Above the Fold Goes to Court

A busy year ahead for the Supreme Court... and jelly beans

SCOTUSmarket

While the correlation doesn’t hold perfectly, most of the contenders for the TIME Person of the Year market have one thing in common: they all have a high density of popular markets about them on Manifold. Currently fifth on Manifold’s TIME POTY odds are “The Courts,” after Pope Leo XIV, AI, Donald Trump, and Elon Musk. If you’ll recall from 2023’s heated race, the Manifold favorite, Sam Altman, was shortlisted and ultimately named CEO of the year but lost to Taylor Swift for the grand prize. He was also at the center of some intense drama just before the TIME announcement, resulting in dozens of markets on his role at OpenAI.

This year, with Musk starting to fade from the spotlight and Trump unlikely to win back to back awards for the first time since Nixon, the next most prominent player in the political and cultural moment might indeed be “The Courts.” And this is supported by the sheer amount of newsworthy and market-worthy issues upon which the courts are expected to rule upon this year.

The last few days, for example, have seen some whiplashes in tariff policy. First, there was a ruling canceling the tariffs that fall under the “International Emergency Economic Powers Act,” granted by the U.S. Court of International Trade. This was followed rapidly by a temporary pause to that order granted by the U.S. Court of Appeals for the Federal Circuit. You can see the effect of these two events in the last 48 hours of this market, where the graph rose rapidly to 99% and then crashed down after the pause was granted:

Traders indeed seem to think that the Supreme Court is likely to side with the U.S. Court of International Trade against the Trump administration, either through taking up the case or letting an appeals court verdict ruling against the administration stand.

The tranche of the tariffs affected by this legislation is broad, as the Trump administration prioritized setting tariffs through this particular pathway. However, this may have spoiled the pot, even though they have some leeway to redefine these tariffs through other pathways that could have put them on more sound constitutional footing. It might be too late to do so, as the legal justifications for the tariffs may fall flat in court if they’re adjusted ex post facto.

The Supreme Court will have a lot more on its plate than just tariffs. Given the extent to which the current administration has picked battles with the courts, they will have an additional set of reactionary rulings they will be expected to issue on top of—or perhaps supplanting—their traditional workload. Indeed, there’s a market itself on whether the Supreme Court will rule to ban the national injunctions that lower federal courts have found themselves forced to issue:

That decision, among others, is currently pending on the Supreme Court’s “shadow docket,” as reported by SCOTUSblog:

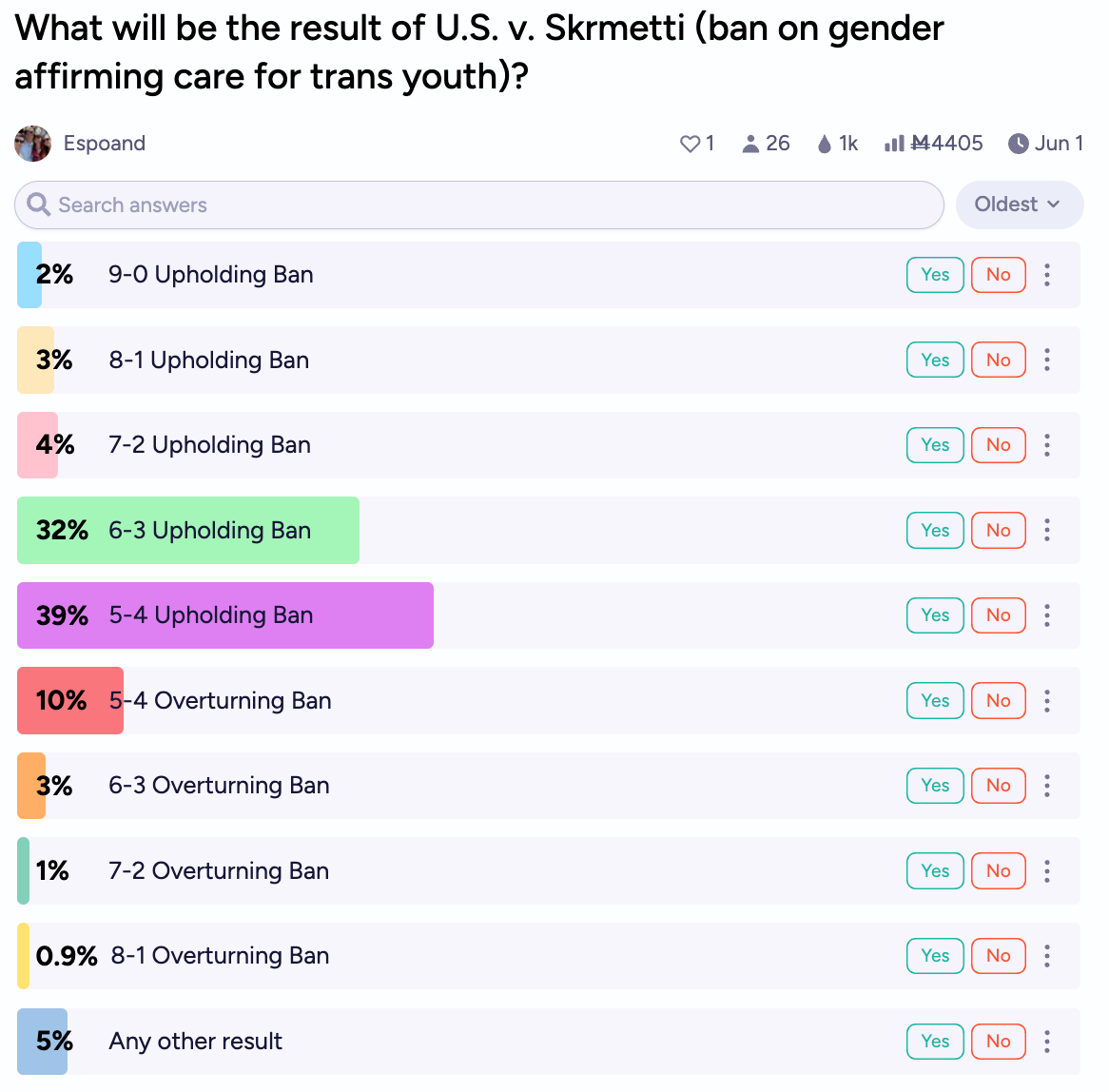

You can see other cases that will be decided by SCOTUS during the 2024-2025 term here at Oyez.org, including United States v. Skrmetti, for which you can bet on precise outcomes on Manifold…

…as well as Free Speech Coalition, Inc. v. Paxton, where the Supreme Court will rule on Texas’s age-verification law for online content:

It also appears plausible that the Supreme Court will be asked to rule on Harvard’s enrollment of foreign students, which the administration has been attempting to curtail.

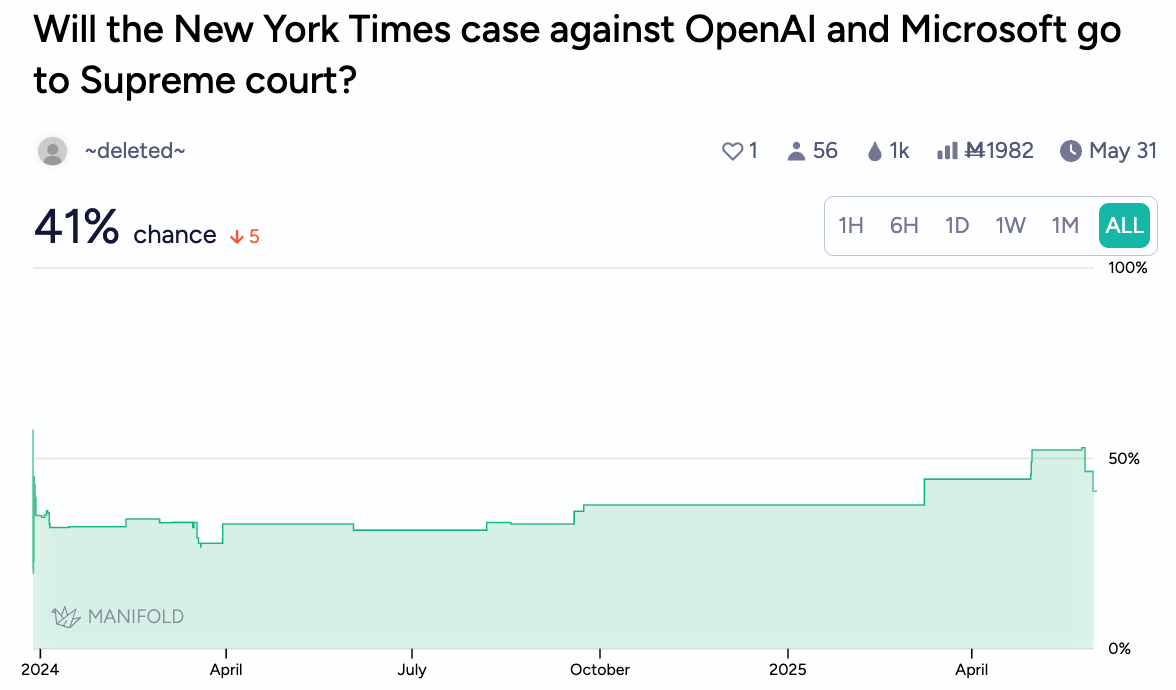

And of course, like in the rest of society, AI will begin to occupy a much greater share of the Supreme Court’s concerns over the next few years.

All these rulings may have an effect on the long-declining popularity of SCOTUS, which currently looks more likely than not to continue its decline in Gallup polling this year:

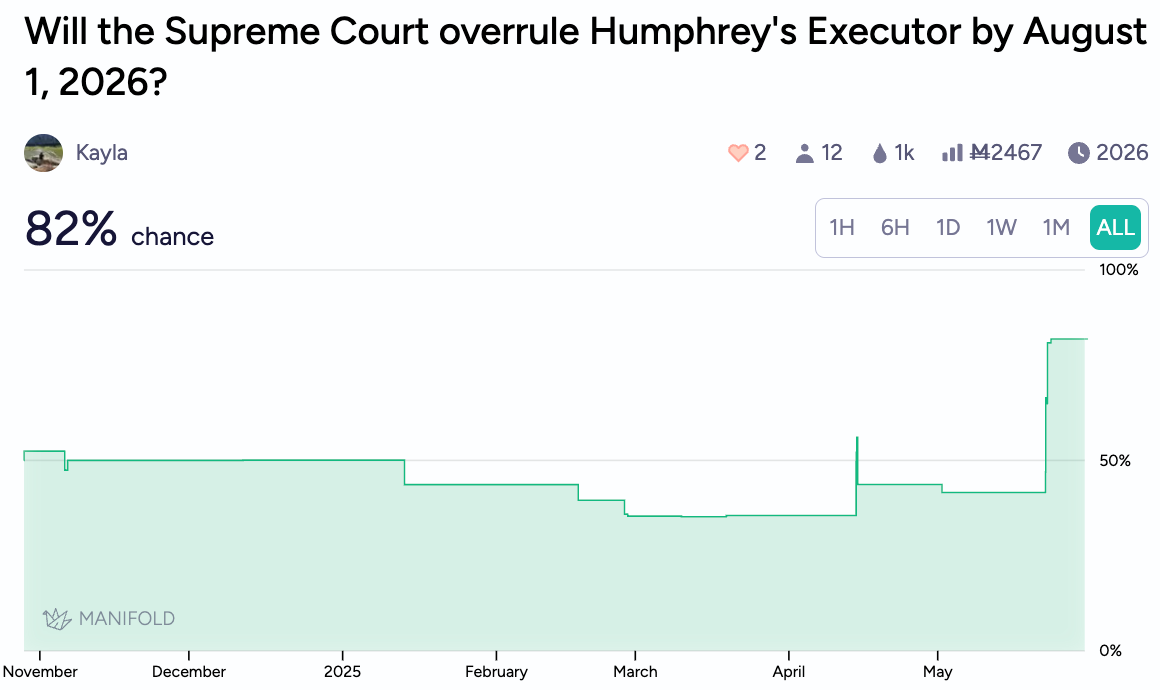

Unitary Executive

Odds on whether the Supreme Court will overturn precedent from 1935 in Humphrey's Executor v. United States have soared as well. This precedent limits the ability of the president to fire the leaders of independent executive-branch government agencies.

SCOTUS sent a clear signal that they intend to overrule Humphrey’s Executor through a 6-3 decision to grant the administration’s request for a stay in a lower court ruling halting Trump from firing a National Labor Relations Board member, as well as a member of the Merit Systems Protection Board. This issue will now fall back to the lower courts, and very well may work its way back up to the Supreme Court over the next year (as Manifold traders seem to expect).

Traders do think there may be a limit to the reaches of the “Unitary-Executive” paradigm that the current administration has been operating under in legal proceedings. Albeit on very low trading volume, traders think that the administration’s efforts to fully dismantle the U.S. Institute of Peace may not succeed in court.

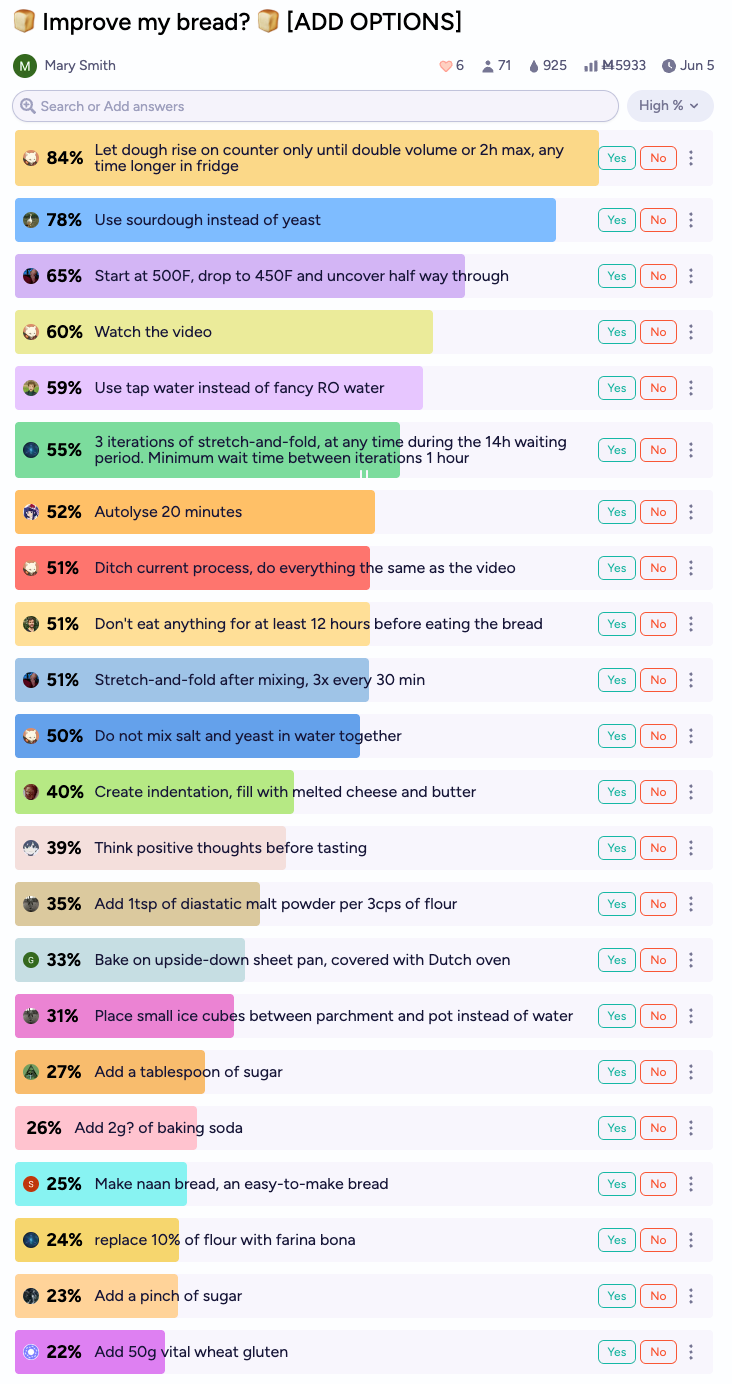

Bread

I’m a sucker for creative market mechanisms, as are many Manifold users, and the most creative market of the last couple weeks has been user Mary Smith’s effort to “improve their bread.” Market options resolve YES if the change is distinguishable AND is better… NO if the change is distinguishable AND is worse… YES if the change is indistinguishable AND greatly reduces the time/inputs… and NO if the change is indistinguishable AND does not greatly reduce the time/inputs. Make sense?

Traders have proposed a range of potential improvements, from replacing yeast with sourdough (the market thinks this is very likely to improve the bread) to playing classical music while baking (unlikely to improve the bread).

Starting with a barebones base recipe, Mary will bake a loaf with each of the changes, judging it based on its crust, crumb, moisture, and taste, and blinding the taste tests as needed against a control.

So far, Mary has already managed to test a few suggestions, all of which have failed to improve the bread measurably:

Jellybeans

YouTube channel Veritasium appears to be running some sort of challenge, asking its subscribers to estimate the number of jelly beans in a jar, a classic challenge relating to the wisdom of crowds!

Naturally, us wisdom-of-crowds lovers on Manifold have started betting on it. One Manifold user made a market, but the market coalesced on one of the windows pretty quickly, necessitating an even more fine-grained market:

Manifold traders expect just ~1750 jelly beans in the jar. Let’s see how that estimate compares to the Veritasium crowd-sourced estimate, as well as the eventual actual number of jelly beans. You can bet on whether Manifold traders will beat the crowd-sourced average here.

Happy Forecasting!

-Above the Fold