redesign

Numeric markets and multichoice markets are back!

Each market type has a different initial cost based on how much liquidity they need to function well. Yes/No markets costs M$50 now!

AI-generated closing time. We use AI to look at the market title and description to set a closing time if you do not set one yourself.

Thanks for reading!

David Chee