Above the Fold - Manifold Madness

A look at GPT, gamification of Manifold, April Fools, and The market

Over the past few weeks, we’ve seen some very silly things occur on Manifold thanks to April Fools and The Market.

But, we’ve also witnessed some inspiring projects from the community. We’ve felt that this might have been Manifold most efficient month ever with regard to development.

GPT plays Manifold

You better be clutching your mana close to your chest, as AI has descended to claim it. User Minos has created an awesome GPT-4 integration that advises you on how it would trade on Manifold.

https://twitter.com/minosvasilias/status/1637583474361004034

(there’s a really cool video in the tweet, you’ll have to click through to view it unfortunately due to Elon Musk’s battle with Substack preventing tweets to be embedded)

He then set up an account and automated it so GPT-4 could directly trade on the site without human intervention. Its portfolio thus far isn’t the most impressive we’ve seen, but it seems to be able to hold its own.

Welcome CGP Grey!

Many of you receiving this newsletter for the first time are probably here from CGP Grey, welcome! It’s been awesome how he has been able to leverage our site as a tool to engage his audience during the downtime between videos.

https://twitter.com/cgpgrey/status/1638916899802083332

I previously hadn’t even watched many of his videos, yet by the end of March I was sweating with anticipation as my shares’ expected value fell. But was there ever any doubt that he wouldn’t come through and upload a video, I think not!

If you haven’t yet traded on it yet, CPG Grey created a market to help him figure out when he will hit 1 billion views:

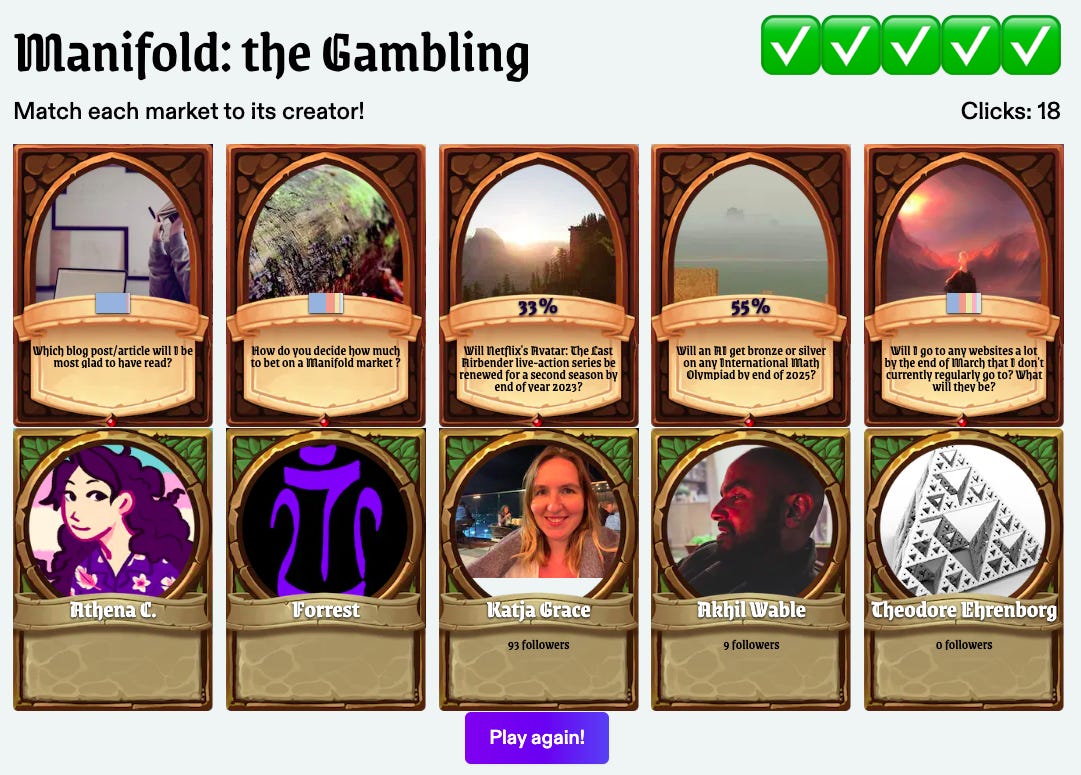

Quests and gamification

It’s no secret that we have been actively gamifying Manifold, so I wanted to share what goes into our decision-making, and how it could affect what Manifold looks like in the future.

Quests which have been added since the last newsletter are self-explanatory, however, I wanted to highlight Ian’s genius to include “trade on an ancient market this week”. It prompted a large cohort of users to find and trade in interesting but neglected markets causing them to re-enter circulation.

Our next steps are to create new user quests, which as existing users you won’t interface with, but will look something like this:

When unlocking a new feature, it is the perfect opportunity for us to provide a popup with educational material that allows new users to progress.

One of our core goals with Manifold is to provide tangible value to individuals who use it and longer-term create an impact by facilitating the adoption of improved forecasting methods by the world. But is our site achieving this considering it is being advertised as “This site is a lot of fun and maybe somewhat useful, but be warned it is very addicting” with users requesting account deletion due to overuse?

First, we should ask if making Manifold a daily habit is harmful. I’m inclined to say no as it improves literacy in forecasting and reshapes one’s decision-making patterns. Additionally, the more people use Manifold, the greater its potential for success and impact.

Crucially, we prioritise mindfulness in determining whether our implementations are solely for retention, or if they genuinely enhance the experience and value the app provides.

With this in mind, I'm pleased with the proposed new user quests above, as they effectively educate users on limit orders, loan importance, and viewing things in terms of opportunity cost rather than objective value.

The Market

Awe inspiring,

Depth defying,

Yes bettors dying,

Isaac King crying.

(with joy)

Manifold Markets has many claims to legitimate forecasting with an end goal of providing value… this isn’t one of them. Gamblers Traders set their differences aside to form teams which vied to push The Market above or below a 50% average.

Over a 7-day period, The Market accumulated a record-breaking trading volume of 2,268,703 mana. For reference, this is 2.8x more volume than Dan Stock which sits at 880,000 mana after months of trading activity. Be warned that there may be some lag upon attempting to visit the page due to the 825 comments.

It seems that with one day to go, team YES eventually gave up causing the final average probability of the market to be 36.457%.

Among the top earners from The Market, both Isaac King and Marcus Abramovitch had large outstanding loans from Austin. It is unclear what sort of effect this may have had on The Market.

Some notable moments from The Market:

Spindle continued his infamous traunching and his upside-down profits.

Team Yes and No form to pledge donations of winnings to different charities.

I think these comments from Ada and Jospeph do a good job of representing this market.

And of course, commiserations to Galen, who although lost, had a call with us and still loves the product. ❤️ Thanks for being such a good sport!

April Fool’s

Manifold hosted an internal hackathon to create fun things for April Fools! Did you spot all of them?

Stephen ran an auction for 10,000 mana, but everyone had to pay their highest bid even if they didn’t win.

In total nearly 40,000 mana was spent on bids. So much for “giving back to the community”.

Mira decided on chaos and outbid Andrew’s 10,000 bid with one for 11,000!

Catnee was having none of it, and swooped in on the final minute with a 12,000 mana bid!

Mira had anticipated this and was willing to pay an extra 3,000 mana to at least win 10,000 back, even if it left them net negative.

James created versus mode

212 versus markets were created during the event!

52 traders deemed Roblox better than Minecraft… Blasphemy!

Someone has a weird obsession with frogs and the frog army beat pretty much everything (except dinosaurs).

This newsletter is getting far too long, so here are some other noteworthy things…

One of our altruistic-focused projects has been the development of Manifund, a platform for investing in impact certificates.

Manifund has recently initiated an AI essay contest run by Open Philanthropy.

Ads

There is a large demand from creators to be able to pay money to acquire competent forecasters to trade on their markets. Ads were one experiment to solve this, whilst also providing users strapped for mana a chance to boost their balance. It had significant usage, but we’ve found it wasn’t valuable to creators, so are back to the drawing board on how to meet that need.

Here is a small experiment Gabrielle conducted to test out the ads.

Stonks

We decided to further punt creating an entirely new market mechanism for permanent stock markets, however, have reskinned our binary markets with a stonks variant. This new UI should improve clarity and removes issues that occurred such as closing dates being forgotten about.

Controversially, we removed limit orders from this variant. Not for technical reasons, but because we thought it could make for a more fun experience. We will be monitoring this, but we’d be eager to hear your thoughts on this change.

Home feed

Over the past month, the feed has had a couple of visual redesigns (which we are very happy with) and some algorithmic improvements (which we are still not satisfied with).

We’ve started using OpenAI’s embeddings to improve the relevance of the markets being shown. But this hasn’t entirely solved the problem that the site tends to be dominated by markets from either AI, Trump or Destiny markets, particularly for new users. Improving surfacing relevant markets to new users is still our biggest room for improvement.

James has just pushed a drop-down menu to help filter by topics on your feed, although this admittedly has its own issues.

Check out this awesome prediction markets post by a German Substack writer

Private groups are almost here. If you are a project manager of a small team and have been hoping for a while to try and implement markets into your workflow management, send me an email (david@manifold.markets).

Thanks for reading! There are undoubtedly other changes that were made that I’ve forgotten to include, but I guess you’ll just have to use the site to figure them out!

David Chee